You may use Excel

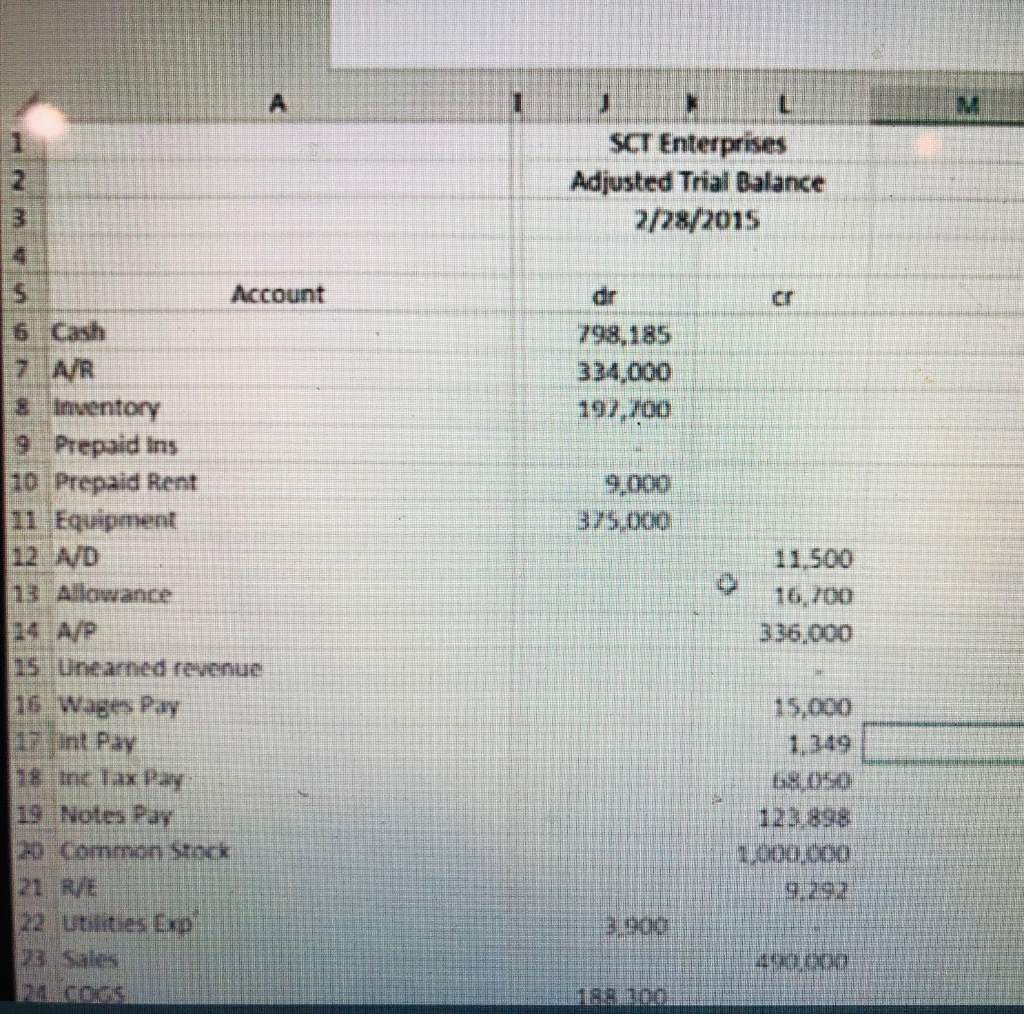

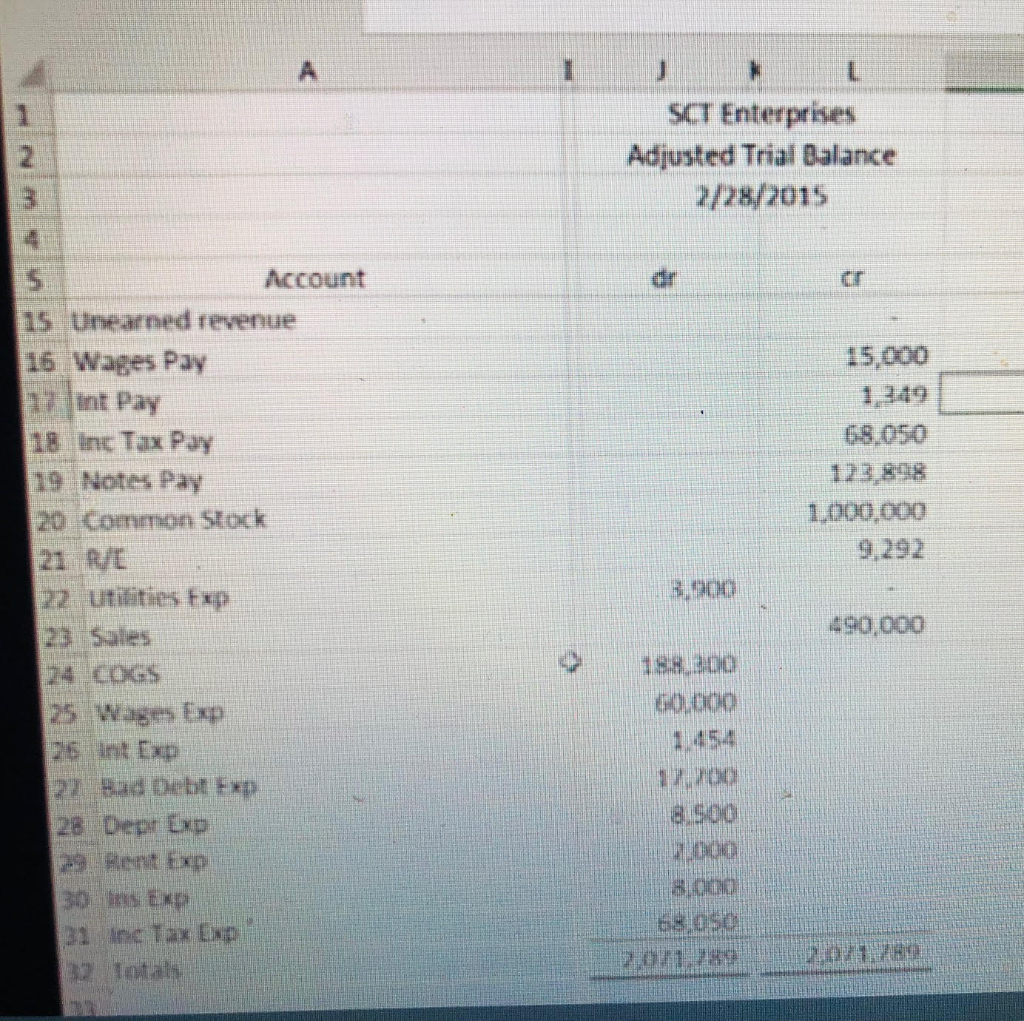

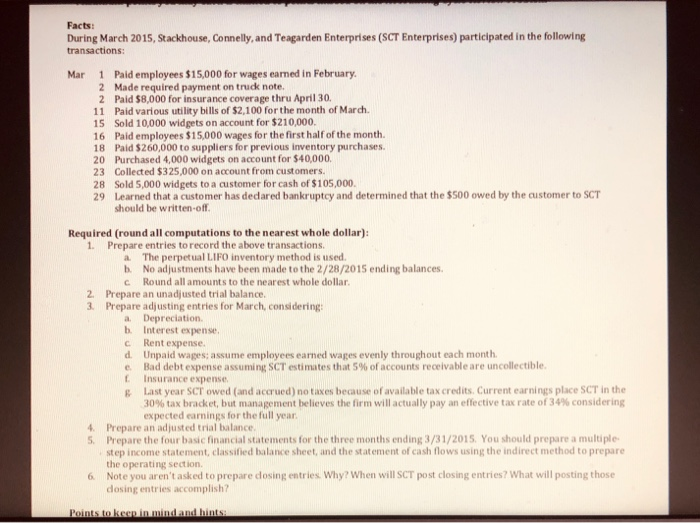

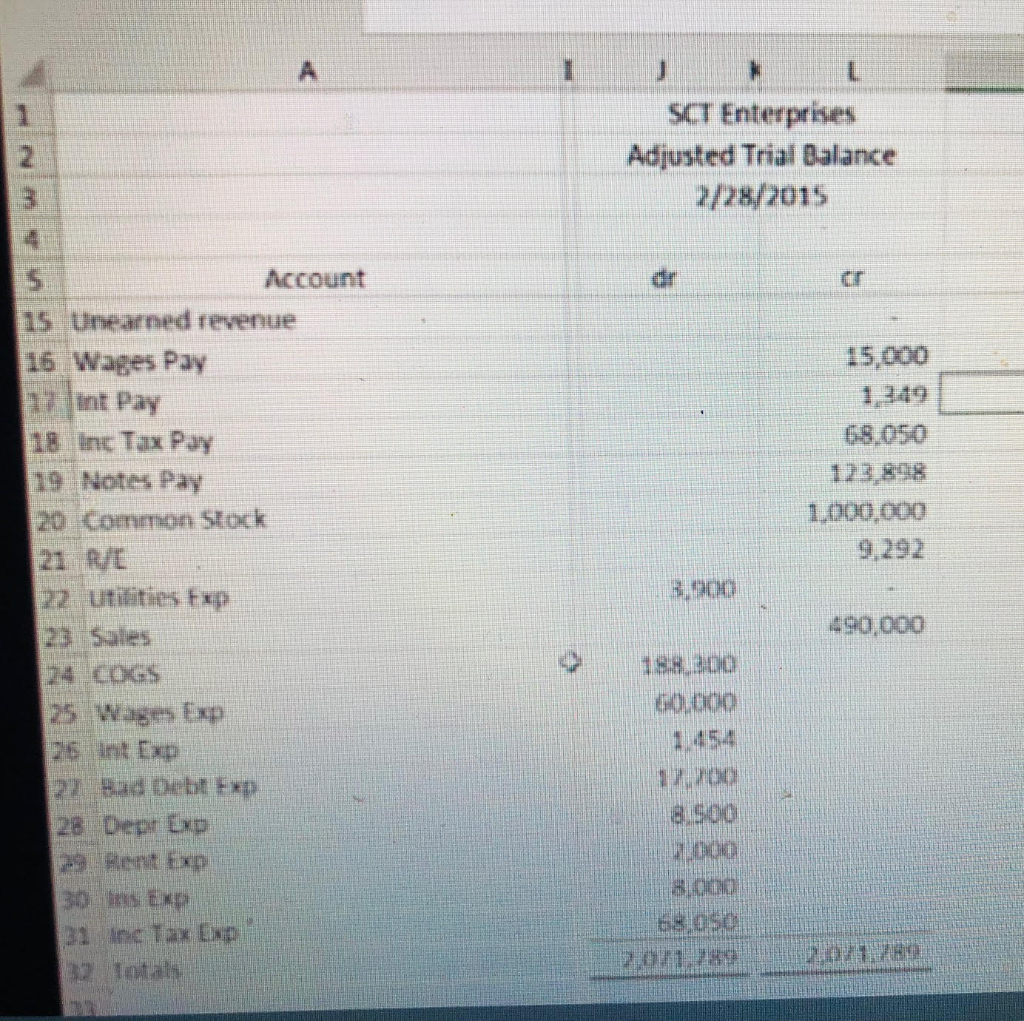

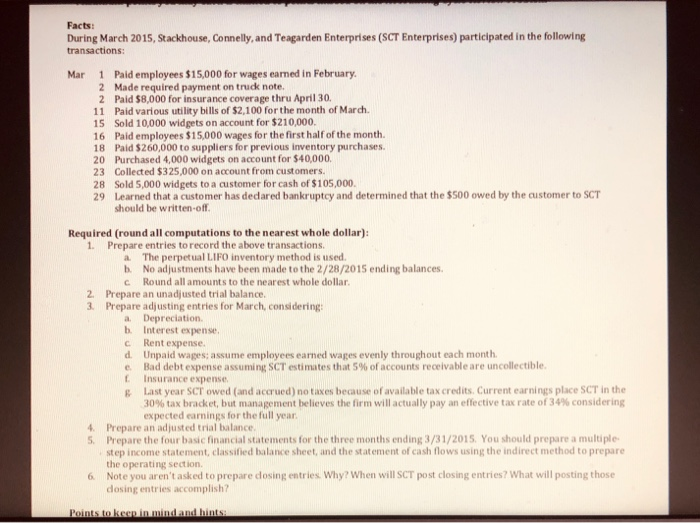

SCT Enterprises Adjusted Trial Balance 2/28/2015 Account 798,185 334,000 197,700 AYR & inventory 9. Prepaid Ins 10 Prepaid Rent 11 Equipment 12. AD 13 Allowance 9,000 375.000 11.500 16,700 336,000 15,000 69,090 15 Unearned revenue 16 Wages Pay 17 Hint Pay 18 inc lax Pay 19 Notes Pay Comment 21 RUE 22 utilities Exp 23. Sales 1.000.000 SCT Enterprkes Adjusted Trial Balance 2/28/2015 15,000 1,349 Account 15 Unearned revenue 16 Wages Pay 27 lint Pay 18 Inc Tax Pay 19 Notes Pay 20 Common Stock 21 / 22 utilities tup 23 Sales 