Question

You operate in a CAPM market and follow the consensus view on most assets. The one exception is stock A, where your research tells

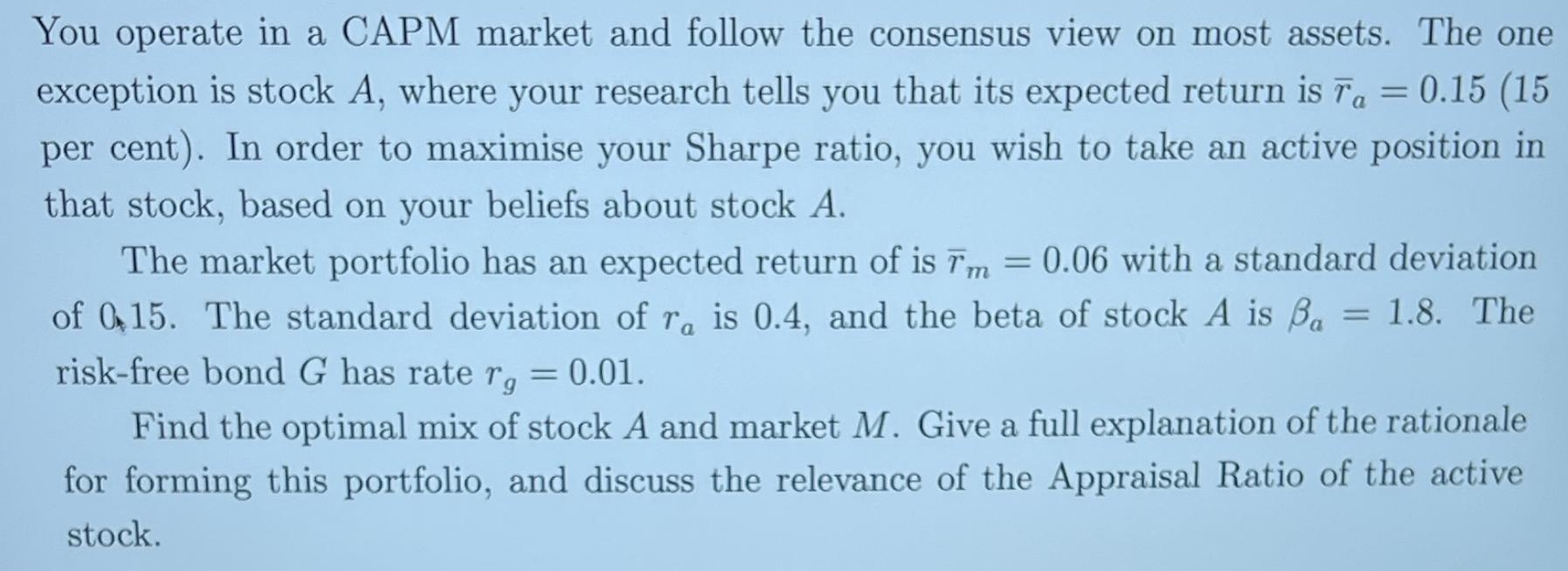

You operate in a CAPM market and follow the consensus view on most assets. The one exception is stock A, where your research tells you that its expected return is Ta = 0.15 (15 per cent). In order to maximise your Sharpe ratio, you wish to take an active position in that stock, based on your beliefs about stock A. The market portfolio has an expected return of is Tm = 0.06 with a standard deviation of 0,15. The standard deviation of ra is 0.4, and the beta of stock A is a = 1.8. The risk-free bond G has rate rg = 0.01. Find the optimal mix of stock A and market M. Give a full explanation of the rationale for forming this portfolio, and discuss the relevance of the Appraisal Ratio of the active stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App