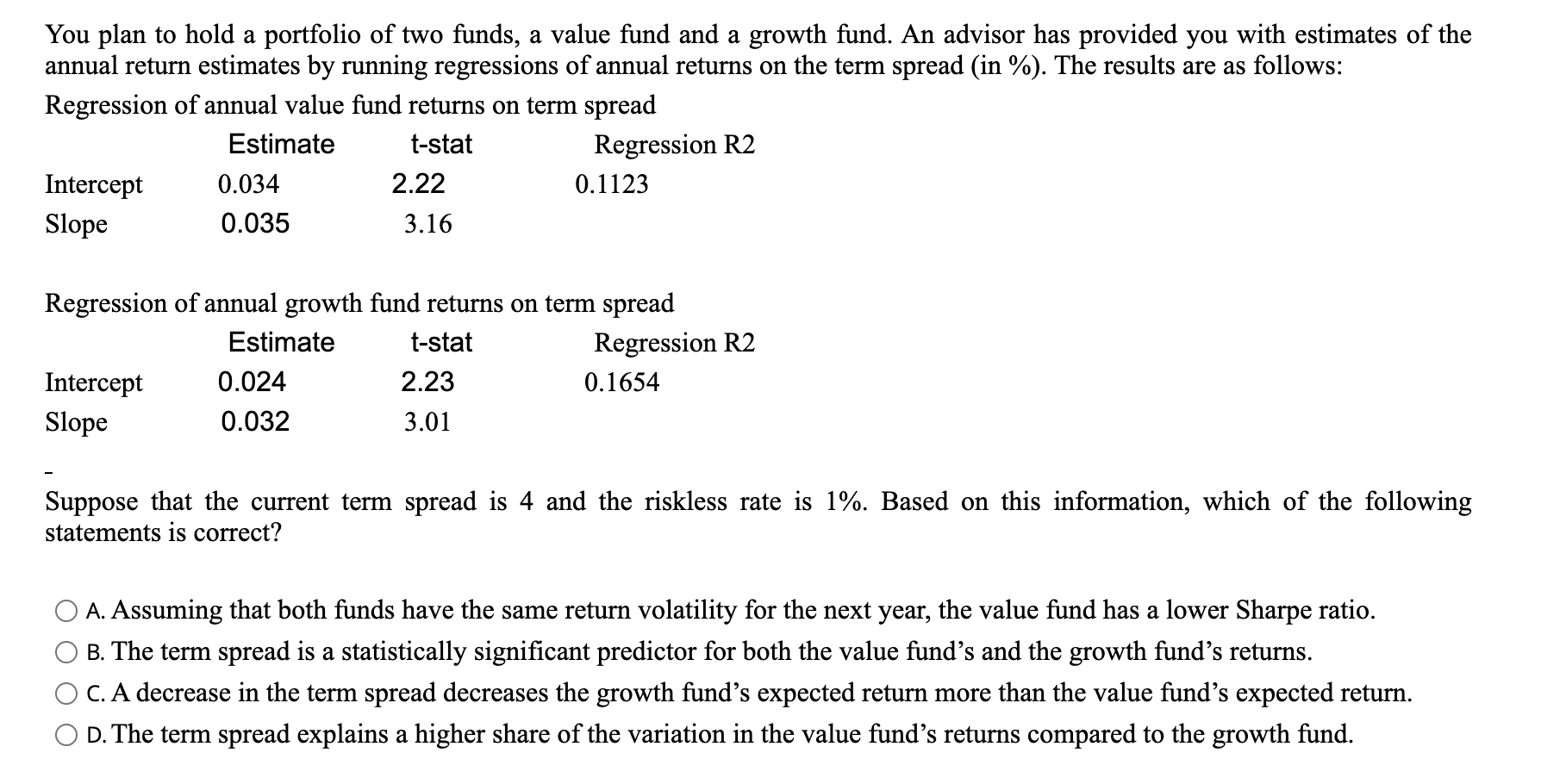

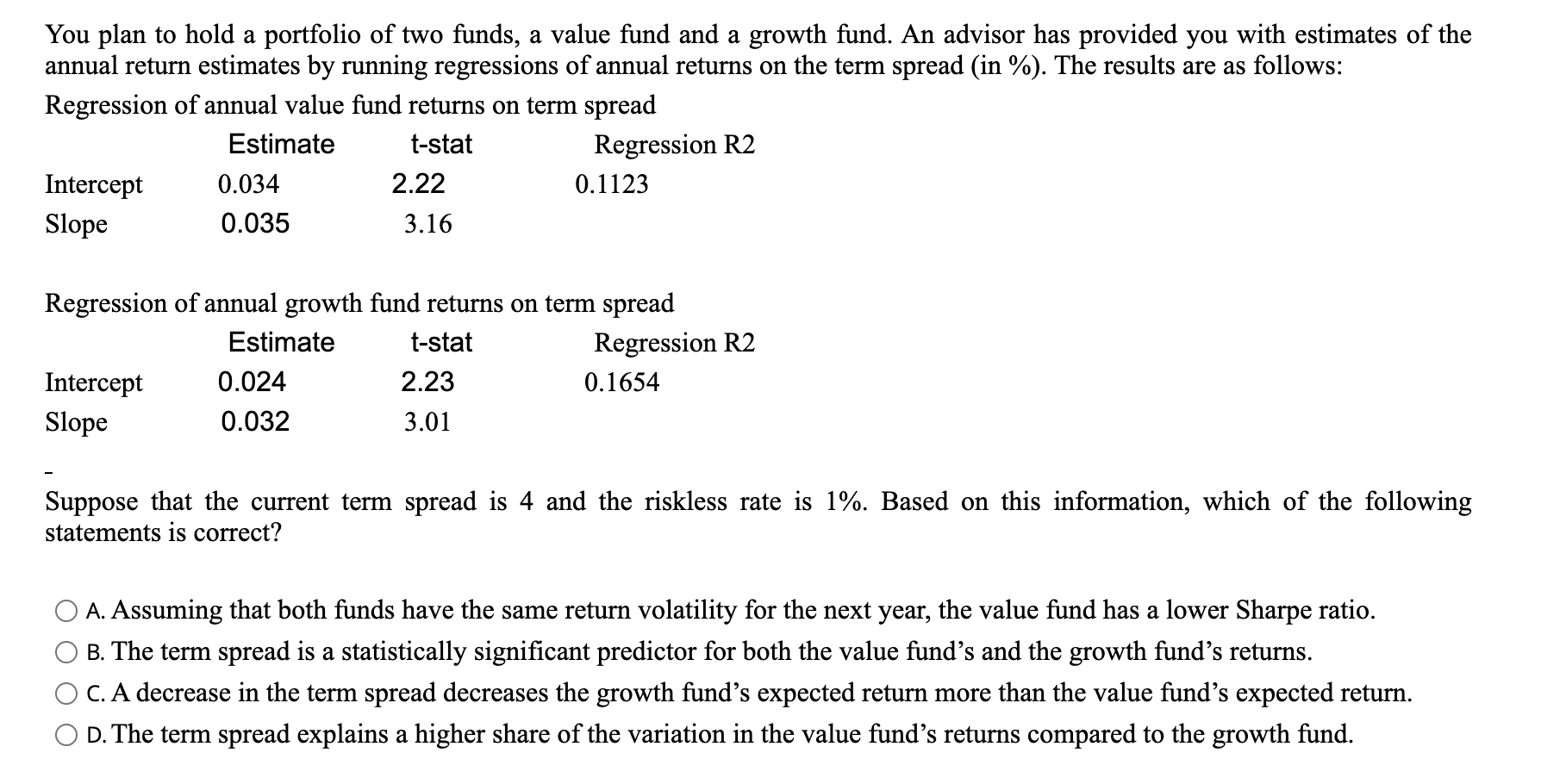

You plan to hold a portfolio of two funds, a value fund and a growth fund. An advisor has provided you with estimates of the annual return estimates by running regressions of annual returns on the term spread (in %). The results are as follows: Regression of annual value fund returns on term spread Estimate t-stat Regression R2 Intercept 0.034 2.22 0.1123 Slope 0.035 3.16 Regression of annual growth fund returns on term spread Estimate t-stat Regression R2 Intercept 0.024 2.23 0.1654 Slope 0.032 3.01 Suppose that the current term spread is 4 and the riskless rate is 1%. Based on this information, which of the following statements is correct? a A. Assuming that both funds have the same return volatility for the next year, the value fund has a lower Sharpe ratio. B. The term spread is a statistically significant predictor for both the value fund's and the growth fund's returns. O C. A decrease in the term spread decreases the growth fund's expected return more than the value fund's expected return. O D. The term spread explains a higher share of the variation in the value fund's returns compared to the growth fund. You plan to hold a portfolio of two funds, a value fund and a growth fund. An advisor has provided you with estimates of the annual return estimates by running regressions of annual returns on the term spread (in %). The results are as follows: Regression of annual value fund returns on term spread Estimate t-stat Regression R2 Intercept 0.034 2.22 0.1123 Slope 0.035 3.16 Regression of annual growth fund returns on term spread Estimate t-stat Regression R2 Intercept 0.024 2.23 0.1654 Slope 0.032 3.01 Suppose that the current term spread is 4 and the riskless rate is 1%. Based on this information, which of the following statements is correct? a A. Assuming that both funds have the same return volatility for the next year, the value fund has a lower Sharpe ratio. B. The term spread is a statistically significant predictor for both the value fund's and the growth fund's returns. O C. A decrease in the term spread decreases the growth fund's expected return more than the value fund's expected return. O D. The term spread explains a higher share of the variation in the value fund's returns compared to the growth fund