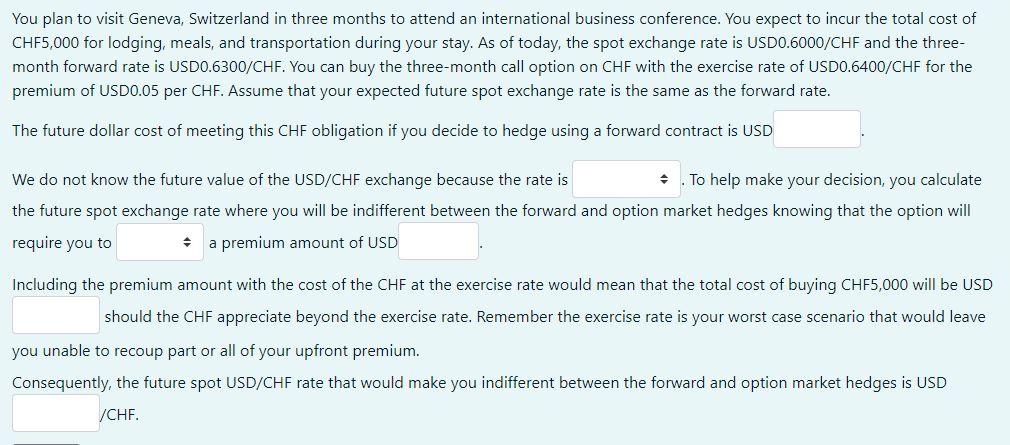

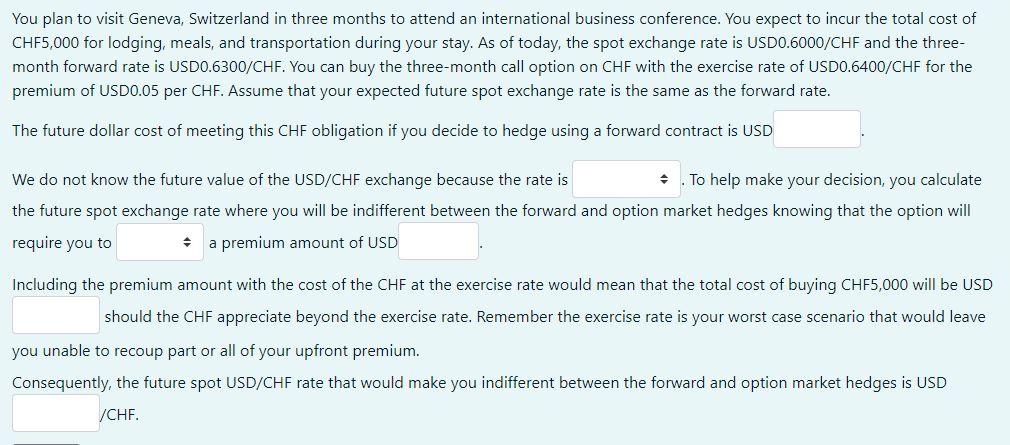

You plan to visit Geneva, Switzerland in three months to attend an international business conference. You expect to incur the total cost of CHF5,000 for lodging, meals, and transportation during your stay. As of today, the spot exchange rate is USD0.6000/CHF and the three- month forward rate is USD0.6300/CHF. You can buy the three-month call option on CHF with the exercise rate of USD0.6400/CHF for the premium of USD0.05 per CHF. Assume that your expected future spot exchange rate is the same as the forward rate. The future dollar cost of meeting this CHF obligation if you decide to hedge using a forward contract is USD We do not know the future value of the USD/CHF exchange because the rate is To help make your decision, you calculate the future spot exchange rate where you will be indifferent between the forward and option market hedges knowing that the option will require you to a premium amount of USD Including the premium amount with the cost of the CHF at the exercise rate would mean that the total cost of buying CHF5,000 will be USD should the CHF appreciate beyond the exercise rate. Remember the exercise rate is your worst case scenario that would leave you unable to recoup part or all of your upfront premium. Consequently, the future spot USD/CHF rate that would make you indifferent between the forward and option market hedges is USD /CHF. You plan to visit Geneva, Switzerland in three months to attend an international business conference. You expect to incur the total cost of CHF5,000 for lodging, meals, and transportation during your stay. As of today, the spot exchange rate is USD0.6000/CHF and the three- month forward rate is USD0.6300/CHF. You can buy the three-month call option on CHF with the exercise rate of USD0.6400/CHF for the premium of USD0.05 per CHF. Assume that your expected future spot exchange rate is the same as the forward rate. The future dollar cost of meeting this CHF obligation if you decide to hedge using a forward contract is USD We do not know the future value of the USD/CHF exchange because the rate is To help make your decision, you calculate the future spot exchange rate where you will be indifferent between the forward and option market hedges knowing that the option will require you to a premium amount of USD Including the premium amount with the cost of the CHF at the exercise rate would mean that the total cost of buying CHF5,000 will be USD should the CHF appreciate beyond the exercise rate. Remember the exercise rate is your worst case scenario that would leave you unable to recoup part or all of your upfront premium. Consequently, the future spot USD/CHF rate that would make you indifferent between the forward and option market hedges is USD /CHF