Answered step by step

Verified Expert Solution

Question

1 Approved Answer

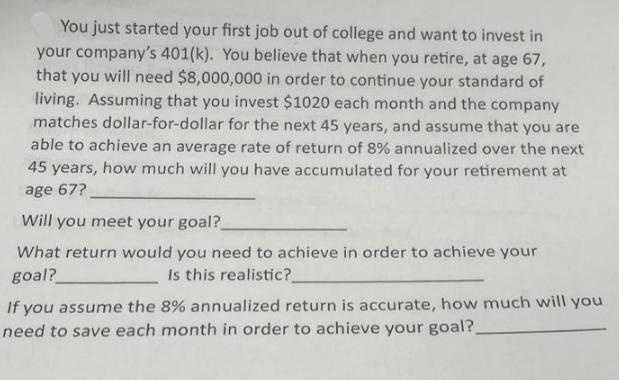

You just started your first job out of college and want to invest in your company's 401(k). You believe that when you retire, at

You just started your first job out of college and want to invest in your company's 401(k). You believe that when you retire, at age 67, that you will need $8,000,000 in order to continue your standard of living. Assuming that you invest $1020 each month and the company matches dollar-for-dollar for the next 45 years, and assume that you are able to achieve an average rate of return of 8% annualized over the next 45 years, how much will you have accumulated for your retirement at age 67? Will you meet your goal?_ What return would you need to achieve in order to achieve your goal? Is this realistic?_ If you assume the 8% annualized return is accurate, how much will you need to save each month in order to achieve your goal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the accumulated amount for retirement we can use the future value of an annuity formula The formula is FV P 1 rn 1 r Where FV Future valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started