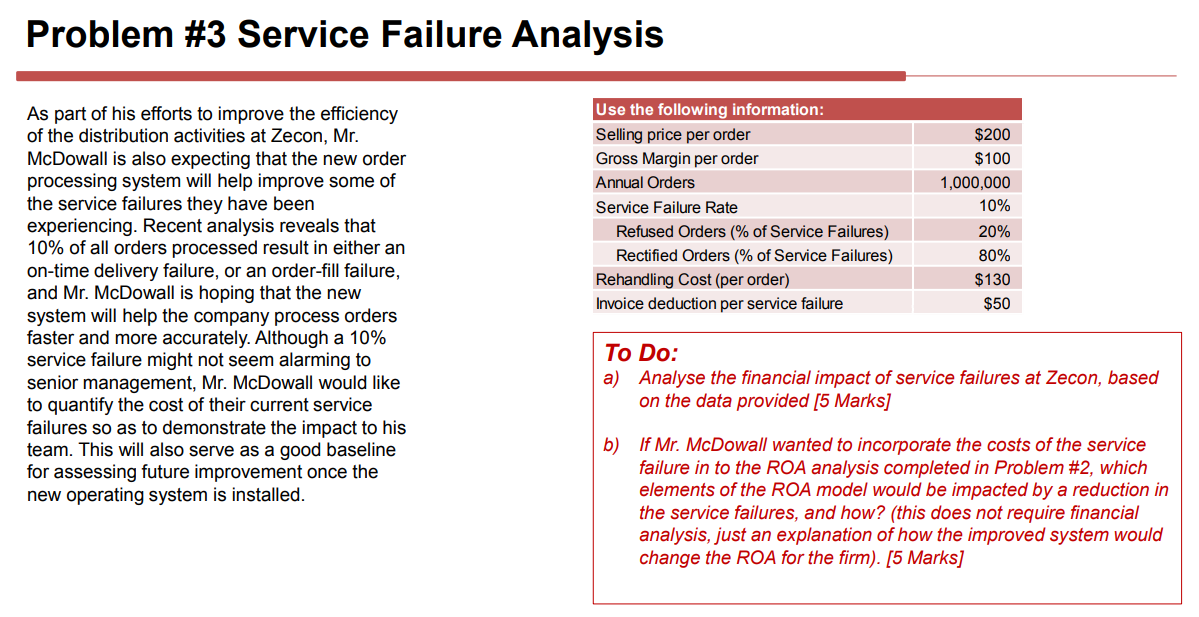

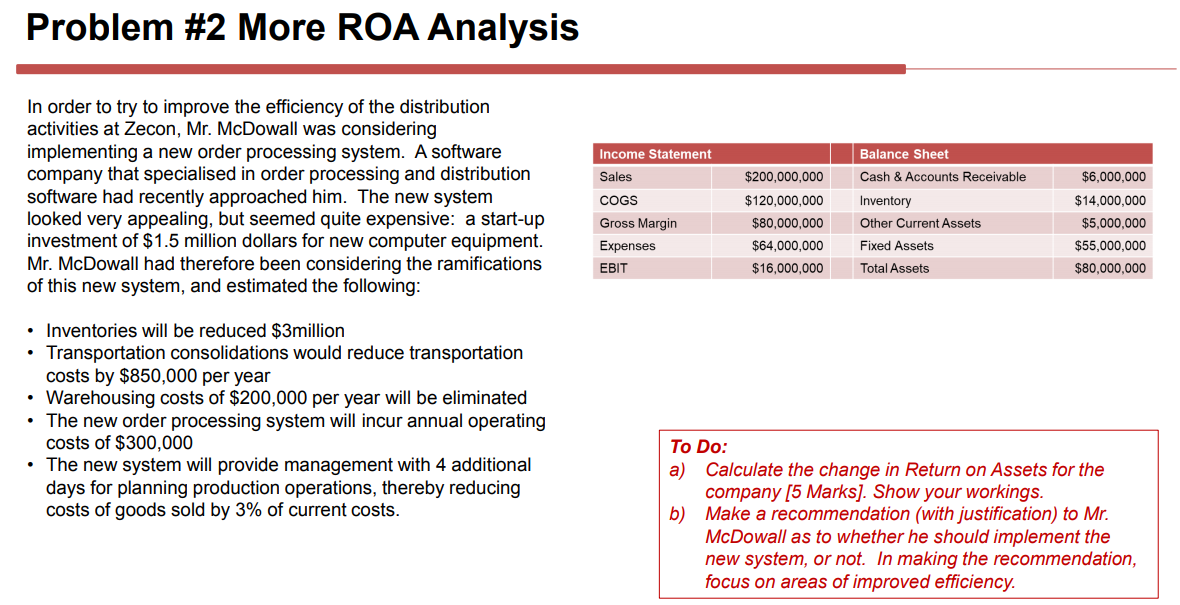

You only need to do "Problem 3 Service Failure Analysis". Thank you Problem #3 Service Failure Analysis As part of his efforts to improve the efficiency of the distribution activities at Zecon, Mr. McDowall is also expecting that the new order processing system will help improve some of the service failures they have been experiencing. Recent analysis reveals that 10% of all orders processed result in either an on-time delivery failure, or an order-fill failure, and Mr. McDowall is hoping that the new system will help the company process orders faster and more accurately. Although a 10% service failure might not seem alarming to senior management, Mr. McDowall would like to quantify the cost of their current service failures so as to demonstrate the impact to his team. This will also serve as a good baseline for assessing future improvement once the new operating system is installed. Use the following information: Selling price per order Gross Margin per order Annual Orders Service Failure Rate Refused Orders (% of Service Failures) Rectified Orders (% of Service Failures) Rehandling Cost (per order) Invoice deduction per service failure $200 $100 1,000,000 10% 20% 80% $130 $50 To Do: a) Analyse the financial impact of service failures at Zecon, based on the data provided [5 Marks] b) If Mr. McDowall wanted to incorporate the costs of the service failure in to the ROA analysis completed in Problem #2, which elements of the ROA model would be impacted by a reduction in the service failures, and how? (this does not require financial analysis, just an explanation of how the improved system would change the ROA for the firm). [5 Marks] Problem #2 More ROA Analysis Balance Sheet Income Statement Sales In order to try to improve the efficiency of the distribution activities at Zecon, Mr. McDowall was considering implementing a new order processing system. A software company that specialised in order processing and distribution software had recently approached him. The new system looked very appealing, but seemed quite expensive: a start-up investment of $1.5 million dollars for new computer equipment. Mr. McDowall had therefore been considering the ramifications of this new system, and estimated the following: COGS Gross Margin Expenses EBIT $200,000,000 $120,000,000 $80,000,000 $64,000,000 $16,000,000 Cash & Accounts Receivable Inventory Other Current Assets Fixed Assets Total Assets $6,000,000 $14,000,000 $5.000.000 $55,000,000 $80,000,000 . Inventories will be reduced $3million Transportation consolidations would reduce transportation costs by $850,000 per year Warehousing costs of $200,000 per year will be eliminated The new order processing system will incur annual operating costs of $300,000 The new system will provide management with 4 additional days for planning production operations, thereby reducing costs of goods sold by 3% of current costs. To Do: a) Calculate the change in Return on Assets for the company [5 Marks]. Show your workings. b) Make a recommendation (with justification) to Mr. McDowall as to whether he should implement the new system, or not. In making the recommendation, focus