Question

You just purchased a share of Apple Inc. stock for $135. You decided to hedge the downside risk of the stock price falling below $135

You just purchased a share of Apple Inc. stock for $135. You decided to hedge the downside risk of the stock price falling below $135 over the next two months by creating a protective put position. To create this position, you would purchase a put option on the stock with a maturity of _____ months, and a strike price equal to $_______.

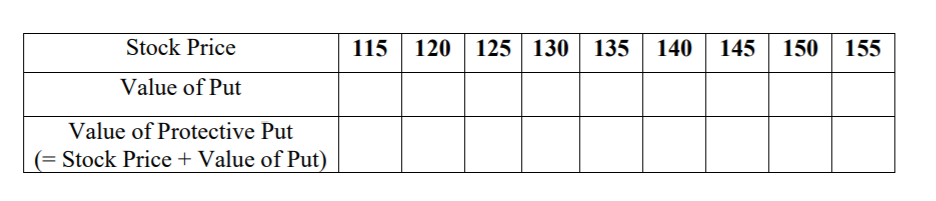

Complete the table above, then draw (a) the payoff diagram for your protective put position as a function of the stock price; and (b) the profit diagram for your protective put position as a function of the stock price. Assume that the premium for the put option is $6.

Stock Price Value of Put Value of Protective Put (= Stock Price + Value of Put) 115 120 125 130 135 140 145 150 155

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To create a protective put position for your Apple Inc stock purchased at 135 and hedge the downside ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started