you make up

started narrative. already approved

part b and c

unless entry is required you can make

up numbers therefore their are no transactions list

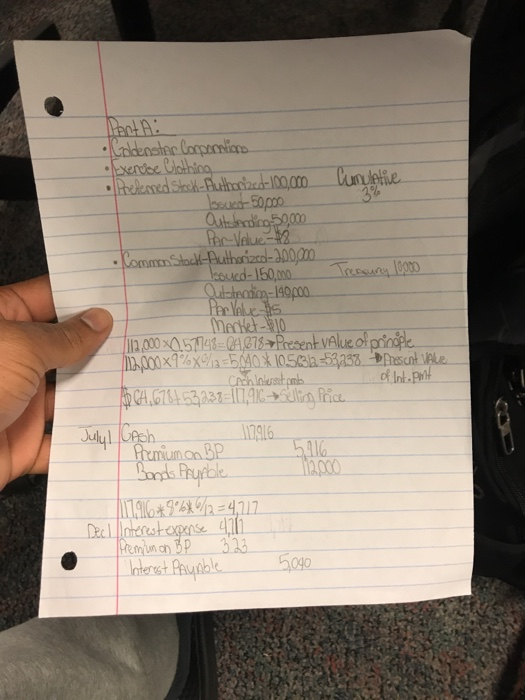

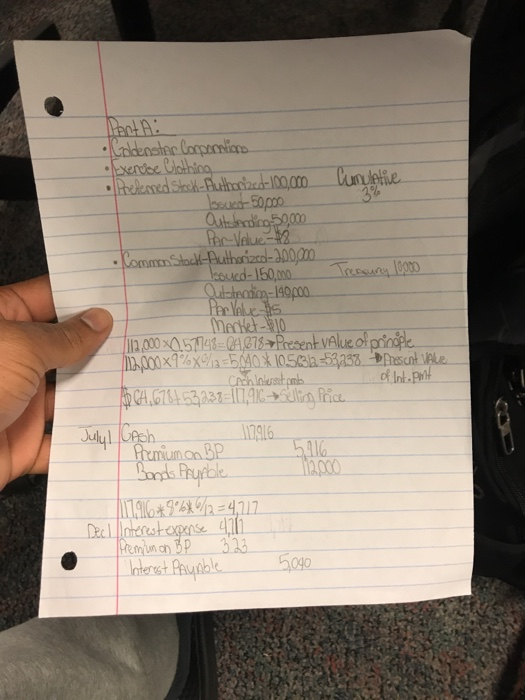

work already calucalted for bonds payable intrest payable interest expense and preimum on on bonds payable

