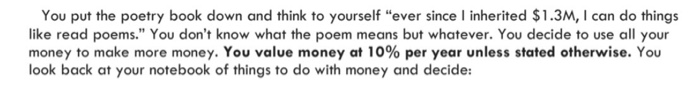

You put the poetry book down and think to yourself "ever since I inherited $1.3M, I can do things like read poems." You don't know what the poem means but whatever. You decide to use all your money to make more money. You value money at 10% per year unless stated otherwise. You look back at your notebook of things to do with money and decide: Not including the value of the business if sold and only just considering the projection of Sale for Diamond Sutra Publishing, then sales in Present Worth for the next 8 years is closest to (note that from years 6 onward, it appears sales will increase by about 10% per year): Diamond Sutra Publishing of Changsha: Projected Sales [in $K] 40 35 35 30 25 20 16.5 15.01 15 13.64 12.40 11.27 10.25 10 9.32 7.70 8.47 7 7 7 7 7 5 HI 1 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Let us say you are able to sale Diamond Sutra at the end of year 8 for $2.2M, your (simple) Rate of Return is [% assumed, so if you get 80% you enter 80]: You should know that even if a Cash Flow shows 14 years worth of payments or costs, or 140, if the problem states evaluate at 8 years then the other years after 8 don't matter and you ignore them. You put the poetry book down and think to yourself "ever since I inherited $1.3M, I can do things like read poems." You don't know what the poem means but whatever. You decide to use all your money to make more money. You value money at 10% per year unless stated otherwise. You look back at your notebook of things to do with money and decide: Not including the value of the business if sold and only just considering the projection of Sale for Diamond Sutra Publishing, then sales in Present Worth for the next 8 years is closest to (note that from years 6 onward, it appears sales will increase by about 10% per year): Diamond Sutra Publishing of Changsha: Projected Sales [in $K] 40 35 35 30 25 20 16.5 15.01 15 13.64 12.40 11.27 10.25 10 9.32 7.70 8.47 7 7 7 7 7 5 HI 1 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Let us say you are able to sale Diamond Sutra at the end of year 8 for $2.2M, your (simple) Rate of Return is [% assumed, so if you get 80% you enter 80]: You should know that even if a Cash Flow shows 14 years worth of payments or costs, or 140, if the problem states evaluate at 8 years then the other years after 8 don't matter and you ignore them