Answered step by step

Verified Expert Solution

Question

1 Approved Answer

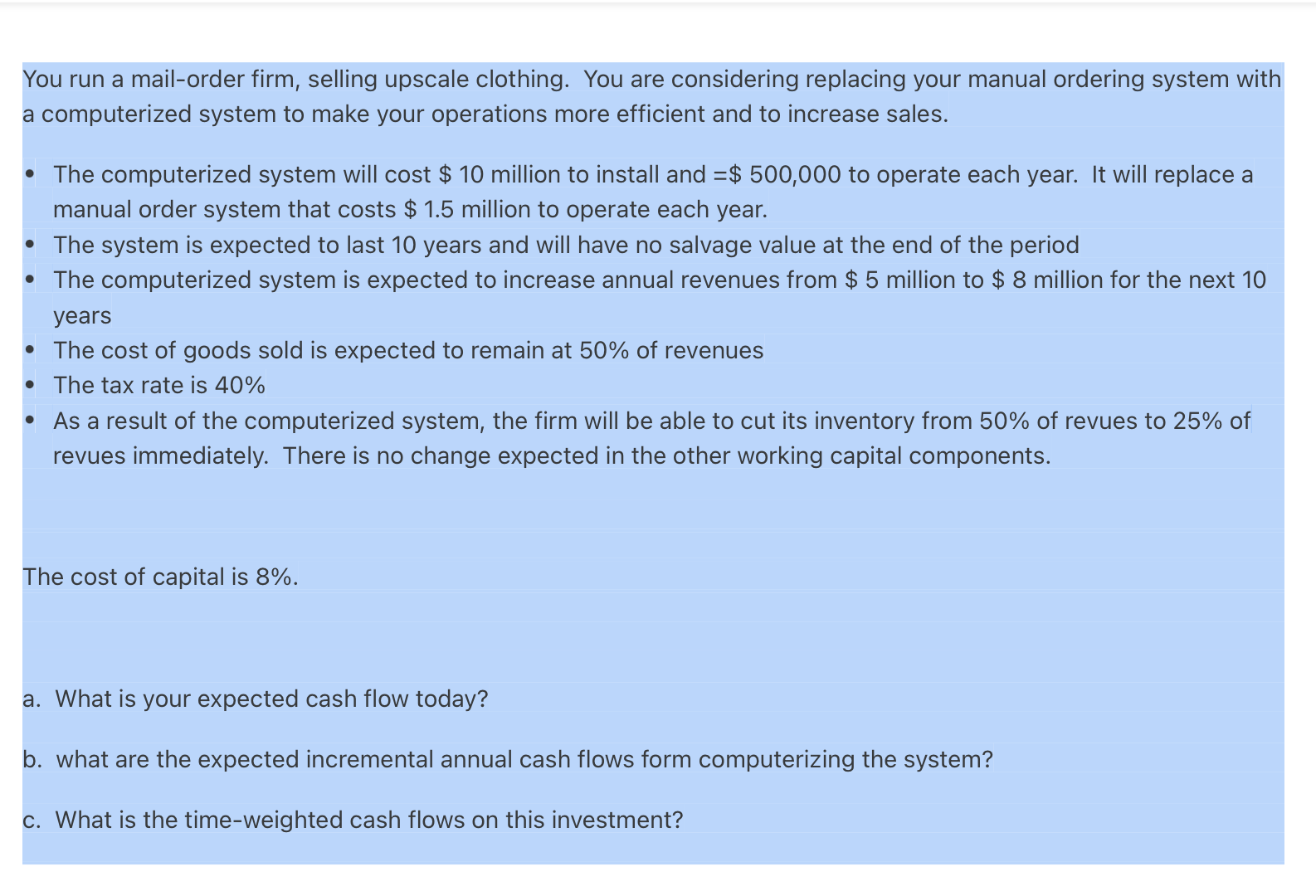

You run a mail-order firm, selling upscale clothing. You are considering replacing your manual ordering system witt a computerized system to make your operations more

You run a mail-order firm, selling upscale clothing. You are considering replacing your manual ordering system witt a computerized system to make your operations more efficient and to increase sales. - The computerized system will cost $10 million to install and =$500,000 to operate each year. It will replace a manual order system that costs $1.5 million to operate each year. - The system is expected to last 10 years and will have no salvage value at the end of the period - The computerized system is expected to increase annual revenues from $5 million to $8 million for the next 10 years - The cost of goods sold is expected to remain at 50% of revenues - The tax rate is 40% - As a result of the computerized system, the firm will be able to cut its inventory from 50% of revues to 25% of revues immediately. There is no change expected in the other working capital components. The cost of capital is 8%. a. What is your expected cash flow today? b. what are the expected incremental annual cash flows form computerizing the system? c. What is the time-weighted cash flows on this investment

You run a mail-order firm, selling upscale clothing. You are considering replacing your manual ordering system witt a computerized system to make your operations more efficient and to increase sales. - The computerized system will cost $10 million to install and =$500,000 to operate each year. It will replace a manual order system that costs $1.5 million to operate each year. - The system is expected to last 10 years and will have no salvage value at the end of the period - The computerized system is expected to increase annual revenues from $5 million to $8 million for the next 10 years - The cost of goods sold is expected to remain at 50% of revenues - The tax rate is 40% - As a result of the computerized system, the firm will be able to cut its inventory from 50% of revues to 25% of revues immediately. There is no change expected in the other working capital components. The cost of capital is 8%. a. What is your expected cash flow today? b. what are the expected incremental annual cash flows form computerizing the system? c. What is the time-weighted cash flows on this investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started