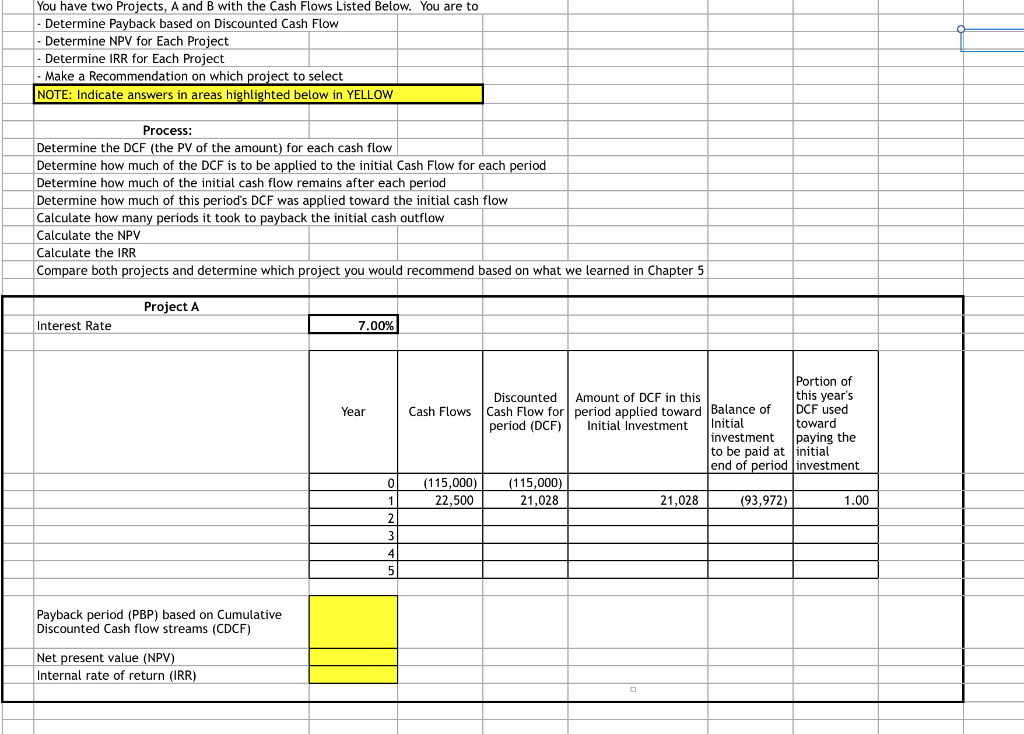

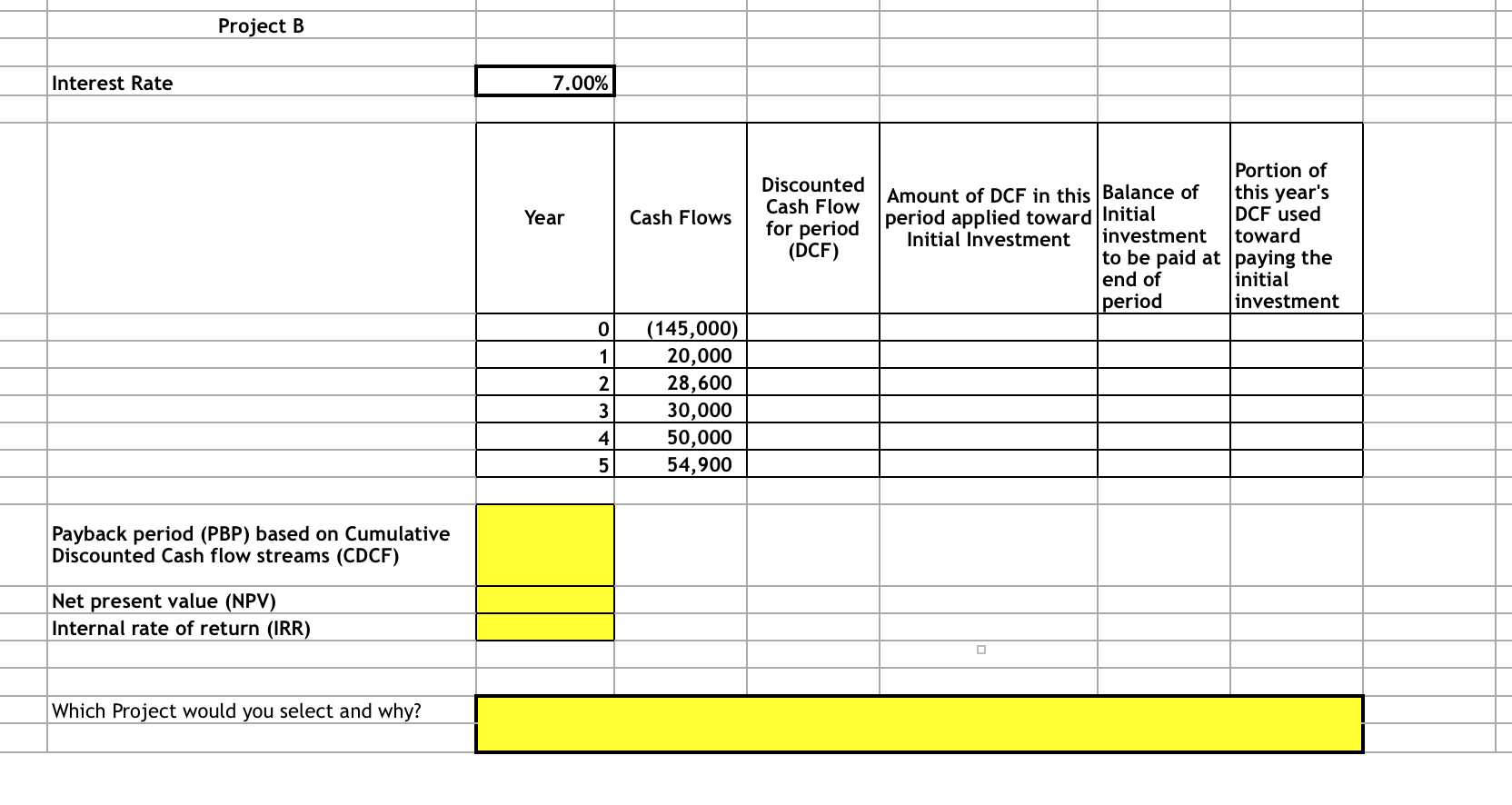

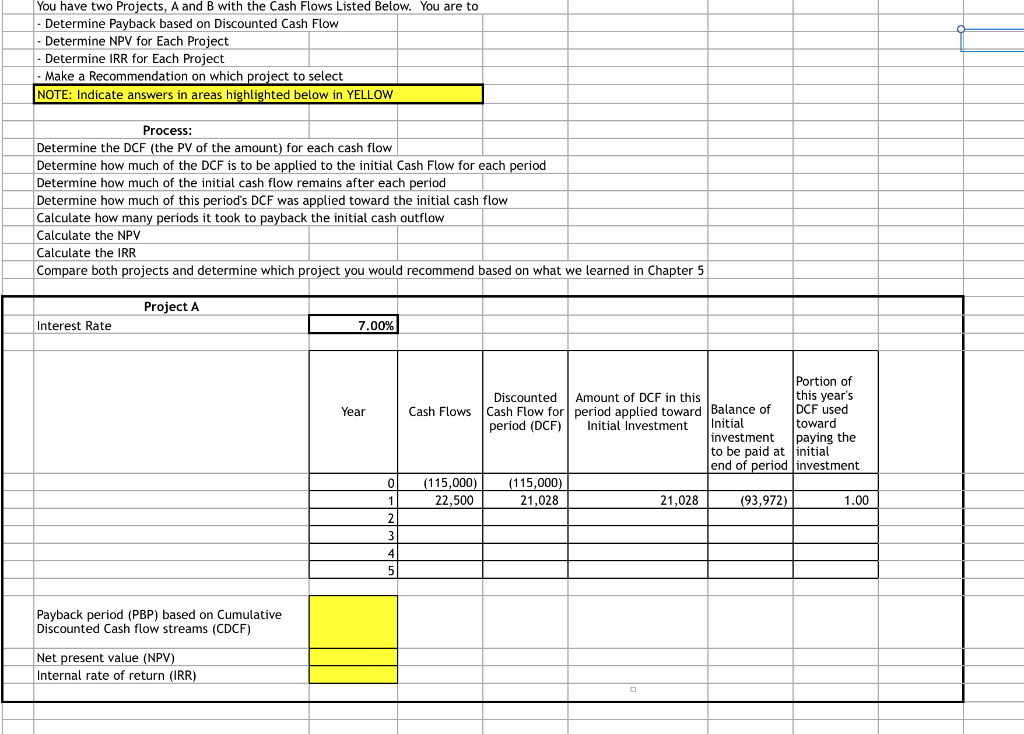

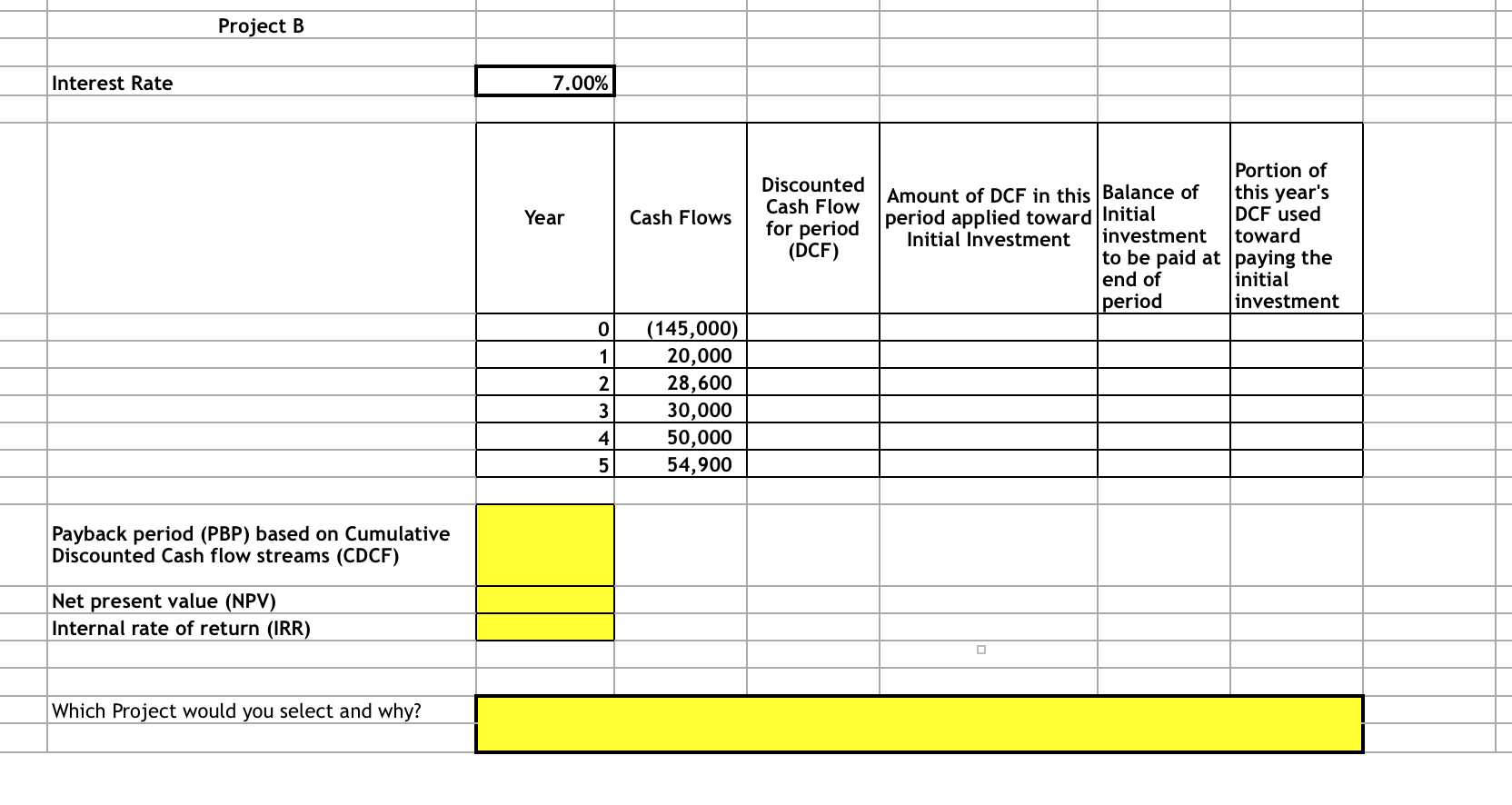

You have two Projects, A and B with the Cash Flows Listed Below. You are to - Determine Payback based on Discounted Cash Flow - Determine NPV for Each Project - Determine IRR for Each Project - Make a Recommendation on which project to select NOTE: Indicate answers in areas highlighted below in YELLOW Process: Determine the DCF (the PV of the amount) for each cash flow Determine how much of the DCF is to be applied to the initial Cash Flow for each period Determine how much of the initial cash flow remains after each period Determine how much of this period's DCF was applied toward the initial cash flow Calculate how many periods it took to payback the initial cash outflow Calculate the NPV Calculate the IRR Compare both projects and determine which project