Question

You run a profitable conglomerate thinking about getting into the new business by acquiring the firm X. Current info for you, X and their similar

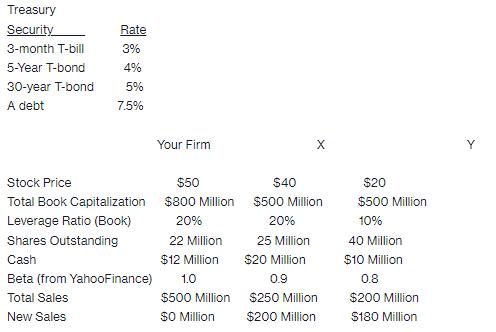

You run a profitable conglomerate thinking about getting into the new business by acquiring the firm X. Current info for you, X and their similar comp is listed below. You estimate that, once you own X, it could immediately capture 3% market share of $10 billion. You also could enhance its other sales by 10%. You were planning on getting into the business yourself that would have increased your sales 15% -- instead now your sales will only increase 4% through synergies. These figures will be flat for the next five years then you expect long term growth from there at 5% per year forever on all line items. Margins will be such that COGS will be 60% of all sales. The acquired business will require an initial CAPX of $100 million, half of which will be expensed and the other half straight-line depreciated over the five years. The firm currently carries Depreciation of $15 million a year. At the end of year 5, maintenance CAPX needs to be spent to match that depreciation of $15 million. Operating expenses will be $10 million each year in addition to these depreciation figures. Net Working capital is always 5% of sales. There is an additional synergy: You could sell property that was housing a plant that is on your books for $100 million for a price of $75 million. Current overhead for X is $10 million a year and you plan on increasing this overhead by your firm's allocation rate of 10% of your firm's overhead of $40 million. Your figures are flat for the five year horizon and then free cash flows are expected to grow at the rate previously mentioned.

Note: The corporate tax rate is 20%. Assume that all cash flows are year-end except for the up-front investment. You will finance the project appropriately with 20% A debt. Assume beta of debt = 0 and a market risk premium of 6.

You also have the following financial data pertaining to the market and to your publicly-traded competitors:

What is the breakeven bid per share for you to acquire X?

Treasury Security 3-month T-bill 5-Year T-bond 30-year T-bond A debt Rate 3% 4% 5% 7.5% Stock Price Total Book Capitalization Leverage Ratio (Book) Shares Outstanding Cash Beta (from YahooFinance) Total Sales New Sales Your Firm $50 $800 Million 20% 22 Million $12 Million 1.0 $500 Million $0 Million $40 $500 Million 20% 25 Million $20 Million 0.9 $250 Million $200 Million $20 $500 Million 10% 40 Million $10 Million 0.8 $200 Million $180 Million Y

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here is a breakdown of the financial projections and valuation for the potential acquisition of firm X 1 Revenue Projections Xs current revenue Unknown Estimated mark...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started