Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You purchased a n airplane for $5 00,000 and will depreciate it using a 7-year MACRS , but it will only have a 4-year life

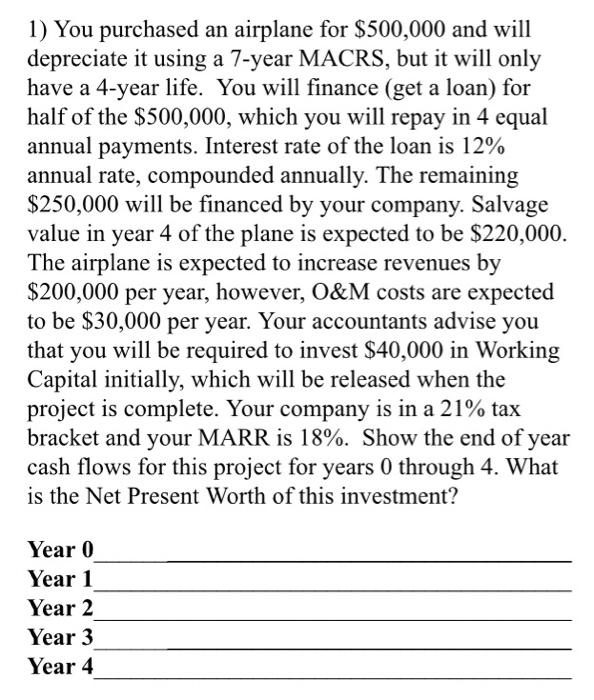

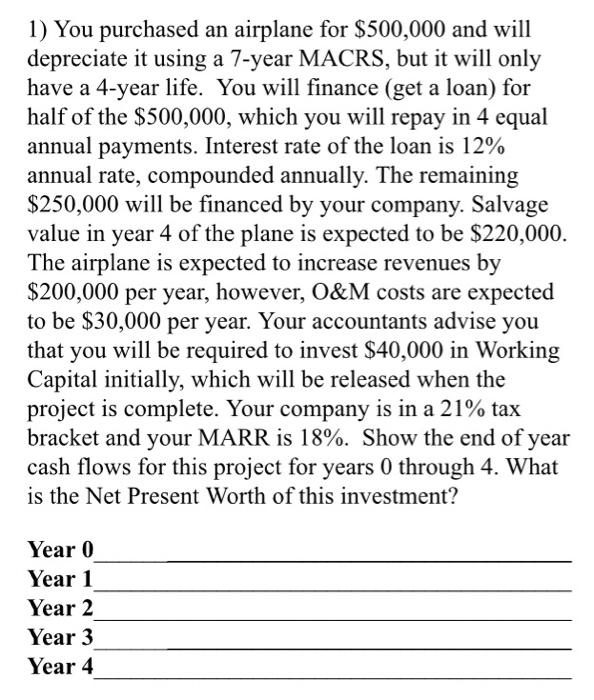

"You purchased an airplane for $500,000 and will depreciate it using a 7-year MACRS, but it will only have a 4-year life. You will finance (get a loan) for half of the $500,000, which you will repay in 4 equal annual payments. Interest rate of the loan is 12% annual rate, compounded annually. The remaining $250,000 will be financed by your company. Salvage value in year 4 of the plane is expected to be $220,000. The airplane is expected to increase revenues by $200,000 per year, however, O&M costs are expected to be $30,000 per year. Your accountants advise you that you will be required to invest $40,000 in Working Capital initially, which will be released when the project is complete. Your company is in a 21% tax bracket and your MARR is 18%. Show the end of year cash flows for this project for years 0 through 4. What is the Net Present Worth of this investment?" If it's possible to show the appropriate formulas and calculations, especially for calculating the principal repayment, that would be much appreciated. Every solution I've seen only shows an Excel spreadsheet without any of the calculations, which isn't especially helpful for understanding how to approach the problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started