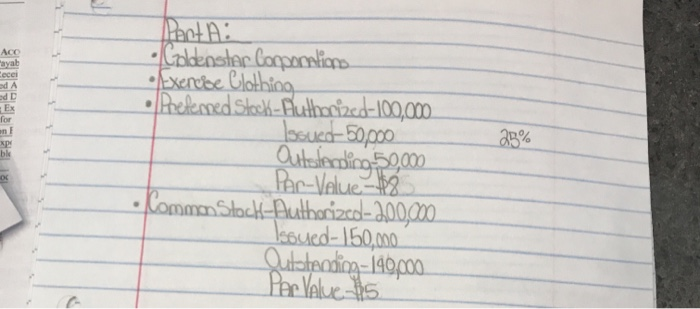

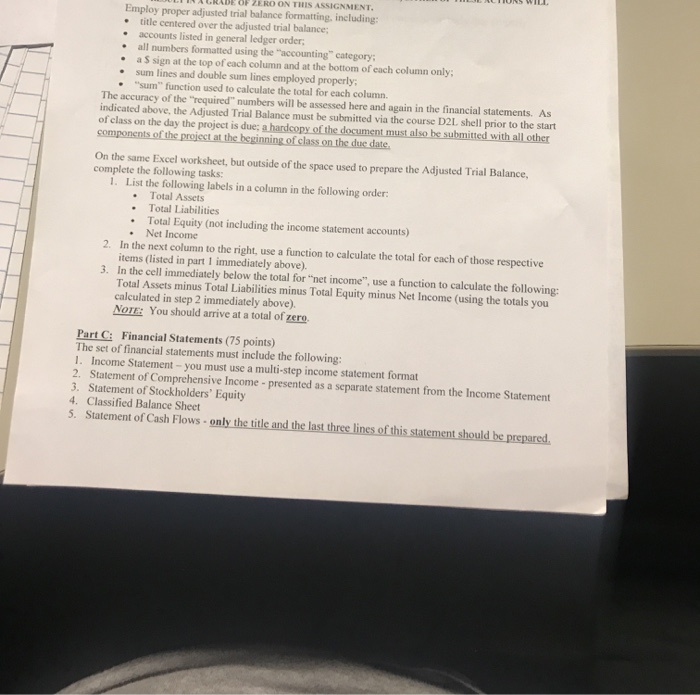

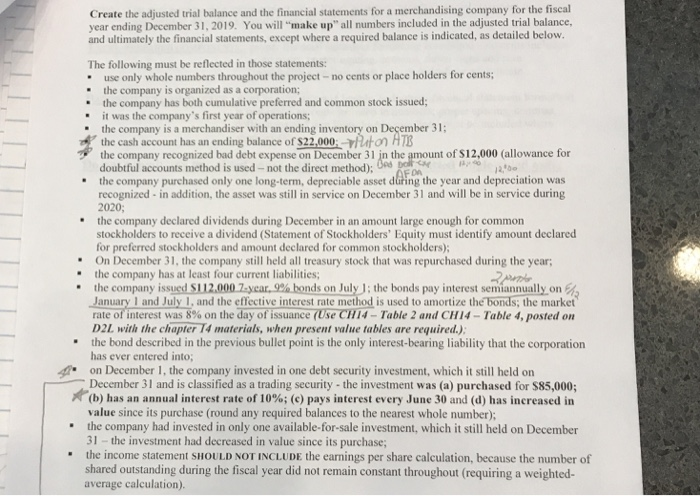

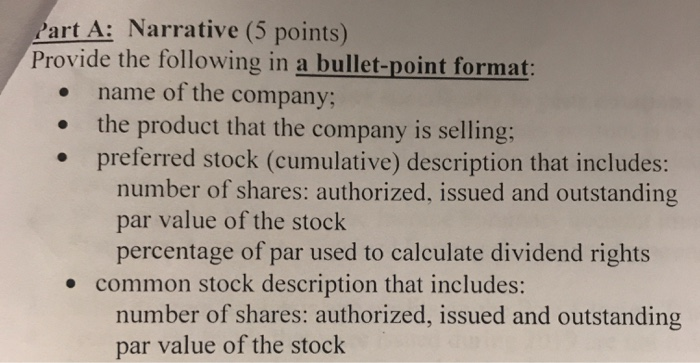

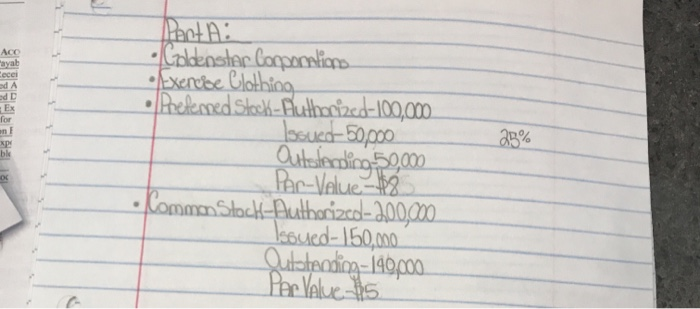

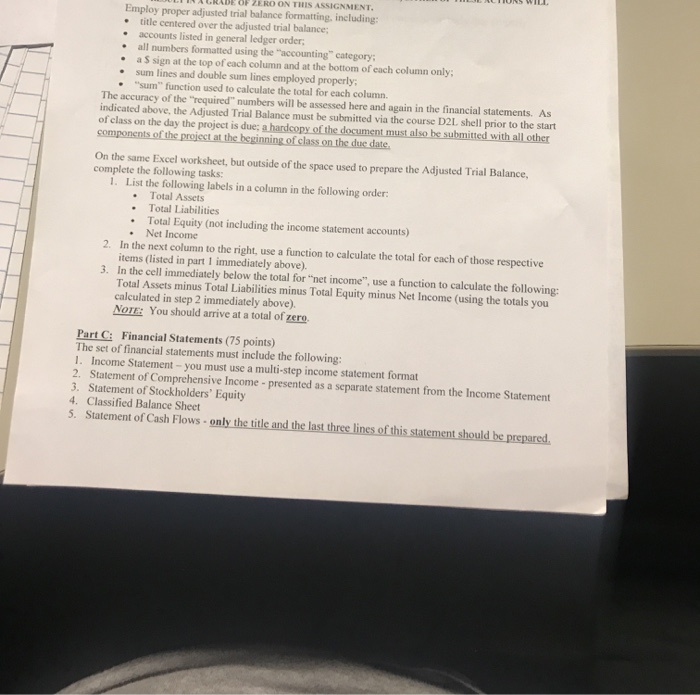

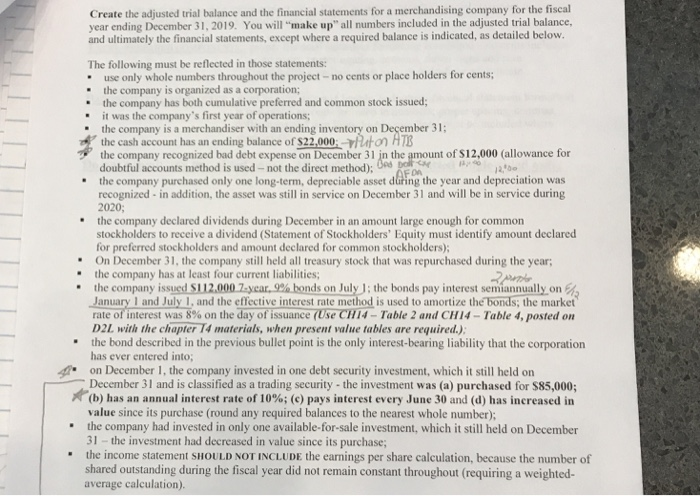

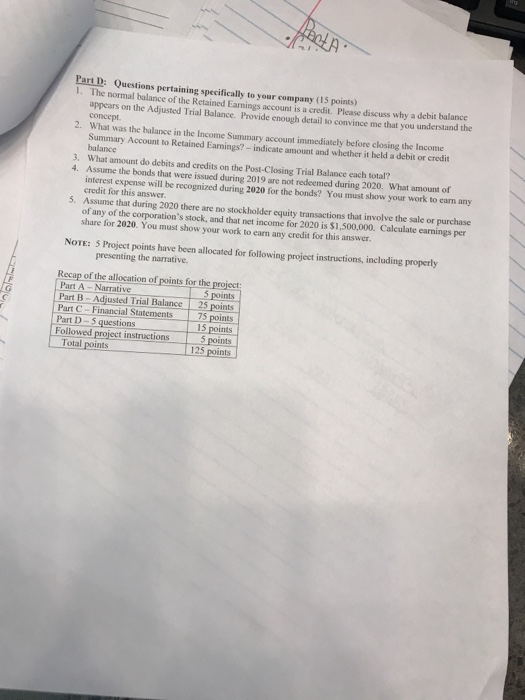

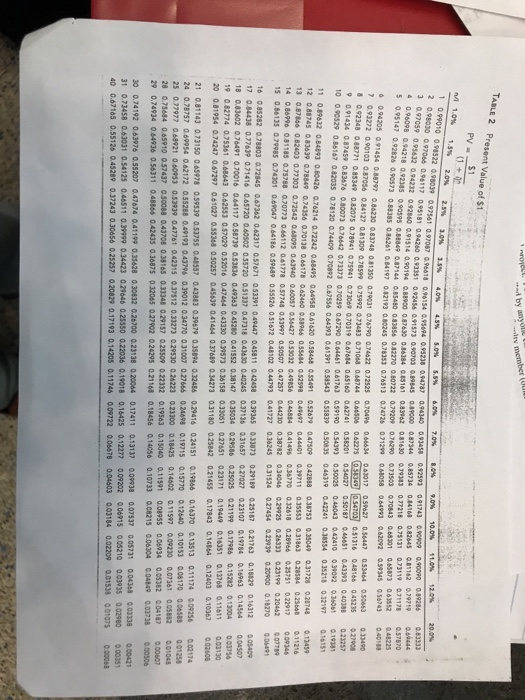

Part A: Narrative (5 points) Provide the following in a bullet-point format: name of the company; the product that the company is selling; preferred stock (cumulative) description that includes: number of shares: authorized, issued and outstanding par value of the stock percentage of par used to calculate dividend rights common stock description that includes: number of shares: authorized, issued and outstanding par value of the stock Cecel ed D an 29% Doct A: Coldenster Corporation Exercoe Clothing, Prefemed Stock-Authorized-100,000 Ssuko-50 poo Outstanding 50,000 Par-Value $8 ommm Stock-Authorized 200.000 Issued- 150,000 Outstanding - 199,000 Par Value 15 ARE OF ZERO ON THIS ASSIGNMENT. Employ proper adjusted trial balance formatting, including: . title centered over the adjusted trial balance; accounts listed in general ledger order all numbers formatted using the accounting" category: . a S sign at the top of each column and at the bottom of each column only: sum lines and double sum lines employed properly: "sum" function used to calculate the total for each column. The accuracy of the required" numbers will be assessed here and again in the financial statements. As indicated above, the Adjusted Trial Balance must be submitted via the course D2L shell prior to the start of class on the day the project is due: a hardcopy of the document must also be submitted with all other components of the project at the beginning of class on the due date. On the same Excel worksheet, but outside of the space used to prepare the Adjusted Trial Balance, complete the following tasks: 1. List the following labels in a column in the following order: Total Assets Total Liabilities Total Equity (not including the income statement accounts) Net Income 2. In the next column to the right, use a function to calculate the total for each of those respective items listed in part 1 immediately above). 3. In the cell immediately below the total for "net income", use a function to calculate the following: Total Assets minus Total Liabilities minus Total Equity minus Net Income (using the totals you calculated in step 2 immediately above). NOTE: You should arrive at a total of zero Part C: Financial Statements (75 points) The set of financial statements must include the following: 1. Income Statement - you must use a multi-step income statement format 2. Statement of Comprehensive Income - presented as a separate statement from the Income Statement 3. Statement of Stockholders' Equity 4. Classified Balance Sheet 5. Statement of Cash Flows - only the title and the last three lines of this statement should be prepared. Create the adjusted trial balance and the financial statements for a merchandising company for the fiscal year ending December 31, 2019. You will make up all numbers included in the adjusted trial balance, and ultimately the financial statements, except where a required balance is indicated, as detailed below. AFON The following must be reflected in those statements: - use only whole numbers throughout the project - no cents or place holders for cents; the company is organized as a corporation; the company has both cumulative preferred and common stock issued; it was the company's first year of operations, the company is a merchandiser with an ending inventory on December 31; the cash account