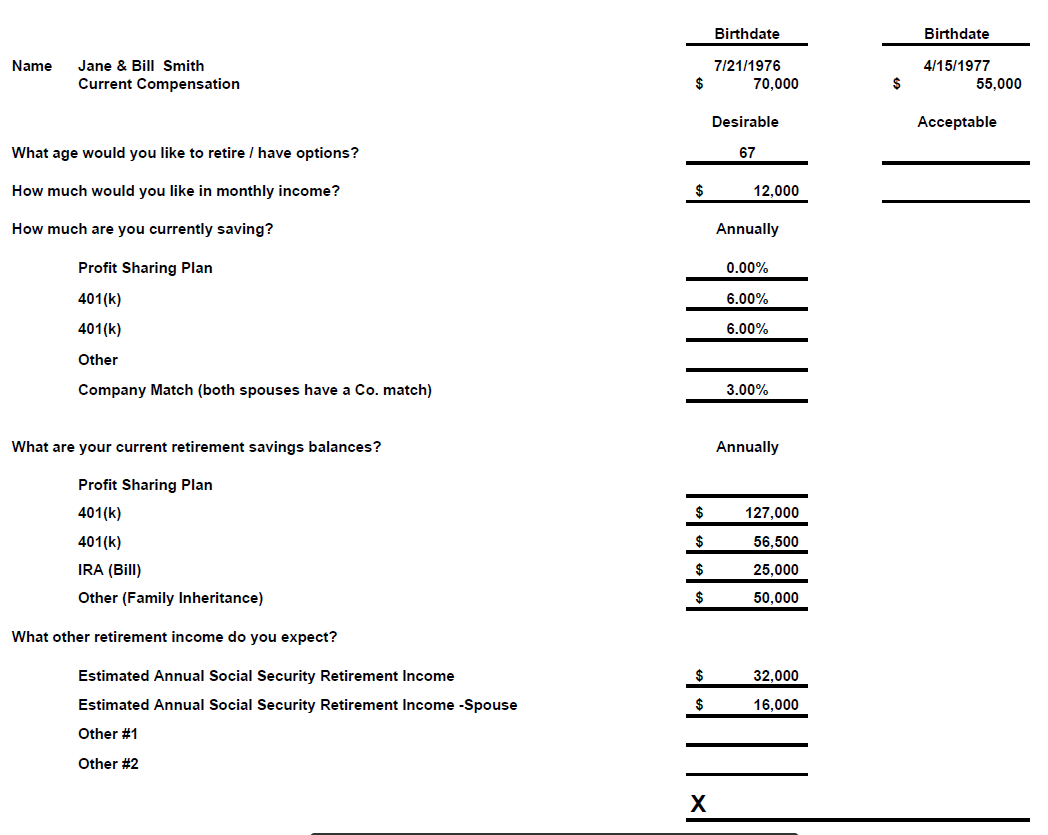

Question

You recently had a client meeting with Bill & Jane Smith and gathered the attached information from your time together. The big question that your

You recently had a client meeting with Bill & Jane Smith and gathered the attached information from your time together. The big question that your clients had was; Will we have enough to retire and how much is enough?

Your task is to be able to meet with them again and report back.

Note:

You are to assume a 4% portfolio yield during the distribution period, (retirement).

You gathered that during retirement they would prefer never to use capital, such that they can leave an inheritance to their children.

Q.1 How much will they need at retirement in their retirement portfolio?

Q.2 what required investment rate of return will they need to achieve this goal.

Q3 Is this realistic, how could they improve their chances for reaching their goal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started