Answered step by step

Verified Expert Solution

Question

1 Approved Answer

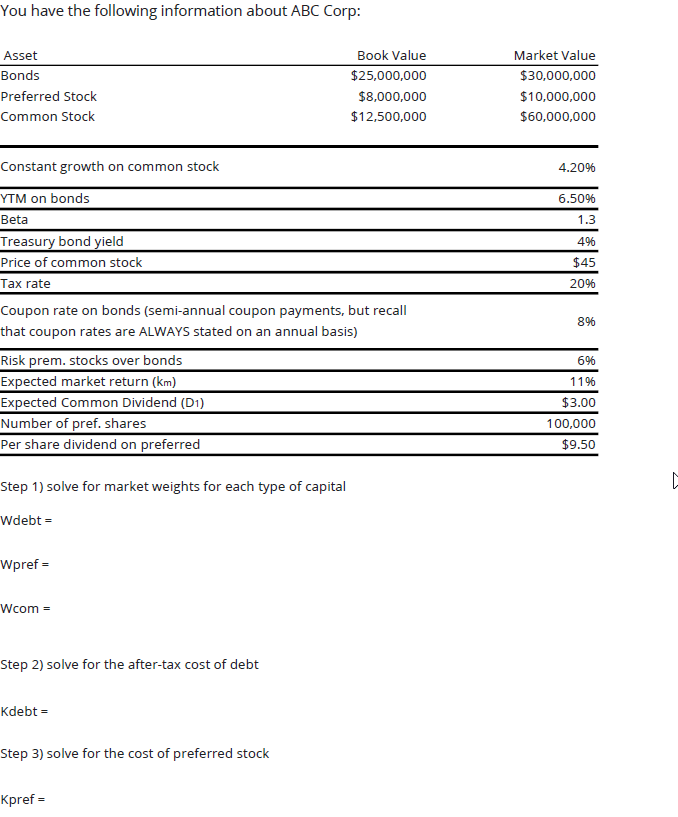

You have the following information about ABC Corp: Asset Bonds Preferred Stock Common Stock Constant growth on common stock YTM on bonds Beta Treasury

You have the following information about ABC Corp: Asset Bonds Preferred Stock Common Stock Constant growth on common stock YTM on bonds Beta Treasury bond yield Book Value $25,000,000 $8,000,000 $12,500,000 Price of common stock Tax rate Coupon rate on bonds (semi-annual coupon payments, but recall that coupon rates are ALWAYS stated on an annual basis) Risk prem. stocks over bonds Expected market return (km) Expected Common Dividend (D1) Number of pref. shares Per share dividend on preferred Step 1) solve for market weights for each type of capital Wdebt = Wpref= Wcom = Step 2) solve for the after-tax cost of debt Kdebt = Step 3) solve for the cost of preferred stock Kpref= Market Value $30,000,000 $10,000,000 $60,000,000 4.20% 6.50% 1.3 4% $45 20% 8% 6% 11% $3.00 100,000 $9.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

s The market weights represent the proportion of the total capital that each type of capital contributes bonds preferred stock and common stock We can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started