Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just turned 24 years old and would like to start saving for your dream car which you plan to buy on your 30th birthday.

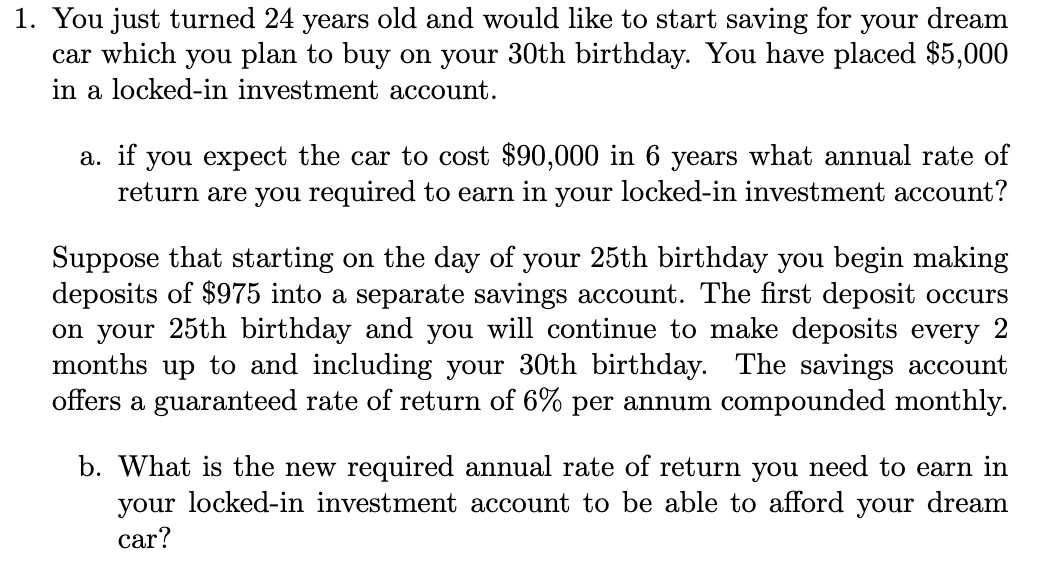

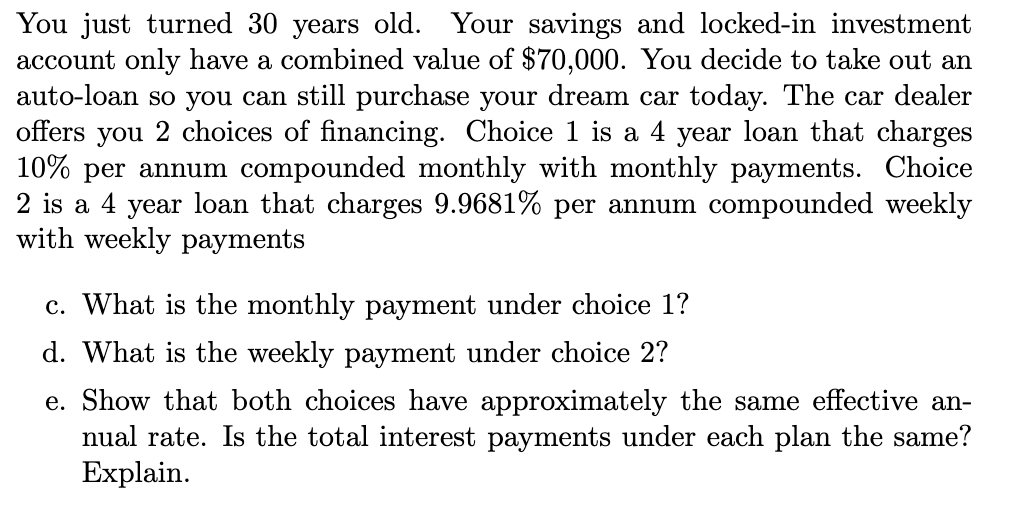

You just turned 24 years old and would like to start saving for your dream car which you plan to buy on your 30th birthday. You have placed $5,000 in a locked-in investment account. a. if you expect the car to cost $90,000 in 6 years what annual rate of return are you required to earn in your locked-in investment account? Suppose that starting on the day of your 25th birthday you begin making deposits of $975 into a separate savings account. The first deposit occurs on your 25th birthday and you will continue to make deposits every 2 months up to and including your 30th birthday. The savings account offers a guaranteed rate of return of 6% per annum compounded monthly. b. What is the new required annual rate of return you need to earn in your locked-in investment account to be able to afford your dream car? You just turned 30 years old. Your savings and locked-in investment account only have a combined value of $70,000. You decide to take out an auto-loan so you can still purchase your dream car today. The car dealer offers you 2 choices of financing. Choice 1 is a 4 year loan that charges 10% per annum compounded monthly with monthly payments. Choice 2 is a 4 year loan that charges 9.9681% per annum compounded weekly with weekly payments c. What is the monthly payment under choice 1 ? d. What is the weekly payment under choice 2 ? e. Show that both choices have approximately the same effective annual rate. Is the total interest payments under each plan the same? Explain

You just turned 24 years old and would like to start saving for your dream car which you plan to buy on your 30th birthday. You have placed $5,000 in a locked-in investment account. a. if you expect the car to cost $90,000 in 6 years what annual rate of return are you required to earn in your locked-in investment account? Suppose that starting on the day of your 25th birthday you begin making deposits of $975 into a separate savings account. The first deposit occurs on your 25th birthday and you will continue to make deposits every 2 months up to and including your 30th birthday. The savings account offers a guaranteed rate of return of 6% per annum compounded monthly. b. What is the new required annual rate of return you need to earn in your locked-in investment account to be able to afford your dream car? You just turned 30 years old. Your savings and locked-in investment account only have a combined value of $70,000. You decide to take out an auto-loan so you can still purchase your dream car today. The car dealer offers you 2 choices of financing. Choice 1 is a 4 year loan that charges 10% per annum compounded monthly with monthly payments. Choice 2 is a 4 year loan that charges 9.9681% per annum compounded weekly with weekly payments c. What is the monthly payment under choice 1 ? d. What is the weekly payment under choice 2 ? e. Show that both choices have approximately the same effective annual rate. Is the total interest payments under each plan the same? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started