Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You receive R 8 0 0 0 0 0 . 0 0 from K Hart as a deposit for the purchase of a property. K

You receive R from K Hart as a deposit for the purchase of a property.

K Hart authorises you in writing to invest the funds on his behalf with Green Bank.

M Carey instructed you to collect an amount of R from C Rock as

damages to her vehicle caused by the negligence of Mr Rock. You issue a

summons and debit a fee of R

You receive R from T Banks as a deposit for the registration of a trust.

Mrs Banks instructs you in writing to invest the money with Blue Bank.

Mrs Banks further instructs you to proceed with the registration of the Bank's

Family Trust. You draft the documents you charge a fee of R

Mrs Banks instructs you to withdraw R from the investment.

Mrs Banks further instructs you to pay Rinclusive of VAT to the agent

that submitted the documents at the Master's offices.

You receive a further payment of R from K Hart in respect of the transfer

costs which include transfer fees and transfer duty.

You receive payment in the amount of Rinclusive of VAT from A Keys

in settlement of your statement of account, for professional services rendered in

her divorce case.

You pay R to SARS in respect of the transfer duty in the matter of Mr

Hart.

You receive a payment in the amount of R from Mr Rock as a part

payment in respect of the damages to Mrs Carey's vehicle.

You record the collection commission in the amount of R

You receive R from Obama Construction Pty Ltd as the purchase

price in respect of a new development.

You decide to invest R of the available trust funds with Red Bank.

You call up the investment with Green Bank and you receive interest in the amount

of R You pay the beneficiaries thereof.

You receive a cash payment from D Johnson in the amount of R as a

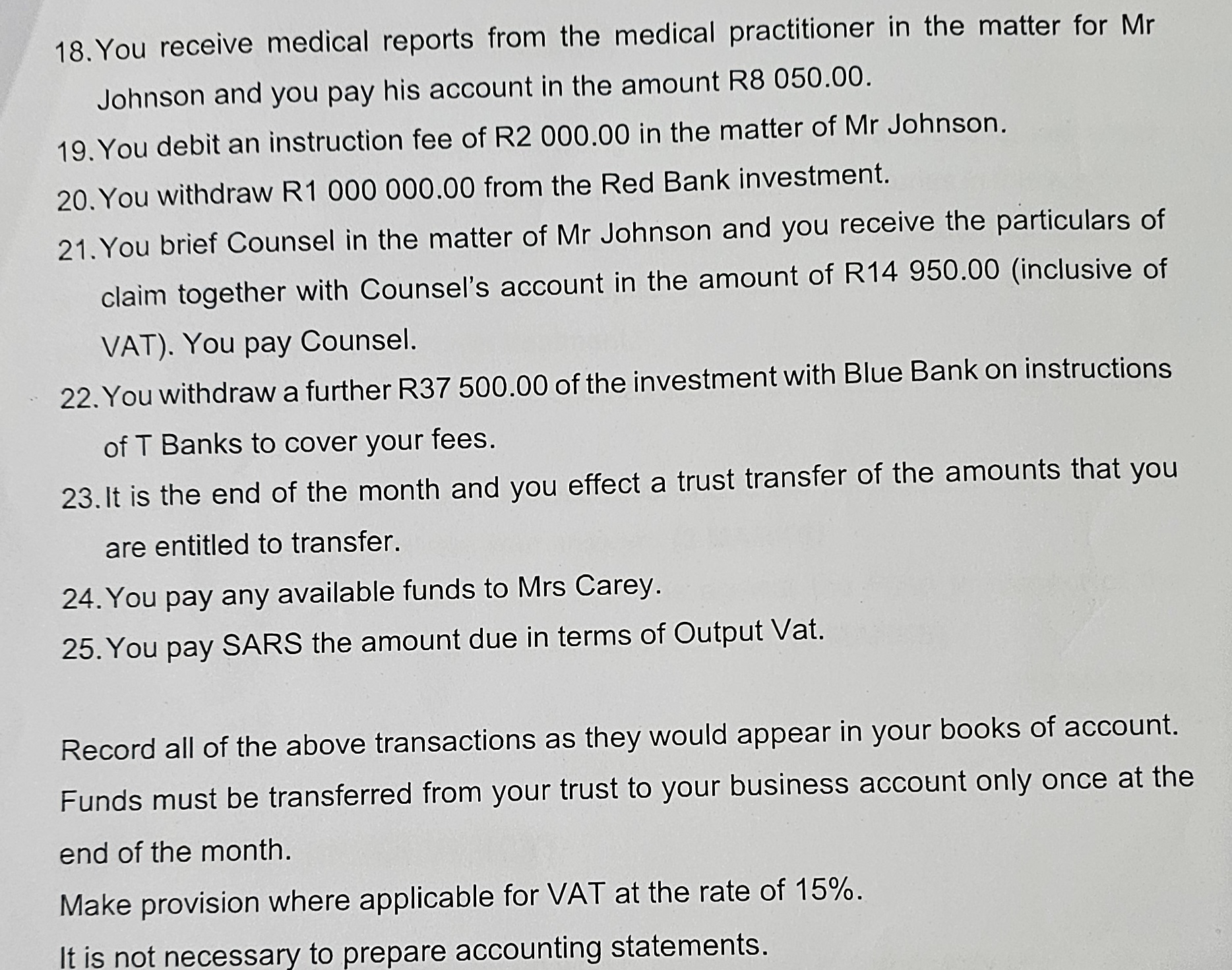

deposit in action proceedings against the Minister of Police.You receive medical reports from the medical practitioner in the matter for Mr

Johnson and you pay his account in the amount R

You debit an instruction fee of R in the matter of Mr Johnson.

You withdraw R from the Red Bank investment.

You brief Counsel in the matter of Mr Johnson and you receive the particulars of

claim together with Counsel's account in the amount of Rinclusive of

VAT You pay Counsel.

You withdraw a further R of the investment with Blue Bank on instructions

of Banks to cover your fees.

It is the end of the month and you effect a trust transfer of the amounts that you

are entitled to transfer.

You pay any available funds to Mrs Carey.

You pay SARS the amount due in terms of Output Vat.

Record all of the above transactions as they would appear in your books of account.

Funds must be transferred from your trust to your business account only once at the

end of the month.

Make provision where applicable for VAT at the rate of

It is not necessary to prepare accounting statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started