Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have the option to purchase or lease a five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the

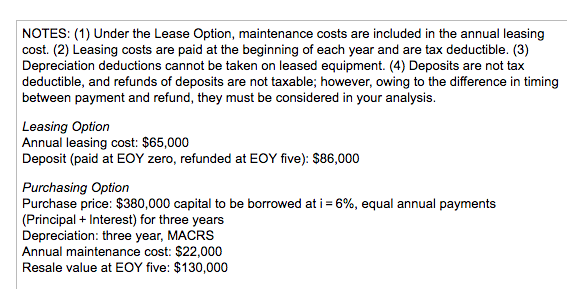

You have the option to purchase or lease a five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the same whether it is leased or purchased. Considering the information given, should you lease or purchase the machine? Conduct after-tax analyses of both options. The effective income tax rate is 40%, the evaluation period is five years, and the MARR is 10% per year.

Calculate the AW(10%) Leasing Option and the AW(10%) Purchase Option

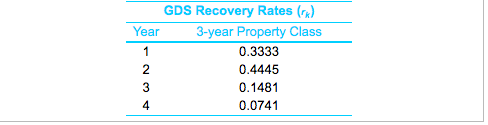

NOTES: (1) Under the Lease Option, maintenance costs are included in the annual leasing cost. (2) Leasing costs are paid at the beginning of each year and are tax deductible. (3) Depreciation deductions cannot be taken on leased equipment. (4) Deposits are not tax deductible, and refunds of deposits are not taxable; however, owing to the difference in timing between payment and refund, they must be considered in your analysis Leasing Option Annual leasing cost: $65,000 Deposit (paid at EOY zero, refunded at EOY fve): $86,000 Purchasing Option Purchase price: $380,000 capital to be borrowed at i = 6%, equal annual payments (Principal+Interest) for three years Depreciation: three year, MACRS Annual maintenance cost: $22,000 Resale value at EOY five: $130,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started