has an ending balance of $22.000 ton 73 the company recognized bad debt expense on December 31 in the amount of $12,000 (allowance for doubtful accounts method is used- not the direct method): es pot the company purchased only one long-term, depreciable asset during the year and depreciation was recognized - in addition, the asset was still in service on December 31 and will be in service during 2020; the company declared dividends during December in an amount large enough for common stockholders to receive a dividend (Statement of Stockholders' Equity must identify amount declared for preferred stockholders and amount declared for common stockholders); On December 31, the company still held all treasury stock that was repurchased during the year; the company has at least four current liabilities: the company issued S112.000 7-year, 9% bonds on July 1: the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds, the market rate of interest was 8% on the day of issuance (Use CH14 - Table 2 and CH14 - Table 4. posted on D2L with the chapter 74 materials, when present value tables are required.). the bond described in the previous bullet point is the only interest-bearing liability that the corporation has ever entered into on December 1, the company invested in one debt security investment, which it still held on December 31 and is classified as a trading security - the investment was (a) purchased for $85,000; (b) has an annual interest rate of 10%; (c) pays interest every June 30 and (d) has increased in value since its purchase (round any required balances to the nearest whole number); the company had invested in only one available-for-sale investment, which it still held on December 31 - the investment had decreased in value since its purchase; the income statement SHOULD NOT INCLUDE the earnings per share calculation, because the number of shared outstanding during the fiscal year did not remain constant throughout (requiring a weighted- average calculation). Part D: Questions pertaining specifically to your company (15 points) 1. The normal balance of the Retained Famnings account is a credit Please discuss why a debit balance appears on the Adjusted Trial Balance Provide enough detail to convince me that you understand the concept 2. What was the balance in the Income Summary account immediately before closing the Income Summary Account to Retained Earnings? - indicate amount and whether it held a debitor credit balance 3. What amount de debits and credits on the Post-Closing Trial Balance each total? 4. Assume the bonds that were issued during 2019 are not redeemed during 2020. What amount of interest expense will be recognized during 2020 for the bonds? You must show your work to earn any credit for this answer 5. Assume that during 2020 there are no stockholder equity transactions that involve the sale or purchase of any of the corporation's stock, and that net income for 2020 is $1,500,000. Calculate earnings per share for 2020. You must show your work to earn any credit for this answer. NOTE: 5 Project points have been allocated for following project instructions, including properly presenting the narrative. Recap of the allocation of points for the project: Part A - Narrative S points Part B - Adjusted Trial Balance 25 points Part C - Financial Statements 75 points Part D-questions 15 points Followed project instructions S points Total points 125 points w by anyone wombe TABLE 2 Present Value of $1 PV = $1 M 1.0% 1.39 54 2.0% 2.5% 0.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.90154 3.5% 4.0 * 4.5 4.5 9.0 5.0% 5.8 .5% 6.0% . 