1,000,000 9,292 3,900 490,000 198 200 60,000 25 wgs Exp 26 Int Exp 22Bad Debt Exp 28 Dept Lup 8.500 31 inc Tax END Facts: During March 2015, Stackhouse, Connelly, and Teagarden Enterprises (SCT Enterprises) participated in the following transactions: Mar 1 Paid employees $15,000 for wages earned in February 2 Made required payment on truck note. 2 Paid $8,000 for insurance coverage thru April 30. 11 Paid various utility bills of $2,100 for the month of March 15 Sold 10,000 widgets on account for $210,000. 16 Paid employees $15,000 wages for the first half of the month 18 Paid $260,000 to suppliers for previous inventory purchases 20 Purchased 4,000 widgets on account for $40,000. 23 Collected $325,000 on account from customers. 28 Sold 5,000 widgets to a customer for cash of $105,000 29 Learned that a customer has dedared bankruptcy and determined that the $500 owed by the customer to SCT should be written off Required (round all computations to the nearest whole dollar): 1. Prepare entries to record the above transactions a The perpetual LIFO inventory method is used b. No adjustments have been made to the 2/28/2015 ending balances C Round all amounts to the nearest whole dollar 2. Prepare an unadjusted trial balance. 3. Prepare adjusting entries for March, considering: a Depreciation. b. Interest expense C Rent expense. d. Unpaid wages: assume employees earned wages evenly throughout each month e Bad debt expense assuming SCT estimates that 5% of accounts receivable are uncollectible. L Insurance expense & Last year SCT owed and accrued) no taxes because of available tax credits. Current earnings place SCT in the 30% tax bracket, but management believes the firm will actually pay an effective tax rate of 34% considering expected earnings for the full year 4. Prepare an adjusted trial balance 5. Prepare the four basic financial statements for the three months ending 3/31/2015. You should prepare a multiple step income statement, classified balance sheet, and the statement of cash flows using the indirect method to prepare the operating section. 6. Note you aren't asked to prepare dosing entries. Why? When will SCT post closing entries? What will posting those dosing entries accomplish? Points to keep in mind and hints