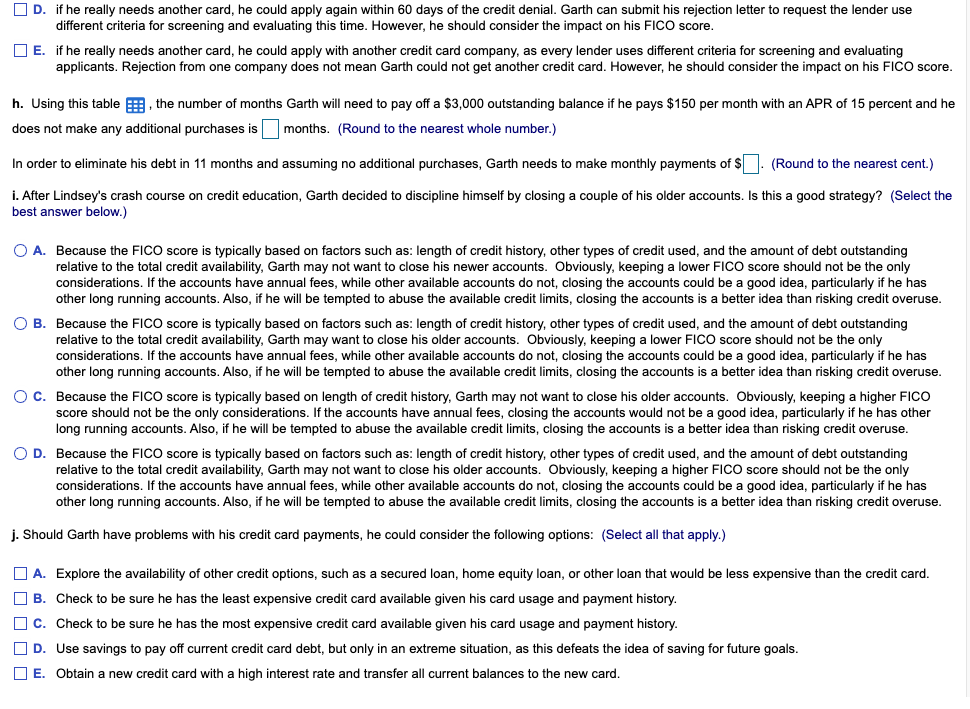

Garth was amazed to hear that his friend Lindsey always pays off her credit card balance each month. Garth just assumed that everyone used credit cards the same way - buy now, pay later - only in his case, months later. He buys almost everything he needs or wants, including clothes, food, and entertainment with his card. When Lindsey asked him about the balance calculation method, APR, grace period, or other fees and features of his card, Garth was clueless. He reasoned that his credit card was a safe and convenient way to shop and it allowed him to buy expensive items by paying minimum monthly payments. Overall, Garth thought of himself as a responsible credit user, despite the fact he had been late making a few monthly payments, and, once or twice, had gone over his credit limit. He also uses his card regularly to obtain cash advances. After hearing all of this, Lindsey is worried about her friend. She has come to you for help in answering the following questions. a. What type of credit user is Garth? Based on your answer, what is the number one factor that should influence Garth's choice of a credit card? b. Lindsey insisted that Garth request a free credit report. List and briefly explain the information that Lindsey will need to help Garth decipher his report. c. Nathaniel, another friend, suggested that Garth should obtain a secured credit card, or better yet a Titanium card. Do you agree? Why or why not? d. Based on what you know about Garth, what kind of additional fees and penalties is he most likely to encounter? What is the impact of these fees and penalties on Garth? e. Explain the differences in credit card interest rates when described as a fixed, variable, teaser, or penalty rate. How do these different rates affect the cost of using a credit card? e. Explain the differences in credit card interest rates when described as a fixed, variable, teaser, or penalty rate. How do these different rates affect the cost of using a credit card? f. What factors should Garth consider if he decides to transfer his current card balance to another card? g. Much to Garth's surprise, his last credit card application was rejected. What actions, if any, should he take? Why should he be concerned about this rejection if he still has his other cards? h. Using this table determine how many months Garth will need to pay off a $3,000 outstanding balance if he pays $150 per month with an APR of 15 percent and he does not make any additional purchases. Tell Garth how much his monthly payment needs to be in order to eliminate his debt in 11 months, assuming no additional purchases. i. After Lindsey's crash course on credit education, Garth decided to discipline himself by closing a couple of his older accounts. Is this a good strategy? j. What advice would you give Garth if he has trouble paying his credit card bill in the future? a. Garth would be classified as a: (Select the best answer below.) O A. credit user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. O B. convenience user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. O C. credit user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the highest possible interest rate. He should also find a card with a low cash advance fee. O D. convenience user, because he pays off his balance every month. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. b. Although the format may vary, all credit reports include information that Lindsey and Garth will need to review for accuracy: (Select all that apply.) A. personal identification information such as name, address, driver's license number, proof of car insurance, and education information. B. public record and collection reports such as legal actions recorded in state and county courts (e.g., bankruptcies, foreclosures, judgments, liens, wage attachments, or suits) or overdue debts pursued by collection agencies. C. inquiries for the last 2 years by anyone accessing the account, including "voluntary" inquiries from creditors, representing accounts Garth has attempted to open, as well as "involuntary" inquiries from creditors making preapproved offers. D. personal identification information such as name, address, Social Security number, birth date, and employment information. | E. trade lines or credit accounts including the type of account, creditor name, account number, balance, date opened, payment history and current payment status of the account. OF. academic records for the last 4 years, including classes taken, GPA, and any academic probation. c. Nathaniel, another friend, suggested that Garth should obtain a secured credit card, or better yet a Titanium card. Do you agree? Why or why not? (Select the best answer below.) O A. A secured credit card is the highest class of credit card that offers the highest credit limits and perks to cardholders. This is an appropriate card for Garth because he would have a higher credit limit and would be able to make purchases without going over his limit. It is very doubtful that Garth could qualify for a Titanium card, which is a regular bank card backed by collateral. OB. A