70% 8.0% 0.0% 0.0% 11.0% 12.0% 20.0% 2 0.98070 097066 0.99117 0.95181 0966 0.93351 0.92456 0.91573 0.90703 0.69845 01 0920820.956188154 54.932 .941400291418 2393 09173 W.97059 0.95632 0.94232 0.92860 0.91514 0.00194 OVS 0.71573 0.90703 0.89845 0.19000 0.87344 0.85734 0.84168 0.82645001142 0.79719 0.69444 0.96098 0.94218 0.92385 0.90595 100 0.87630 0.36354 0.85161 were 0.86364 0.05101 0.002 0.83962 0.81630 0.79303 0.77218 0.75131 0.73119 0.71178 0.57870 0.07144 0.8543008385 1 $ 0.95147 0.92826 0.90573 W30 0.03456 012210 0.00022 0.02770 0.107220 0.79209 0.762.90 0.73503 0.70843 0.00385 0.86251 0.14197 0.1219) 0.80245 0. 7353 076513 0.66301 0.65873 063552 0.48225 w.aty 0.82173 0.80245 0.78353 0.76513 0.74721071299 0.707 0 063058 0649930.62092 0.393450.56743 $ 0.94205 0.01454 0.38797 0.86230 08374 0.01350 0.79031 0.7679007422 0.72525 0 0.79031 0.76790 0.74622 0.72525 0.704160.000 0.70496 0.66634 063017 0.5%627 0.56447 0.53464 0.50663 0.33490 wan2 0.V0103 0.87056 0.84127 0.81309 0.78599 0.75992 0.7343 071008 0.68744 0.66506 0.62275 56.349 54702 0.51316040100 used 0.07 0.85340 0.82075 0.78941 0.75941 0.73069 0.70319 0.67614 045160 0.62741 0.58201054027 0.90789 0.4665 ese 0.87454 0.83676 0.80073 0.76642 0.73373 0.70250 0.57290 064461 061763 0.59190054393 050025 0.46043 0.43410039042 0.36061 0.1901 100.0529 0.86167 0.82035 0.78120 0.74409 0.70092 0.67556 0.64393 0.61391 05854) 0558390_50835 0.46319 0.42241 0.30554 0.35218 0.12197 0.16151 11 0.896.32 0.84093 0.80426 0.76214 0.72242 0.66495 0.44958 0.61420 0.58468 0.55401 0.52479 0.47509 0.4268 0.38753 0.35049 0.11726020748 0.13459 120.007 0.0363 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.48697 0.44401 0.39711 0.35553 0.11863 0.20544 0.25666 0.1126 130.07066 0.82403 0.77303 0.72542 0.68095 0. 6940 0.60057 0.56427 0.53032 0.498560.46834 0.41496 0.36770 0.32618 0.2066 0.25751 0.22917 00046 1e 0.16 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782034046 0.29925 0.2633 0.231 0.20462 097789 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59609 055526 0.51672 0.48102 0.44793 0.41727 0.34245 0.31524 0.27454 0.239.39 0.20900 0.16270 0.0001 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.393660.33073 0.29180 0.25187 0.21763 0.18828 0.16112 005400 17 0.84436 0.77639 0.71416 0.65720 0.60502 0 55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.04507 18 0.03602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45200 0.41552 0.36147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15212 0.01756 0.13004 19 082774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47454 0.43330 0.39573 0.36158 0.33051 0.27651023171 0.19449 0.16351 0.13768 0.11611 0.03130 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41454 0.37619 0.34273 0.31180025842 0.21455 0.17843 0.14864 0.12403 002608 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43863 0.39679 0.35894 0.32486 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.24098 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.01258 25 0.77077 0.68921 0.60053 0.53919 0.47761 0.42315 0.37512 0.31273 0.29530 0.24223 0.233000.18425 0.14602 0.11597 0.09210 0.07361 0.05082 0.01045 28 0.75664 0.65910 0.57437 0.50088 0.43708 0.38165 0.33346 0.29157 0.25500 0.22332 0.19563 0.15040 0.11591 0.01955 0.06934 0.05382 0.00607 0.04187 29 0.74934 0 64936 0.56311 0.46366 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.06215 0.06304 0.04849 0.00738 0.00506 30 0.74192 0.63976 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.098 0.07537 0.05731 0.04348 0.03 0.00421 31 0.73458 0.63031 0.54125 0.46511 0.9999 0.34423 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.09202 0.00015 0.05210 0.00035 0.02300 0 0035 40 0.67165 0.55126 0.45289 0.37243 0.30656 0.25257 0.20829 0.17193 0.14205 0.11746 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00068 