Question

You noted that your firm's market value of common equity was more than $13 billion. You also discussed with JB the current capital-market conditions and

You noted that your firm's market value of common equity was more than $13 billion. You also discussed with JB the current capital-market conditions and decided to focus on the assumption that the firm could borrow $3 billion at a credit rating of AAA in the current market.Bell Technologies (BT hereafter) was one of the world's largest manufacturers and distributors of computers. The firm's industry, technology, was intensely competitive and was dominated by a few large players, Pear Inc., Microtender, Facegram, to name a few. Its revenues and earnings had grown substantially in the past five years, thanks to working-at-home policies implemented by many companies since COVID-19 and related restrictions (Exhibit 1: Income Statement in Excel). Historically, the firm had been conservatively financed. At the end of 2021, it had total assets of $1.9 billion and no long-term debt (Exhibit 2: Balance Sheet in Excel). BT's stock price (Exhibit 4: Other Information in Excel) had significantly outperformed the S&P 500 composite index and was running slightly ahead of its industry index.Under the proposed leveraged recapitalisation, BT could borrow $5 billion and use it either to pay an equivalent dividend or to re-purchase an equivalent value of shares. You knew that this combination of actions could affect the firm's share value, cost of capital, debt coverage, and earnings per share. Accordingly, you thought to evaluate the effect of the recapitalisation from these aspects. ? The effect on valuation and share price You recalled that debt increased the value of a firm by means of shielding cash flows from taxes. Thus, the present value of debt tax shields could be added to the value of the underlying unlevered firm to yield the value of the levered enterprise. The marginal tax rate proposed to use was 25%, reflecting the sum of federal,state and local taxes.? The effect on the cost of capital You also knew that the maximum value of the firm was achieved when the weighted average cost of capital (WACC) was minimised. Thus, you intended to estimate what the cost of equity (rE) and the rWACC might be if BT pursued this capital structure change. The projected cost of debt (rD) would depend on the assessment of the firm's debt rating, AAA, given the current capital market rates (Exhibit 3: Credit Rating in Excel). The cost of equity (rE) could be estimated by using a capital asset pricing model (CAPM). Exhibit 3 gives yields on U.S. Treasury instruments which afforded possible estimates of the risk-free return (rf) and the equity market risk premium (rm - rf) of 7%. Exhibit 4 gives BT's current (unlevered) beta. ? The impact on reported earnings per share You intended to estimate the expected effect on earnings per share (EPS) that would occur at different levels of operating income (EBIT) with a change in leverage. You planned to draw a graph to illustrate this. ? Other effects Lastly, you wondered whether your analysis covered everything. Where, for instance, should you consider potential costs of bankruptcy and distress or the effects of leverage as the signal for future operations of the company? More leverage would also create certain constraints or incentives for management. Should those be also included in the report for consideration

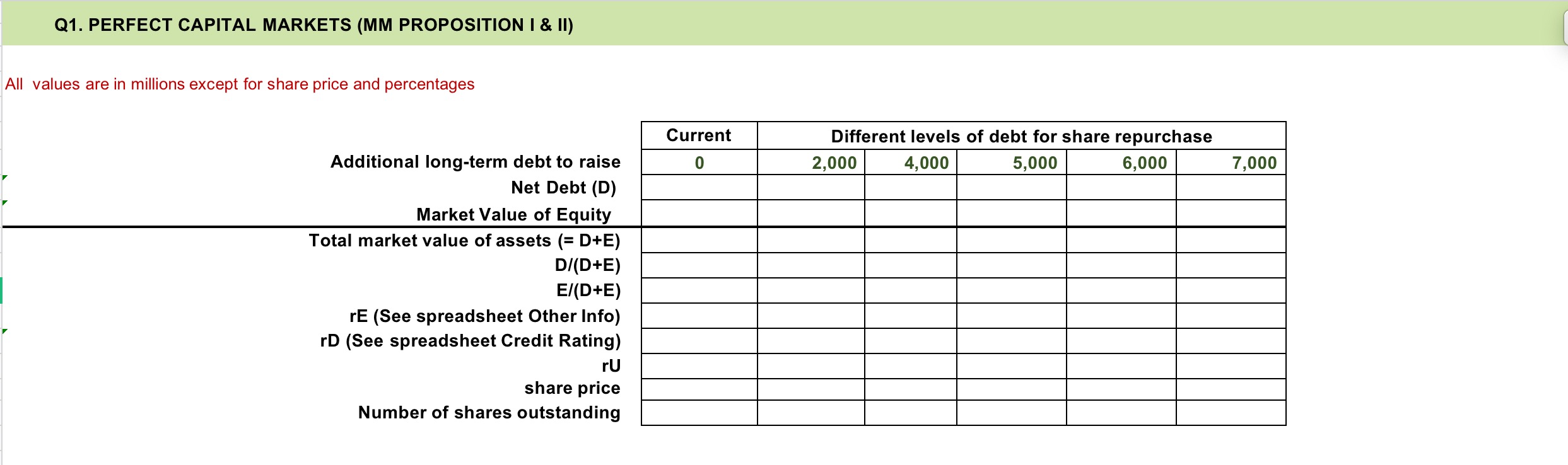

Question 1 (Q1) Base case: the MM theory of capital structure In perfect capital markets, what is the relationship between capital structure and cost of capital (WACC)? Apply the famous Miller-Modigliani propositions to BT's case and explain how a different capital structure may or may not affect its market value. Tips: 1. Complete the table in Excel spreadsheet Q1 Perfect Mkt. 2. Draw a chart using debt level (D) against rE and WACC to support the discussion of MM proposition I and II. (Paste the chart in appendix.)

Q1. PERFECT CAPITAL MARKETS (MM PROPOSITION I & II) All values are in millions except for share price and percentages Different levels of debt for share repurchase 6,000 4,000 5,000 Current Additional long-term debt to raise Net Debt (D) 0 2,000 Market Value of Equity Total market value of assets (= D+E) D/(D+E) E/(D+E) rE (See spreadsheet Other Info) rD (See spreadsheet Credit Rating) rU share price Number of shares outstanding 7,000

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER In perfect capital markets according to the ModiglianiMiller MM propositions 1 MM Proposition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started