you would recommend based on what we learned in Chapter 5 Project A Interest Rate 7.00% Year Portion of Discounted Amount of DCF in this this year's Cash Flows Cash Flow for period applied toward Balance of IDCF used period (DCF) | Initial Investment Initial toward investment paying the to be paid at initial end of period investment (115,000) (115,000) 22,500 21,028 21,028 (93,972) 1.00 0 Payback period (PBP) based on Cumulative Discounted Cash flow streams (CDCF) Net present value (NPV) Internal rate of return (IRR) Project B Interest Rate 7.00% Year Cash Flows Discounted Cash Flow for period (DCF) Portion of Amount of DCF in this Balance of this year's period applied toward Initial DCF used Initial Investment investment toward to be paid at paying the end of initial period investment UAWN (145,000) 20,000 28,600 30,000 50,000 54,900 Payback period (PBP) based on Cumulative Discounted Cash flow streams (CDCF) Net present value (NPV) Internal rate of return (IRR) Which Project would you select and why? You have two Projects, A and B with the Cash Flows Listed Below. You are to - Determine Payback based on Discounted Cash Flow - Determine NPV for Each Project - Determine IRR for Each Project - Make a Recommendation on which project to select NOTE: Indicate answers in areas highlighted below in YELLOW Process: Determine the DCF (the PV of the amount) for each cash flow Determine how much of the DCF is to be applied to the initial Cash Flow for each period Determine how much of the initial cash flow remains after each period Determine how much of this period's DCF was applied toward the initial cash flow Calculate how many periods it took to payback the initial cash outflow Calculate the NPV Calculate the IRR Compare both projects and determine which project you would recommend based on what we learned in Chapter 5 Project A Interest Rate 7.00% Year Portion of Discounted Amount of DCF in this this year's Cash Flows Cash Flow for period applied toward Balance of IDCF used period (DCF) | Initial Investment Initial toward investment paying the to be paid at initial end of period investment (115,000) (115,000) 22,500 21,028 21,028 (93,972) 1.00 0 Payback period (PBP) based on Cumulative Discounted Cash flow streams (CDCF) Net present value (NPV) Internal rate of return (IRR) Project B Interest Rate 7.00% Year Cash Flows Discounted Cash Flow for period (DCF) Portion of Amount of DCF in this Balance of this year's period applied toward Initial DCF used Initial Investment investment toward to be paid at paying the end of initial period investment UAWN (145,000) 20,000 28,600 30,000 50,000 54,900 Payback period (PBP) based on Cumulative Discounted Cash flow streams (CDCF) Net present value (NPV) Internal rate of return (IRR) Which Project would you select and why