Pant A: Goldenstar Conporntions Exercise Clothing tunned Stoch-Authoriz-100,000 Vanuative Culcedino 50,000 Ter-Velue-12 Lommen Stocki-Authorizzo-200,000 soucd-150,000 Treasurey 10000 Outstanding - 199poo Par Value 85 Market - $10 ||10,000 x0.57748=64,678>Present value of principle 12,000x9%x%2=52031053253238 pescat Constant of Int. pont ACA.675453233=11,96 m Price Julyl Gash 17916 Premium on BP 5116 Bonds Paunble 1916*8%*12=4,717 Deel interest expense 411 Premium on BP 323 I Interest Payable 5040 112,000xDex%a=4420 SUBMISSION INSTRUCTIONS: THE COVERNIEET ON WHICH HAVE WRITTEN YOUR NAME MUST BE STAPLED TO THE FRONT OF YOLR PROJECT. DO NOT USE A REPORT COVER All components of the project may be handwritten, with the exception of the Adjusted Trial Balance, which must be prepared as an Excel document and submitted through the Dropbox in our course D2L shell prior to the start of class on the due date. Only the Adiusted Trial Balance should be submitted via the drop box. See Instructions below under "Part B" for specific requirements pertaining to the Excel requirements for the Adjusted Trial Balance NOTE: You may prepare your entire project using Excel: however, proper financial statement formatting must be used throughout if you choose to utilize Excel. EXCEL-PREPAREDCOMPONENTS proper financial statement formatting is required - Docents included in numbers, proper spacing, commas, dollar signs and sum lines double sum lines must be included where appropriate. HANDWRITTENCOMPONENTS must be very neat and legible, and proper financial statement formatting. is required-ho cents included in numbers, proper spacing, commas, dollar signs and sum lines double sum lines must be included where appropriate Do not submit any two-sided pages. All work must be submitted single-sided only. Part A: Narrative (5 points) Provide the following in a bullet-point format: name of the company; the product that the company is selling; preferred stock (cumulative) description that includes: number of shares: authorized, issued and outstanding par value of the stock percentage of par used to calculate dividend rights common stock description that includes: number of shares: authorized, issued and outstanding par value of the stock Cecel ed D an 29% Doct A: Coldenster Corporation Exercoe Clothing, Prefemed Stock-Authorized-100,000 Ssuko-50 poo Outstanding 50,000 Par-Value $8 ommm Stock-Authorized 200.000 Issued- 150,000 Outstanding - 199,000 Par Value 15 ARE OF ZERO ON THIS ASSIGNMENT. Employ proper adjusted trial balance formatting, including: . title centered over the adjusted trial balance; accounts listed in general ledger order all numbers formatted using the accounting" category: . a S sign at the top of each column and at the bottom of each column only: sum lines and double sum lines employed properly: "sum" function used to calculate the total for each column. The accuracy of the required" numbers will be assessed here and again in the financial statements. As indicated above, the Adjusted Trial Balance must be submitted via the course D2L shell prior to the start of class on the day the project is due: a hardcopy of the document must also be submitted with all other components of the project at the beginning of class on the due date. On the same Excel worksheet, but outside of the space used to prepare the Adjusted Trial Balance, complete the following tasks: 1. List the following labels in a column in the following order: Total Assets Total Liabilities Total Equity (not including the income statement accounts) Net Income 2. In the next column to the right, use a function to calculate the total for each of those respective items listed in part 1 immediately above). 