Question

You need a new car, and the dealer has offered you a price of $ 2000 with the following payment options: (a) pay cash and

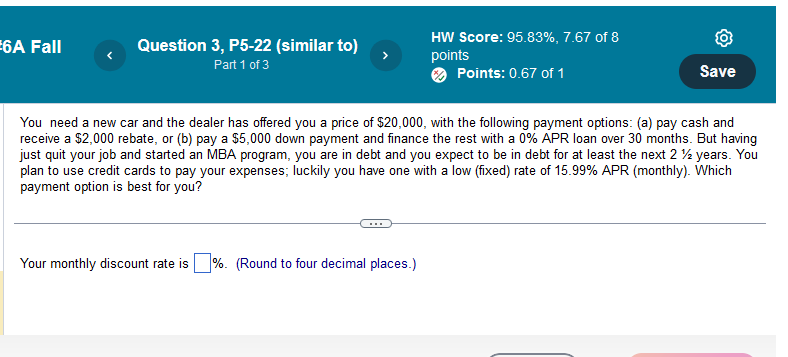

You need a new car, and the dealer has offered you a price of $ 2000 with the following payment options: (a) pay cash and receive a $ 2 000 rebate, or (b) pay a $ 5000 down payment and finance the rest with a 0 % APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt, and you expect to be in debt for at least the next 2 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate o 15.99 % APR (monthly). Which payment option is best for you?

Part 1 - Your monthly discount rate is (Round to four decimal places.)

Part 2 - For you, the present value of option (b) is (Round to the nearest dollar.)

Part 3

Which is the correct decision and why?(Select the best choice below.)

A.

Accept option (b) because it is more expensive than option (a).

B.

Accept option (a) because it is more expensive than option (b).

C.

Accept option (b) because it is less expensive than option (a).

Your answer is correct.

D.

Accept option (a) because it is less expensive than option (b).

Please help me. This is my fourth time doing a similar question and each expert got part 2 and part 3 wrong.

You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2,000 rebate, or (b) pay a $5,000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 21/2 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15.99% APR (monthly). Which payment option is best for you? Your monthly discount rate is \%. (Round to four decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started