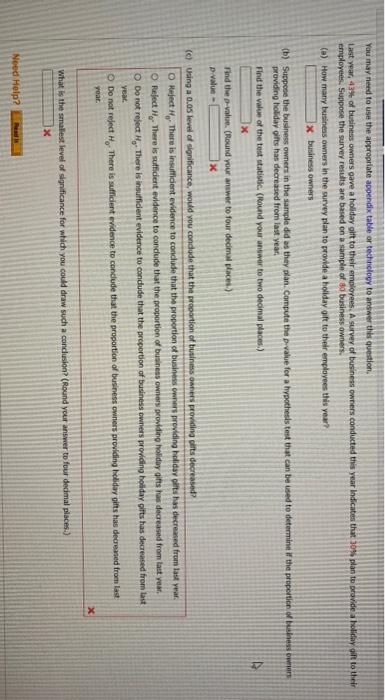

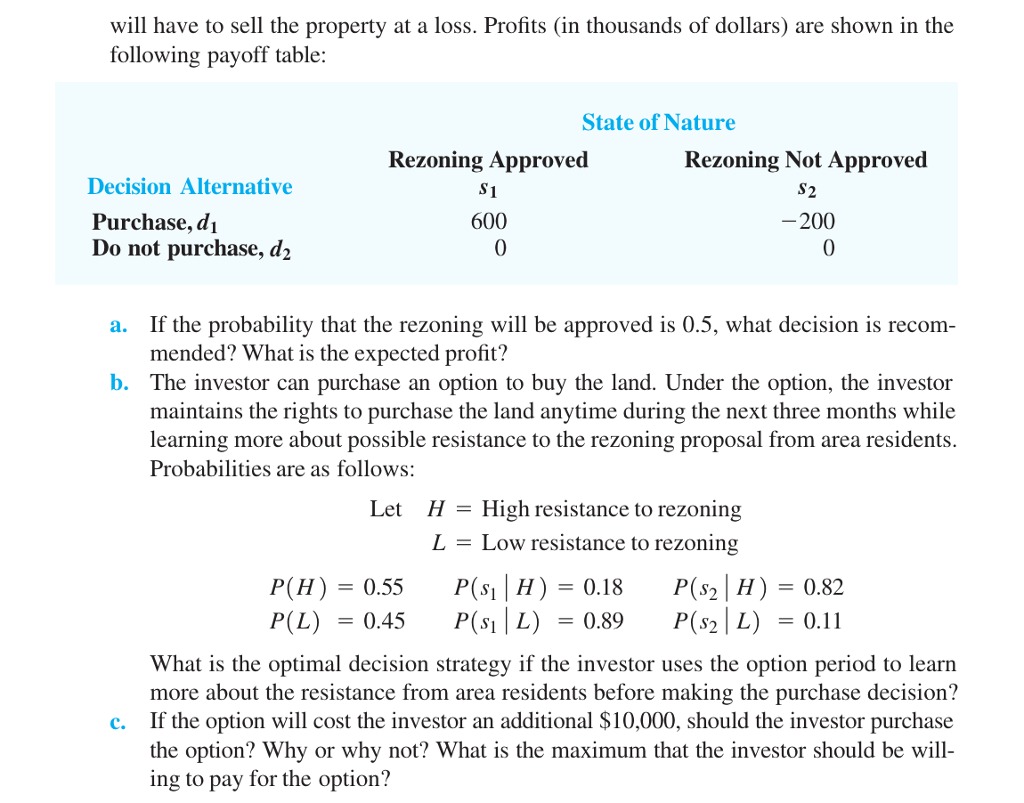

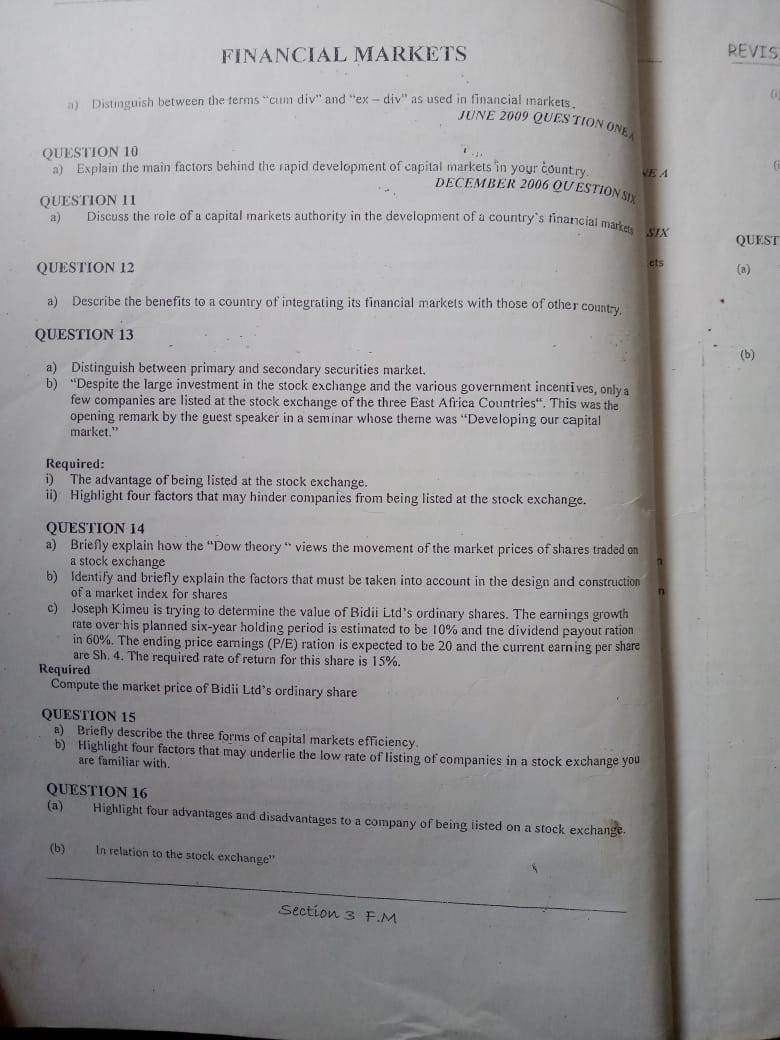

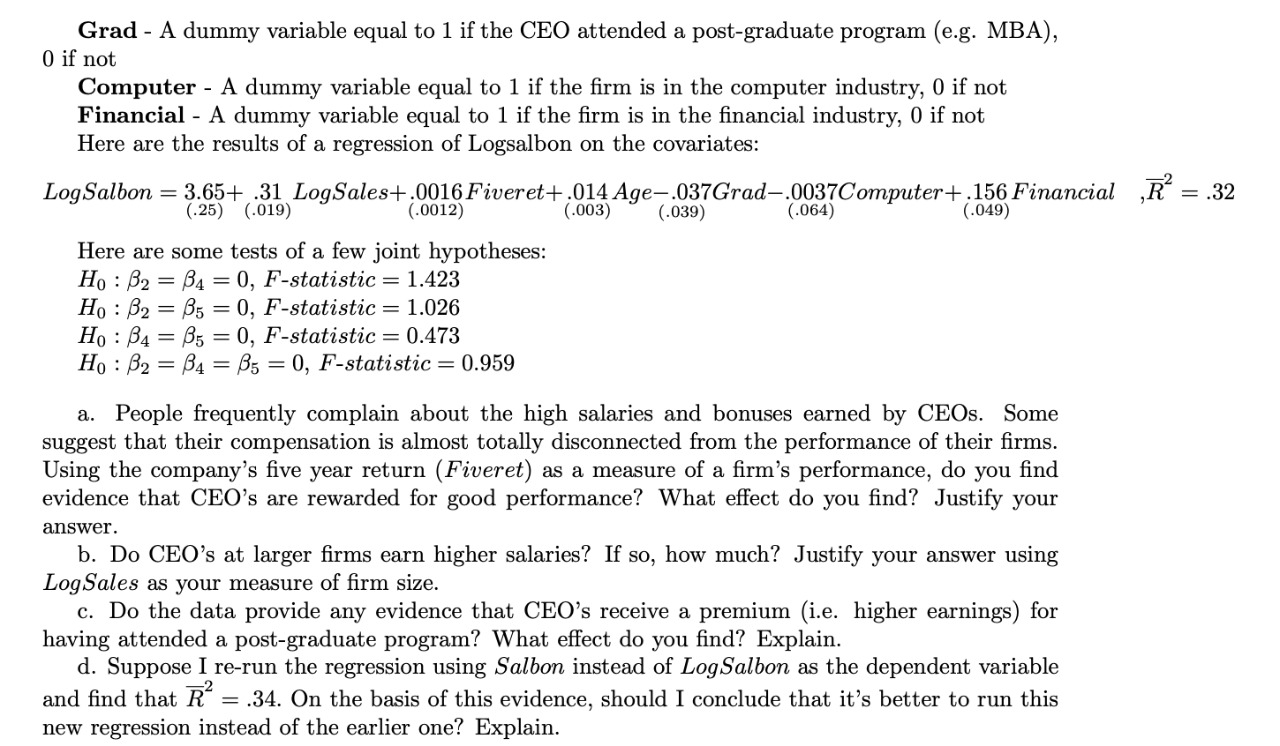

You may need to use the appropriate appendix table or technology to answer the question. Last year, 43:4 of business owners gave a holiday gift to their employees. A survey of business owners conducted thes plan to provide a holiday gift to their employees. Suppose the survey results are based on a sample of do business owners. (2) How many business owners in the survey plan to provide a holiday gift to their employees this year? * business owners (6) Suppose the business owners in the sample did as they plan. Compute the p-value for a hypothesis test that can be used to determine if the proportion of providing holiday gifts has decreased from last year. Find the value of the test statistic. (Round your answer to two decimal places,) Find the p-value. (Round your answer to four decimal places.) X (c)Using a 0.05 level of significance, would you conclude that the proportion of business owners providing gifts decreased? O Reject:. There is Insufficient evidence to conclude that the proportion of business owners providing holiday gifts has decreased from last year O Reject Me There is sufficient evidence to conclude that the proportion of business owners providing holiday gifts has decreased from last year, Q Do not reject N.. There is insufficient evidence to conclude that the proportion of business owners providing holiday gifts has decreased from last Year. O Do not reject H. There is sufficient evidence to conclude that the proportion of business owners providing holiday gifts has decreased from last roar What is the smallest level of significance for which you could draw such a conclusion? (Round your answer to four dodmal places.) Need Help? Canwill have to sell the property at a loss. Prots (in thousands of dollars) are shown in the following payoff table: State of Nature Rezoning Approved Rezoning Not Approved Decision Alternative .31 3'2 Purchase, ch 600 - 200 Do not purchase, d2 0 0 a. If the probability that the rezoning will be approved is 0.5, what decision is recom- mended? What is the expected prot? b. The investor can purchase an option to buy