3. In the cell immediately below the total for "net income", use a function to calculate the following: Total Assets minus Total Liabilities minus Total Equity minus Net Income (using the totals you calculated in step 2 immediately above). NOTE: You should arrive at a total of zero Part C: Financial Statements (75 points) The set of financial statements must include the following: 1. Income Statement - you must use a multi-step income statement format 2. Statement of Comprehensive Income - presented as a separate statement from the Income Statement 3. Statement of Stockholders' Equity 4. Classified Balance Sheet 5. Statement of Cash Flows - only the title and the last three lines of this statement should be prepared. Create the adjusted trial balance and the financial statements for a merchandising company for the fiscal year ending December 31, 2019. You will make up all numbers included in the adjusted trial balance, and ultimately the financial statements, except where a required balance is indicated, as detailed below. AFON The following must be reflected in those statements: - use only whole numbers throughout the project - no cents or place holders for cents; the company is organized as a corporation; the company has both cumulative preferred and common stock issued; it was the company's first year of operations, the company is a merchandiser with an ending inventory on December 31; the cash account has an ending balance of $22.000 ton 73 the company recognized bad debt expense on December 31 in the amount of $12,000 (allowance for doubtful accounts method is used- not the direct method): es pot the company purchased only one long-term, depreciable asset during the year and depreciation was recognized - in addition, the asset was still in service on December 31 and will be in service during 2020; the company declared dividends during December in an amount large enough for common stockholders to receive a dividend (Statement of Stockholders' Equity must identify amount declared for preferred stockholders and amount declared for common stockholders); On December 31, the company still held all treasury stock that was repurchased during the year; the company has at least four current liabilities: the company issued S112.000 7-year, 9% bonds on July 1: the bonds pay interest semiannually on January 1 and July 1, and the effective interest rate method is used to amortize the bonds, the market rate of interest was 8% on the day of issuance (Use CH14 - Table 2 and CH14 - Table 4. posted on D2L with the chapter 74 materials, when present value tables are required.). the bond described in the previous bullet point is the only interest-bearing liability that the corporation has ever entered into on December 1, the company invested in one debt security investment, which it still held on December 31 and is classified as a trading security - the investment was (a) purchased for $85,000; (b) has an annual interest rate of 10%; (c) pays interest every June 30 and (d) has increased in value since its purchase (round any required balances to the nearest whole number); the company had invested in only one available-for-sale investment, which it still held on December 31 - the investment had decreased in value since its purchase; the income statement SHOULD NOT INCLUDE the earnings per share calculation, because the number of shared outstanding during the fiscal year did not remain constant throughout (requiring a weighted- average calculation). Part D: Questions pertaining specifically to your company (15 points) 1. The normal balance of the Retained Famnings account is a credit Please discuss why a debit balance appears on the Adjusted Trial Balance Provide enough detail to convince me that you understand the concept 2. What was the balance in the Income Summary account immediately before closing the Income Summary Account to Retained Earnings? - indicate amount and whether it held a debitor credit balance 3. What amount de debits and credits on the Post-Closing Trial Balance each total? 