secured credit card is the highest class of credit card that offers the highest credit limits and perks to cardholders. This is not an appropriate card for Garth because there is no indication that Garth's credit is bad enough to stop him from obtaining another card or that he cannot make monthly credit card payments. It is very doubtful that Garth could qualify for a Titanium card, which is a regular bank card backed by collateral. OC. A secured credit card is a regular bank card backed by collateral. This is not an appropriate card for Garth because there is no indication that Garth's credit is bad enough to stop him from obtaining another card or that he cannot make monthly credit card payments. It is very doubtful that Garth could qualify for a Titanium card, the highest class of credit card that offers the highest credit limits and perks to cardholders. OD. A secured credit card is a regular bank card backed by collateral. This is an appropriate card for Garth because there is no way that Garth can make his current monthly payments without his new card. It is very doubtful that Garth could qualify for a Titanium card, the highest class of credit card that offers the highest credit limits and perks to cardholders. d. Based on what you know about Garth, the kind of additional fees and penalties is he most likely to encounter are: (Select the best answer below.) d. Based on what you know about Garth, the kind of additional fees and penalties is he most likely to encounter are: (Select the best answer below.) O A. late fees and unpaid balance fees. OB. cash advance fees and late fees O c. cash advance fees and out-of-state usage fees. OD. late fees and secured credit card fees. The impact of these fees and penalties on Garth is that: (Select the best answer below.) O A. because he is sometimes early in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. OB. because he is sometimes late in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases less expensive than they should be. O c. because he is sometimes late in making payments, he may also incur penalty rates that can significantly decrease the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. OD. because he is sometimes late in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. e. The rate charged on a credit card account is a significant determinant of the cost of using that card. Garth may encounter offers with a fixed rate, which is: (Select the best answer below.) A. a significantly lower rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OB. a constant rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. O c. a significantly higher rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OD. a fluctuating rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. Garth may encounter offers with a variable rate, which is: (Select the best answer below.) O A. a constant rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. OB. a fluctuating rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the variable rate. O c. an exceptionally low introductory rate initially charged on the account to attract new users. The teaser rate is available for 3 to 12 months, but then jumps to a higher rate. OD. a fluctuating rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. Garth may encounter offers with teaser rate, which is: (Select the best answer below.) O A. an exceptionally high introductory rate initially charged on the account a lower rate attract new users. The teaser rate is available for 3 to 12 months, but then jumps to Garth may encounter offers with teaser rate, which is: (Select the best answer below.) O A. an exceptionally high introductory rate initially charged on the account to attract new users. The teaser rate is available for 3 to 12 months, but then jumps to a lower rate. OB. a fluctuating rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. O c. a constant rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. OD. an exceptionally low introductory rate initially charged on the account to attract new users. The teaser rate available for 3 to 12 months, but then jumps to a higher rate. Garth may encounter offers with a penalty rate, which is: (Select the best answer below.) O A. a significantly higher rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OB. a significantly lower rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. O c. a constant rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. OD. a fluctuating rate tied to changes another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. f. To maximize the benefit from transferring his credit card balance to another card, Garth should follow these guidelines: (Select all that apply.) A. Ask how long the transfer process will take to insure no missed payments on the original card. B. Comparison shop to find the card offer with the best possible interest rate/fee structure. C. Don't transfer a balance to a card with a balance, because he will likely lose any grace period for the transferred balance. D. Pay as much as possible on the account to reduce the balance before the low rate expires. E. Maintain the old