Question

You may use the Excel spreadsheet named LeasevsBuy.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be

You may use the Excel spreadsheet named LeasevsBuy.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be careful to show all work, so your marker can follow your calculation and award partial marks as needed. (10 marks)

You may use the Excel spreadsheet named LeasevsBuy.xls to answer the following question. If you choose to answer the question without using the spreadsheet, be careful to show all work, so your marker can follow your calculation and award partial marks as needed. (10 marks)

You want to acquire a new car, but youre not sure whether you should lease it or buy it. You can buy your chosen model for $50,000. You expect it to be worth $20,000 after you use it for three years. Alternatively, you could lease it for $650 per month for a three-year term, with the first payment due immediately. The lease company has not told you what interest rate theyre using to calculate the monthly payments, but you know you could borrow money at an annual percentage rate (APR) of 8%.

- Calculate the present value of the lease payments, assuming monthly compounding at the given APR of 8%. (2 marks)

- Calculate the present value of the $20,000 salvage value, again using monthly compounding and the given APR of 8%. Deduct the salvage value from the purchase price to determine the present value of the cost of buying the vehicle. (2 marks)

- Based on your calculations, which option do you prefer: lease or buy? (2 marks)

- Calculate the salvage value at which you should be indifferent between leasing and buying. (2 marks)

- Assume your tax rate is 40%. If you were to use this car 100% for business, rendering the lease payments tax-deductible, or alternatively, allowing you to deduct depreciation straight-line at $10,000 per year for three years, would you prefer to buy or lease the car? (Hint: Use the after-tax borrowing rate to discount the cash flows.) (2 marks)

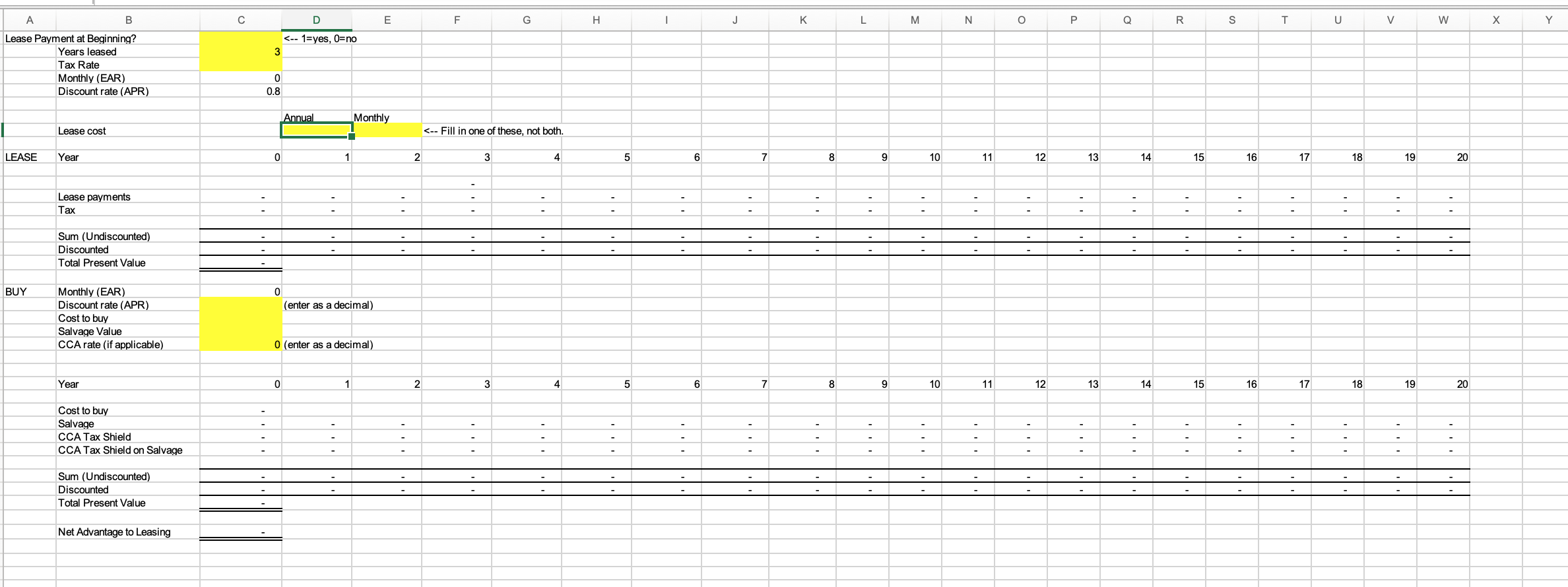

I have attached a photo of the Excel template we've been given to help answer the question if it's helpful. Thanks!

A B D E F G H J - K L Z M O P Q R S T U V W YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started