4. Assume the bonds that were issued during 2019 are not redeemed during 2020. What amount of interest expense will be recognized during 2020 for the bonds? You must show your work to earn any credit for this answer 5. Assume that during 2020 there are no stockholder equity transactions that involve the sale or purchase of any of the corporation's stock, and that net income for 2020 is $1,500,000. Calculate earnings per share for 2020. You must show your work to earn any credit for this answer. NOTE: 5 Project points have been allocated for following project instructions, including properly presenting the narrative. Recap of the allocation of points for the project: Part A - Narrative S points Part B - Adjusted Trial Balance 25 points Part C - Financial Statements 75 points Part D-questions 15 points Followed project instructions S points Total points 125 points w by anyone wombe TABLE 2 Present Value of $1 PV = $1 M 1.0% 1.39 54 2.0% 2.5% 0.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.90154 3.5% 4.0 * 4.5 4.5 9.0 5.0% 5.8 .5% 6.0% . 70% 8.0% 0.0% 0.0% 11.0% 12.0% 20.0% 2 0.98070 097066 0.99117 0.95181 0966 0.93351 0.92456 0.91573 0.90703 0.69845 01 0920820.956188154 54.932 .941400291418 2393 09173 W.97059 0.95632 0.94232 0.92860 0.91514 0.00194 OVS 0.71573 0.90703 0.89845 0.19000 0.87344 0.85734 0.84168 0.82645001142 0.79719 0.69444 0.96098 0.94218 0.92385 0.90595 100 0.87630 0.36354 0.85161 were 0.86364 0.05101 0.002 0.83962 0.81630 0.79303 0.77218 0.75131 0.73119 0.71178 0.57870 0.07144 0.8543008385 1 $ 0.95147 0.92826 0.90573 W30 0.03456 012210 0.00022 0.02770 0.107220 0.79209 0.762.90 0.73503 0.70843 0.00385 0.86251 0.14197 0.1219) 0.80245 0. 7353 076513 0.66301 0.65873 063552 0.48225 w.aty 0.82173 0.80245 0.78353 0.76513 0.74721071299 0.707 0 063058 0649930.62092 0.393450.56743 $ 0.94205 0.01454 0.38797 0.86230 08374 0.01350 0.79031 0.7679007422 0.72525 0 0.79031 0.76790 0.74622 0.72525 0.704160.000 0.70496 0.66634 063017 0.5%627 0.56447 0.53464 0.50663 0.33490 wan2 0.V0103 0.87056 0.84127 0.81309 0.78599 0.75992 0.7343 071008 0.68744 0.66506 0.62275 56.349 54702 0.51316040100 used 0.07 0.85340 0.82075 0.78941 0.75941 0.73069 0.70319 0.67614 045160 0.62741 0.58201054027 0.90789 0.4665 ese 0.87454 0.83676 0.80073 0.76642 0.73373 0.70250 0.57290 064461 061763 0.59190054393 050025 0.46043 0.43410039042 0.36061 0.1901 100.0529 0.86167 0.82035 0.78120 0.74409 0.70092 0.67556 0.64393 0.61391 05854) 0558390_50835 0.46319 0.42241 0.30554 0.35218 0.12197 0.16151 11 0.896.32 0.84093 0.80426 0.76214 0.72242 0.66495 0.44958 0.61420 0.58468 0.55401 0.52479 0.47509 0.4268 0.38753 0.35049 0.11726020748 0.13459 120.007 0.0363 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.48697 0.44401 0.39711 0.35553 0.11863 0.20544 0.25666 0.1126 130.07066 0.82403 0.77303 0.72542 0.68095 0. 