on areas of improved efficiency. You only need to do "Problem 3 Service Failure Analysis". Thank you Problem #3 Service Failure Analysis As part of his efforts to improve the efficiency of the distribution activities at Zecon, Mr. McDowall is also expecting that the new order processing system will help improve some of the service failures they have been experiencing. Recent analysis reveals that 10% of all orders processed result in either an on-time delivery failure, or an order-fill failure, and Mr. McDowall is hoping that the new system will help the company process orders faster and more accurately. Although a 10% service failure might not seem alarming to senior management, Mr. McDowall would like to quantify the cost of their current service failures so as to demonstrate the impact to his team. This will also serve as a good baseline for assessing future improvement once the new operating system is installed. Use the following information: Selling price per order Gross Margin per order Annual Orders Service Failure Rate Refused Orders (% of Service Failures) Rectified Orders (% of Service Failures) Rehandling Cost (per order) Invoice deduction per service failure $200 $100 1,000,000 10% 20% 80% $130 $50 To Do: a) Analyse the financial impact of service failures at Zecon, based on the data provided [5 Marks] b) If Mr. McDowall wanted to incorporate the costs of the service failure in to the ROA analysis completed in Problem #2, which elements of the ROA model would be impacted by a reduction in the service failures, and how? (this does not require financial analysis, just an explanation of how the improved system would change the ROA for the firm). [5 Marks] Problem #2 More ROA Analysis Balance Sheet Income Statement Sales In order to try to improve the efficiency of the distribution activities at Zecon, Mr. McDowall was considering implementing a new order processing system. A software company that specialised in order processing and distribution software had recently approached him. The new system looked very appealing, but seemed quite expensive: a start-up investment of $1.5 million dollars for new computer equipment. Mr. McDowall had therefore been considering the ramifications of this new system, and estimated the following: COGS Gross Margin Expenses EBIT $200,000,000 $120,000,000 $80,000,000 $64,000,000 $16,000,000 Cash & Accounts Receivable Inventory Other Current Assets Fixed Assets Total Assets $6,000,000 $14,000,000 $5.000.000 $55,000,000 $80,000,000 . Inventories will be reduced $3million Transportation consolidations would reduce transportation costs by $850,000 per year Warehousing costs of $200,000 per year will be eliminated The new order processing system will incur annual operating costs of $300,000 The new system will provide management with 4 additional days for planning production operations, thereby reducing costs of goods sold by 3% of current costs. To Do: a) Calculate the change in Return on Assets for the company [5 Marks]. Show your workings. b) Make a recommendation (with justification) to Mr. McDowall as to whether he should implement the new system, or not. In making the recommendation, focus on areas of improved efficiency