Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You purchased 120 acres of land on 1-20-2022 for $8,500 per acre from your neighbor, whose basis was $2,000 per acre. He gave you a

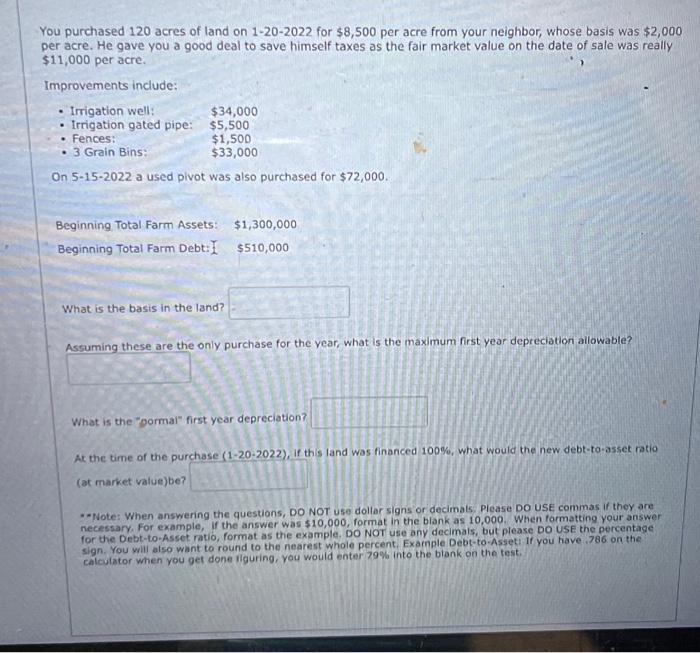

You purchased 120 acres of land on 1-20-2022 for $8,500 per acre from your neighbor, whose basis was $2,000 per acre. He gave you a good deal to save himself taxes as the fair market value on the date of sale was really $11,000 per acre. Improvements include: . Irrigation well: $34,000 $5,500 $1,500 3 Grain Bins: $33,000 On 5-15-2022 a used pivot was also purchased for $72,000. Irrigation gated pipe: Fences: Beginning Total Farm Assets: $1,300,000 Beginning Total Farm Debt: I $510,000 What is the basis in the land? Assuming these are the only purchase for the year, what is the maximum first year depreciation allowable? What is the "pormal" first year depreciation? At the time of the purchase (1-20-2022), if this land was financed 100%, what would the new debt-to-asset ratio (at market value)be? **Note: When answering the questions, DO NOT use dollar signs or decimals. Please DO USE commas if they are necessary, For example, if the answer was $10,000, format in the blank as 10,000. When formatting your answer for the Debt-to-Asset ratio, format as the example. DO NOT use any decimals, but please DO USE the percentage sign. You will also want to round to the nearest whole percent. Example Debt-to-Asset: If you have ,786 on the calculator when you get done figuring, you would enter 79% into the blank on the test.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started