Question

You noted the following items relative to the company's intangibles assets of Pete Corporation at December 31, 2022. On January 2021, Pete signed an agreement

On January 2021, Pete signed an agreement to operate as franchisee of Clear Copy Service, Inc., for an initial franchise of P680,000. Of this amount, P200,000 was paid when the agreement was signed and the balance was payable in four annual payment of P120,000 each beginning on January 1, 2022. The agreement provides that the down payment is not refundable and no future services are required in the franchisor. The implicit rate for loan of this type is 14%. Discount factors of 14% for four years for ordinary annuity and annuity due are 2.9137 and 3.3216, respectively. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Pete's revenue from the franchise for 2022 was P8,000,000. Pete estimates the useful life of the franchise to be ten years.

Pete incurred P624,000 of experimental development costs in its laboratory to develop a patent which was granted on January 2, 2021. Legal fees and other costs associated with the registration of the patent totaled P131,200. Pete estimates that the useful life of the patent will be eight years.

A trademark was purchased from Jane Company for P220,000 on July 1, 2020. Expenditures for successful litigation in defense of the trademark totaling P80,000 were paid on July 1, 2022. Pete estimates that the trademark's useful life will be indefinite.

What are the carrying amounts of the intangible assets (franchise, patents and trademarks, respectively) on December 31, 2022?

On April 1, 2022, Vancouver Company purchased from Sunbucks Company (franchisor), a franchise to operate a 24-hours cafe at Eastwood for P3,125,000. In addition, the franchise contract stipulates that Vancouver shall pay Sunbucks Company 5% of its sales in excess of P5,000,000, payable at the end of the month following the end of every quarter. For the nine months ended December 31, 2022, Vancouver Company's sales amounted to P8,500,000. Vancouver estimates that the useful life of the franchise is 10 years. It is the company's policy to amortize to the nearest month.

How much is Vancouver Company's amortization expense and franchise fee expense for the year 2022?

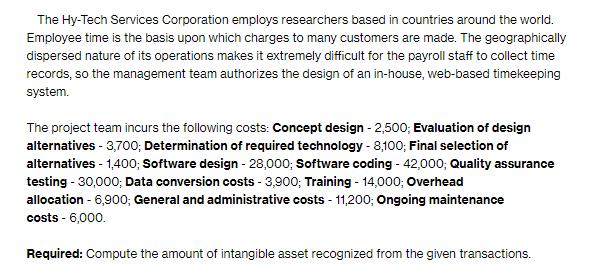

The Hy-Tech Services Corporation employs researchers based in countries around the world. Employee time is the basis upon which charges to many customers are made. The geographically dispersed nature of its operations makes it extremely difficult for the payroll staff to collect time records, so the management team authorizes the design of an in-house, web-based timekeeping system. The project team incurs the following costs: Concept design - 2,500; Evaluation of design alternatives - 3,700; Determination of required technology - 8,100; Final selection of alternatives - 1,400; Software design - 28,000; Software coding - 42,000; Quality assurance testing - 30,000; Data conversion costs - 3,900; Training - 14,000; Overhead allocation - 6,900; General and administrative costs - 11,200; Ongoing maintenance costs - 6,000. Required: Compute the amount of intangible asset recognized from the given transactions.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the carrying amounts of the intangible assets franchise patents and trademarks on December 31 2022 for Pete Corporation based on the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started