the land. Under the Option, the investor maintains the rights to purchase the land anytime during the next three months while learning more about possible resistance to the rezoning prOposal from area residents. Probabilities are as follows: Let H = High resistance to rezoning L = Low resistance to rezoning P(H) = 0.55 P(sl l H) = 0.18 P(sZIH) = 0.82 P(L) = 0.45 Pm l L) = 0.39 13(52 | r.) = 0.11 What is the optimal decision strategy if the investor uses the option period to learn more about the resistance from area residents before making the purchase decision? c. If the option will cost the investor an additional $10,000, should the investor purchase the option? Why or why not? What is the maximum that the investor should he will- ing to pay for the option? FINANCIAL MARKETS REVIS 7) Distinguish between the terms "coin div" and "ex - div" as used in financial markets. JUNE 2009 QUESTION ONE, QUESTION 10 a) Explain the main factors behind the rapid development of capital markets in your country. VE A DECEMBER 2006 QUESTION SIX QUESTION 11 a ) Discuss the role of a capital markets authority in the development of a country's financial markets six QUEST ets QUESTION 12 a) Describe the benefits to a country of integrating its financial markets with those of other country. QUESTION 13 (b) a) Distinguish between primary and secondary securities market. b) "Despite the large investment in the stock exchange and the various government incentives, only a few companies are listed at the stock exchange of the three East Africa Countries", This was the opening remark by the guest speaker in a seminar whose theme was "Developing our capital market." Required: i) The advantage of being listed at the stock exchange. ii) Highlight four factors that may hinder companies from being listed at the stock exchange. QUESTION 14 a) Briefly explain how the "Dow theory " views the movement of the market prices of shares traded on a stock exchange b) Identify and briefly explain the factors that must be taken into account in the design and construction of a market index for shares c) Joseph Kimeu is trying to determine the value of Bidii Ltd's ordinary shares. The earnings growth rate over his planned six-year holding period is estimated to be 