6940 0.60057 0.56427 0.53032 0.498560.46834 0.41496 0.36770 0.32618 0.2066 0.25751 0.22917 00046 1e 0.16 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782034046 0.29925 0.2633 0.231 0.20462 097789 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59609 055526 0.51672 0.48102 0.44793 0.41727 0.34245 0.31524 0.27454 0.239.39 0.20900 0.16270 0.0001 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.393660.33073 0.29180 0.25187 0.21763 0.18828 0.16112 005400 17 0.84436 0.77639 0.71416 0.65720 0.60502 0 55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.04507 18 0.03602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45200 0.41552 0.36147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15212 0.01756 0.13004 19 082774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47454 0.43330 0.39573 0.36158 0.33051 0.27651023171 0.19449 0.16351 0.13768 0.11611 0.03130 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41454 0.37619 0.34273 0.31180025842 0.21455 0.17843 0.14864 0.12403 002608 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43863 0.39679 0.35894 0.32486 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.24098 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.01258 25 0.77077 0.68921 0.60053 0.53919 0.47761 0.42315 0.37512 0.31273 0.29530 0.24223 0.233000.18425 0.14602 0.11597 0.09210 0.07361 0.05082 0.01045 28 0.75664 0.65910 0.57437 0.50088 0.43708 0.38165 0.33346 0.29157 0.25500 0.22332 0.19563 0.15040 0.11591 0.01955 0.06934 0.05382 0.00607 0.04187 29 0.74934 0 64936 0.56311 0.46366 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.06215 0.06304 0.04849 0.00738 0.00506 30 0.74192 0.63976 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.098 0.07537 0.05731 0.04348 0.03 0.00421 31 0.73458 0.63031 0.54125 0.46511 0.9999 0.34423 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.09202 0.00015 0.05210 0.00035 0.02300 0 0035 40 0.67165 0.55126 0.45289 0.37243 0.30656 0.25257 0.20829 0.17193 0.14205 0.11746 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00068 Pant A: Goldenstar Conporntions Exercise Clothing tunned Stoch-Authoriz-100,000 Vanuative Culcedino 50,000 Ter-Velue-12 Lommen Stocki-Authorizzo-200,000 soucd-150,000 Treasurey 10000 Outstanding - 199poo Par Value 85 Market - $10 ||10,000 x0.57748=64,678>Present value of principle 12,000x9%x%2=52031053253238 pescat Constant of Int. pont ACA.675453233=11,96 m Price Julyl Gash 17916 Premium on BP 5116 Bonds Paunble 1916*8%*12=4,717 Deel interest expense 411 Premium on BP 323 I Interest Payable 5040 112,000xDex%a=4420 SUBMISSION INSTRUCTIONS: THE COVERNIEET ON WHICH HAVE WRITTEN YOUR NAME MUST BE STAPLED TO THE FRONT OF YOLR PROJECT. DO NOT USE A REPORT COVER All components of the project may be handwritten, with the exception of the Adjusted Trial Balance, which must be prepared as an Excel document and submitted through the Dropbox in our course D2L shell prior to the start of class on the due date. Only the Adiusted Trial Balance should be submitted via the drop box. See Instructions below under "Part B" for specific requirements pertaining to the Excel requirements for the Adjusted Trial Balance NOTE: You may prepare your entire project using Excel: however, proper financial statement formatting must be used throughout if you choose to utilize Excel. EXCEL-PREPAREDCOMPONENTS proper financial statement formatting is required - Docents included in numbers, proper spacing, commas, dollar signs and sum lines double sum lines must be included where appropriate. HANDWRITTENCOMPONENTS must be very neat and legible, and proper financial statement formatting. is required-ho cents included in numbers, proper spacing, commas, dollar signs and sum lines double sum lines must be included where appropriate Do not submit any two-sided pages. All work must be submitted single-sided only

you make up

you make up  started narrative. already approved

started narrative. already approved part b and c

part b and c unless entry is required you can make

unless entry is required you can make

work already calucalted for bonds payable intrest payable interest expense and preimum on on bonds payable

work already calucalted for bonds payable intrest payable interest expense and preimum on on bonds payable