Question

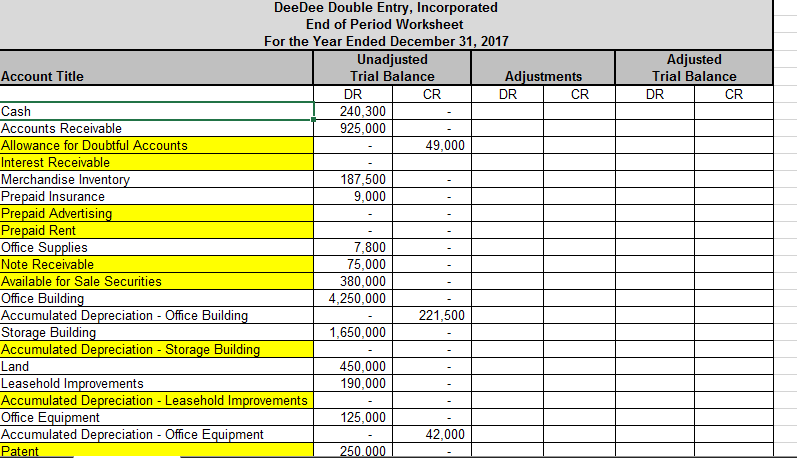

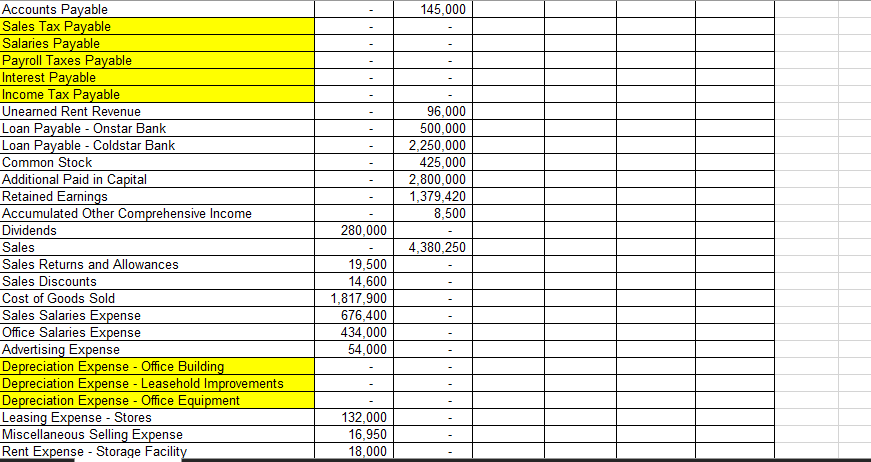

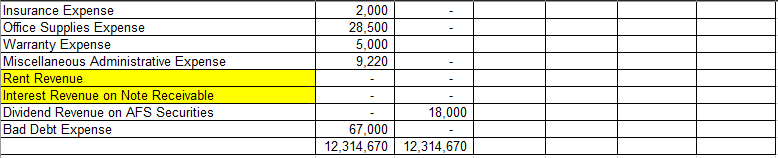

You note that Leasehold Improvements have not been depreciated for this year. DeeDee started to lease some new retail space in 2017 and added shelving

You note that Leasehold Improvements have not been depreciated for this year. DeeDee started to lease some new retail space in 2017 and added shelving and fixtures to this leased space. Based on your review of invoices, the previous accountant capitalized the cost of fixtures but did not capitalize the shipping and installation costs of $5,701. These costs were expensed and recorded as a miscellaneous administrative expense. DeeDee has decided to use double declining balance (DDB) depreciation for this item and to take a full year of depreciation in the year of acquisition. The leasehold improvements have a useful life of 15 years with a salvage value of $10,000.

a) How do I capitalize the shipping and installation costs of $5,701

b) How would I reverse it to get it out of Miscellaneous Administrative Expense?

c) What would be the depreciation? (Using the DDB)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started