credit account for the benefit to his FICO score, but use it only when he can definitely afford to pay the bill in full so as not to incur interest charges. OF. Not open additional credit accounts because opening too many accounts in a short time frame would likely reduce his FICO score. G. Determine the length of the grace period of no interest on transferred balances (if any) and the length of the lower, "teaser rate" period. g. After Garth's latest credit card application was rejected, he should consider taking action by: (Select all that apply.) A. within 60 days of the credit denial, Garth can submit his rejection letter to request a free copy of his credit report from the credit reporting service used by the credit card company. He should carefully review the report for accuracy and correct any inaccurate information. He could be the victim of identity theft. B. contact a representative of the credit card company, or if a local bank, the credit card manager to let them know he will apply with another credit card company that uses different criteria for screening and evaluating applicants. He could be the victim of identity theft. C. contact a representative of the credit card company, or if a local bank, the credit card manager to determine why he was rejected. Garth will then need to take the necessary steps to correct the problem, such as correcting inaccurate information in his credit history or changing his credit use and payment practices. D. if he really needs another card, he could apply again within 60 days of the credit denial. Garth can submit his rejection letter to request the lender use different criteria for screening and evaluating this time. However, he should consider the impact on his FICO score. D. if he really needs another card, he could apply again within 60 days of the credit denial. Garth can submit his rejection letter to request the lender use different criteria for screening and evaluating this time. However, he should consider the impact on his FICO score. E. if he really needs another card, he could apply with another credit card company, as every lender uses different criteria for screening and evaluating applicants. Rejection from one company does not mean Garth could not get another credit card. However, he should consider the impact on his FICO score. h. Using this table , the number of months Garth will need to pay off a $3,000 outstanding balance if he pays $150 per month with an APR of 15 percent and he does not make any additional purchases is months. (Round to the nearest whole number.) In order to eliminate his debt in 11 months and assuming no additional purchases, Garth needs to make monthly payments of $ (Round to the nearest cent.) i. After Lindsey's crash course on credit education, Garth decided to discipline himself by closing a couple of his older accounts. Is this a good strategy? (Select the best answer below.) O A. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may not want to close his newer accounts. Obviously, keeping a lower FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. O B. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may want to close his older accounts. Obviously, keeping a lower FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts a better idea than risking credit overuse. O C. Because the FICO score is typically based on length of credit history, Garth may not want to close his older accounts. Obviously, keeping a higher FICO score should not be the only considerations. If the accounts have annual fees, closing the accounts would not be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. OD. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may not want to close his older accounts. Obviously, keeping a higher FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. j. Should Garth have problems with his credit card payments, he could consider the following options: (Select all that apply.) I A. Explore the availability of other credit options, such as a secured loan, home equity loan, or other loan that would be less expensive than the credit card. B. Check to be sure he has the least expensive credit card available given his card usage and payment history. C. Check to be sure he has the most expensive credit card available given his card usage and payment history. D. Use savings to pay off current credit card debt, but only in an extreme situation, as this defeats the idea of saving for future goals. DE. Obtain a new credit card with a high interest rate and transfer all current balances to the new card. Garth was amazed to hear that his friend Lindsey always pays off her credit card balance each month. Garth just assumed that everyone used credit cards the same way - buy now, pay later - only in his case, months later. He buys almost everything he needs or wants, including clothes, food, and entertainment with his card. When Lindsey asked him about the balance calculation method, APR, grace period, or other fees and features of his card, Garth was clueless. He reasoned that his credit card was a safe and convenient way to shop and it allowed him to buy expensive