10% and the dividend payout ration in 60%. The ending price earnings (P/E) ration is expected to be 20 and the current earning per share are Sh. 4. The required rate of return for this share is 15%. Required Compute the market price of Bidii Lid's ordinary share QUESTION 15 b) Briefly describe the three forms of capital markets efficiency. are familiar with. Highlight four factors that may underlie the low rate of listing of companies in a stock exchange you QUESTION 16 (a) Highlight four advantages and disadvantages to a company of being listed on a stock exchange. (b) In relation to the stock exchange" Section 3 F.MGrad - A dummy variable equal to 1 if the CEO attended a post-graduate program (e.g. MBA), 0 if not Computer - A dummy variable equal to 1 if the firm is in the computer industry, 0 if not Financial - A dummy variable equal to 1 if the firm is in the financial industry, 0 if not Here are the results of a regression of Logsalbon on the covariates: Log Salbon = 3.65+ .31 LogSales+ .0016 Fiveret+ .014 Age-.037Grad-.0037Computer+ .156 Financial ,R = .32 (.25) (.019) (.0012) (.003) (.039) (.064) (.049) Here are some tests of a few joint hypotheses: Ho : B2 = B4 = 0, F-statistic = 1.423 Ho : B2 = 35 = 0, F-statistic = 1.026 Ho : B4 = 35 = 0, F-statistic = 0.473 Ho : B2 = B4 = 35 = 0, F-statistic = 0.959 a. People frequently complain about the high salaries and bonuses earned by CEOs. Some suggest that their compensation is almost totally disconnected from the performance of their firms. Using the company's five year return (Fiveret) as a measure of a firm's performance, do you find evidence that CEO's are rewarded for good performance? What effect do you find? Justify your answer. b. Do CEO's at larger firms earn higher salaries? If so, how much? Justify your answer using Log Sales as your measure of firm size. c. Do the data provide any evidence that CEO's receive a premium (i.e. higher earnings) for having attended a post-graduate program? What effect do you find? Explain. d. Suppose I re-run the regression using Salbon instead of Log Salbon as the dependent variable and find that R" = .34. On the basis of this evidence, should I conclude that it's better to run this new regression instead of the earlier one? Explain