Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you required to prepare statement of profit or loss, statement of change in owners equity and statement of changes in financial position of Triple M

you required to prepare statement of profit or loss, statement of change in owners equity and statement of changes in financial position of Triple M traders at 28 Feb 2019

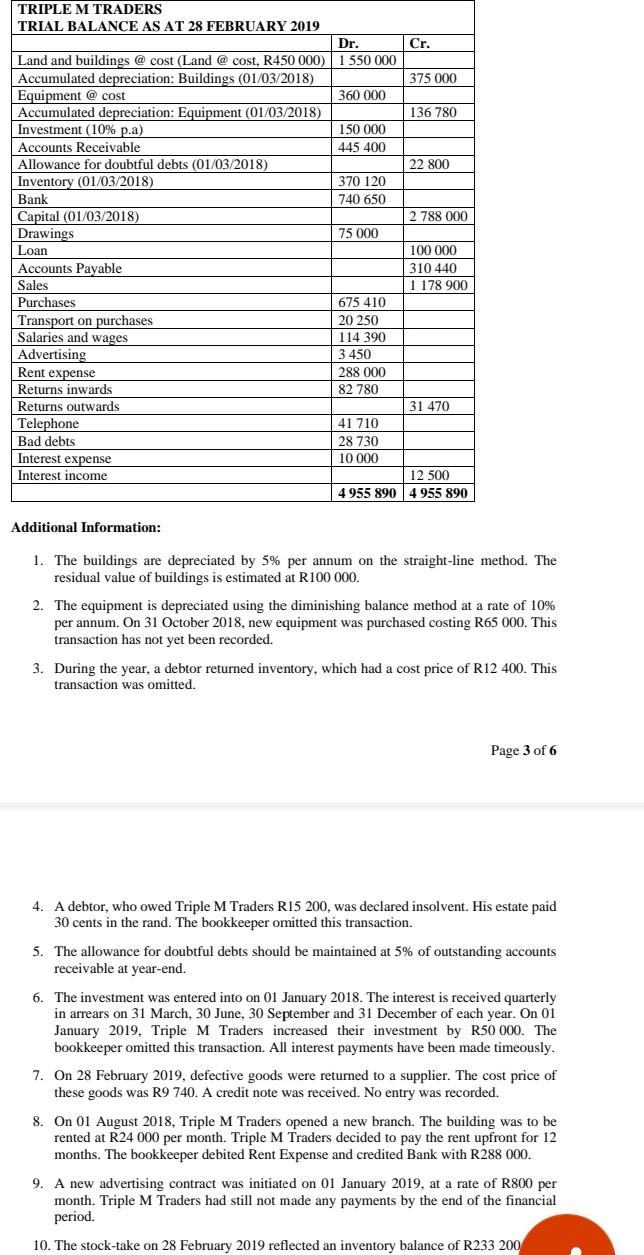

TRIPLE M TRADERS TRIAL BALANCE AS AT 28 FEBRUARY 2019 Dr. Cr. Land and buildings @ cost (Land @ cost, R450 000) 1 550 000 Accumulated depreciation: Buildings (01/03/2018) 375 000 Equipment @ cost 360 000 Accumulated depreciation: Equipment (01/03/2018) 136 780 Investment (10% p.a) 150 000 Accounts Receivable 445 400 Allowance for doubtful debts (01/03/2018) 22 800 Inventory (01/03/2018) 370 120 Bank 740 650 Capital (01/03/2018) 2 788 000 Drawings 75 000 Loan 100 000 Accounts Payable 310 440 Sales 1 178 900 Purchases 675 410 Transport on purchases 20 250 Salaries and wages 114 390 Advertising 3 450 Rent expense 288 000 Returns inwards 82 780 Returns outwards 31 470 Telephone 41 710 Bad debts 28 730 10 000 Interest expense Interest income 12 500 4 955 890 4 955 890 Additional Information: 1. The buildings are depreciated by 5% per annum on the straight-line method. The residual value of buildings is estimated at R100 000. 2. The equipment is depreciated using the diminishing balance method at a rate of 10% per annum. On 31 October 2018, new equipment was purchased costing R65 000. This transaction has not yet been recorded. 3. During the year, a debtor returned inventory, which had a cost price of R12 400. This transaction was omitted. Page 3 of 6 4. A debtor, who owed Triple M Traders R15 200, was declared insolvent. His estate paid 30 cents in the rand. The bookkeeper omitted this transaction. 5. The allowance for doubtful debts should be maintained at 5% of outstanding accounts. receivable at year-end. 6. The investment was entered into on 01 January 2018. The interest is received quarterly in arrears on 31 March, 30 June, 30 September and 31 December of each year. On 01 January 2019, Triple M Traders increased their investment by R50 000. The bookkeeper omitted this transaction. All interest payments have been made timeously. 7. On 28 February 2019, defective goods were returned to a supplier. The cost price of these goods was R9 740. A credit note was received. No entry was recorded. 8. On 01 August 2018, Triple M Traders opened a new branch. The building was to be rented at R24 000 per month. Triple M Traders decided to pay the rent upfront for 12 months. The bookkeeper debited Rent Expense and credited Bank with R288 000. 9. A new advertising contract was initiated on 01 January 2019, at a rate of R800 per month. Triple M Traders had still not made any payments by the end of the financial period. 10. The stock-take on 28 February 2019 reflected an inventory balance of R233 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started