items by paying minimum monthly payments. Overall, Garth thought of himself as a responsible credit user, despite the fact he had been late making a few monthly payments, and, once or twice, had gone over his credit limit. He also uses his card regularly to obtain cash advances. After hearing all of this, Lindsey is worried about her friend. She has come to you for help in answering the following questions. a. What type of credit user is Garth? Based on your answer, what is the number one factor that should influence Garth's choice of a credit card? b. Lindsey insisted that Garth request a free credit report. List and briefly explain the information that Lindsey will need to help Garth decipher his report. c. Nathaniel, another friend, suggested that Garth should obtain a secured credit card, or better yet a Titanium card. Do you agree? Why or why not? d. Based on what you know about Garth, what kind of additional fees and penalties is he most likely to encounter? What is the impact of these fees and penalties on Garth? e. Explain the differences in credit card interest rates when described as a fixed, variable, teaser, or penalty rate. How do these different rates affect the cost of using a credit card? e. Explain the differences in credit card interest rates when described as a fixed, variable, teaser, or penalty rate. How do these different rates affect the cost of using a credit card? f. What factors should Garth consider if he decides to transfer his current card balance to another card? g. Much to Garth's surprise, his last credit card application was rejected. What actions, if any, should he take? Why should he be concerned about this rejection if he still has his other cards? h. Using this table determine how many months Garth will need to pay off a $3,000 outstanding balance if he pays $150 per month with an APR of 15 percent and he does not make any additional purchases. Tell Garth how much his monthly payment needs to be in order to eliminate his debt in 11 months, assuming no additional purchases. i. After Lindsey's crash course on credit education, Garth decided to discipline himself by closing a couple of his older accounts. Is this a good strategy? j. What advice would you give Garth if he has trouble paying his credit card bill in the future? a. Garth would be classified as a: (Select the best answer below.) O A. credit user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. O B. convenience user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. O C. credit user, because he carries an unpaid balance from one month to the next. Garth should focus on the APR offered by a credit card issuer and choose one with the highest possible interest rate. He should also find a card with a low cash advance fee. O D. convenience user, because he pays off his balance every month. Garth should focus on the APR offered by a credit card issuer and choose one with the lowest possible interest rate. He should also find a card with a low cash advance fee. b. Although the format may vary, all credit reports include information that Lindsey and Garth will need to review for accuracy: (Select all that apply.) A. personal identification information such as name, address, driver's license number, proof of car insurance, and education information. B. public record and collection reports such as legal actions recorded in state and county courts (e.g., bankruptcies, foreclosures, judgments, liens, wage attachments, or suits) or overdue debts pursued by collection agencies. C. inquiries for the last 2 years by anyone accessing the account, including "voluntary" inquiries from creditors, representing accounts Garth has attempted to open, as well as "involuntary" inquiries from creditors making preapproved offers. D. personal identification information such as name, address, Social Security number, birth date, and employment information. | E. trade lines or credit accounts including the type of account, creditor name, account number, balance, date opened, payment history and current payment status of the account. OF. academic records for the last 4 years, including classes taken, GPA, and any academic probation. c. Nathaniel, another friend, suggested that Garth should obtain a secured credit card, or better yet a Titanium card. Do you agree? Why or why not? (Select the best answer below.) O A. A secured credit card is the highest class of credit card that offers the highest credit limits and perks to cardholders. This is an appropriate card for Garth because he would have a higher credit limit and would be able to make purchases without going over his limit. It is very doubtful that Garth could qualify for a Titanium card, which is a regular bank card backed by collateral. OB. A secured credit card is the highest class of credit card that offers the highest credit limits and perks to cardholders. This is not an appropriate card for Garth because there is no indication that Garth's credit is bad enough to stop him from obtaining another card or that he cannot make monthly credit card payments. It is very doubtful that Garth could qualify for a Titanium card, which is a regular bank card backed by collateral. OC. A secured credit card is a regular bank card backed by collateral. This is not an appropriate card for Garth because there is no indication that Garth's credit is bad enough to stop him from obtaining another card or that he cannot make monthly credit card payments. It is very doubtful that Garth could qualify for a Titanium card, the highest class of credit card that offers the highest credit limits and perks to cardholders. OD. A secured credit card is a regular bank card backed by collateral. This is an appropriate card for Garth because there is no way that Garth can make his current monthly payments without his new card. It is very doubtful that Garth could qualify for a Titanium card, the highest class of credit card that offers the highest credit limits and perks to cardholders. d. Based on what you know about Garth, the kind of additional fees and penalties is he most likely to encounter are: (Select the best answer below.) d. Based on what you know about Garth, the kind of additional fees and penalties is he most likely to encounter are: (Select the best answer below.) O A. late fees and unpaid balance fees. OB. cash advance fees and late fees O c. cash advance fees and out-of-state usage fees. OD. late fees and secured credit card fees. The impact of these fees and penalties on Garth is that: (Select the best answer below.) O A. because he is sometimes early in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. OB. because he is sometimes late in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases less expensive than they should be. O c. because he is sometimes late in making payments, he may also incur penalty rates that can significantly decrease the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. OD. because he is sometimes late in making payments, he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and penalties work to increase Garth's total cost of credit, making his purchases more expensive than they should be. e. The rate charged on a credit card account is a significant determinant of the cost of using that card. Garth may encounter offers with a fixed rate, which is: (Select the best answer below.) A. a significantly lower rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OB. a constant rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. O c. a significantly higher rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OD. a fluctuating rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. Garth may encounter offers with a variable rate, which is: (Select the best answer below.) O A. a constant rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. OB. a fluctuating rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the variable rate. O c. an exceptionally low introductory rate initially charged on the account to attract new users. The teaser rate is available for 3 to 12 months, but then jumps to a higher rate. OD. a fluctuating rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. Garth may encounter offers with teaser rate, which is: (Select the best answer below.) O A. an exceptionally high introductory rate initially charged on the account a lower rate attract new users. The teaser rate is available for 3 to 12 months, but then jumps to Garth may encounter offers with teaser rate, which is: (Select the best answer below.) O A. an exceptionally high introductory rate initially charged on the account to attract new users. The teaser rate is available for 3 to 12 months, but then jumps to a lower rate. OB. a fluctuating rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. O c. a constant rate tied to changes in another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. OD. an exceptionally low introductory rate initially charged on the account to attract new users. The teaser rate available for 3 to 12 months, but then jumps to a higher rate. Garth may encounter offers with a penalty rate, which is: (Select the best answer below.) O A. a significantly higher rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. OB. a significantly lower rate of interest applied to an account when the cardholder does not pay the minimum payment on time. The penalty rate would be in addition to a late payment fee and may be applied to the account for an extended period of time. O c. a constant rate of interest applied to the calculation of interest for the account. With at least 15 days prior notice, provided in writing to the cardholder, the credit card company can change the fixed rate. OD. a fluctuating rate tied to changes another interest rate specified by the credit card company, such as the prime rate of interest plus X percent. f. To maximize the benefit from transferring his credit card balance to another card, Garth should follow these guidelines: (Select all that apply.) A. Ask how long the transfer process will take to insure no missed payments on the original card. B. Comparison shop to find the card offer with the best possible interest rate/fee structure. C. Don't transfer a balance to a card with a balance, because he will likely lose any grace period for the transferred balance. D. Pay as much as possible on the account to reduce the balance before the low rate expires. E. Maintain the old credit account for the benefit to his FICO score, but use it only when he can definitely afford to pay the bill in full so as not to incur interest charges. OF. Not open additional credit accounts because opening too many accounts in a short time frame would likely reduce his FICO score. G. Determine the length of the grace period of no interest on transferred balances (if any) and the length of the lower, "teaser rate" period. g. After Garth's latest credit card application was rejected, he should consider taking action by: (Select all that apply.) A. within 60 days of the credit denial, Garth can submit his rejection letter to request a free copy of his credit report from the credit reporting service used by the credit card company. He should carefully review the report for accuracy and correct any inaccurate information. He could be the victim of identity theft. B. contact a representative of the credit card company, or if a local bank, the credit card manager to let them know he will apply with another credit card company that uses different criteria for screening and evaluating applicants. He could be the victim of identity theft. C. contact a representative of the credit card company, or if a local bank, the credit card manager to determine why he was rejected. Garth will then need to take the necessary steps to correct the problem, such as correcting inaccurate information in his credit history or changing his credit use and payment practices. D. if he really needs another card, he could apply again within 60 days of the credit denial. Garth can submit his rejection letter to request the lender use different criteria for screening and evaluating this time. However, he should consider the impact on his FICO score. D. if he really needs another card, he could apply again within 60 days of the credit denial. Garth can submit his rejection letter to request the lender use different criteria for screening and evaluating this time. However, he should consider the impact on his FICO score. E. if he really needs another card, he could apply with another credit card company, as every lender uses different criteria for screening and evaluating applicants. Rejection from one company does not mean Garth could not get another credit card. However, he should consider the impact on his FICO score. h. Using this table , the number of months Garth will need to pay off a $3,000 outstanding balance if he pays $150 per month with an APR of 15 percent and he does not make any additional purchases is months. (Round to the nearest whole number.) In order to eliminate his debt in 11 months and assuming no additional purchases, Garth needs to make monthly payments of $ (Round to the nearest cent.) i. After Lindsey's crash course on credit education, Garth decided to discipline himself by closing a couple of his older accounts. Is this a good strategy? (Select the best answer below.) O A. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may not want to close his newer accounts. Obviously, keeping a lower FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. O B. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may want to close his older accounts. Obviously, keeping a lower FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts a better idea than risking credit overuse. O C. Because the FICO score is typically based on length of credit history, Garth may not want to close his older accounts. Obviously, keeping a higher FICO score should not be the only considerations. If the accounts have annual fees, closing the accounts would not be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. OD. Because the FICO score is typically based on factors such as: length of credit history, other types of credit used, and the amount of debt outstanding relative to the total credit availability, Garth may not want to close his older accounts. Obviously, keeping a higher FICO score should not be the only considerations. If the accounts have annual fees, while other available accounts do not, closing the accounts could be a good idea, particularly if he has other long running accounts. Also, if he will be tempted to abuse the available credit limits, closing the accounts is a better idea than risking credit overuse. j. Should Garth have problems with his credit card payments, he could consider the following options: (Select all that apply.) I A. Explore the availability of other credit options, such as a secured loan, home equity loan, or other loan that would be less expensive than the credit card. B. Check to be sure he has the least expensive credit card available given his card usage and payment history. C. Check to be sure he has the most expensive credit card available given his card usage and payment history. D. Use savings to pay off current credit card debt, but only in an extreme situation, as this defeats the idea of saving for future goals. DE. Obtain a new credit card with a high interest rate and transfer all current balances to the new card