Answered step by step

Verified Expert Solution

Question

1 Approved Answer

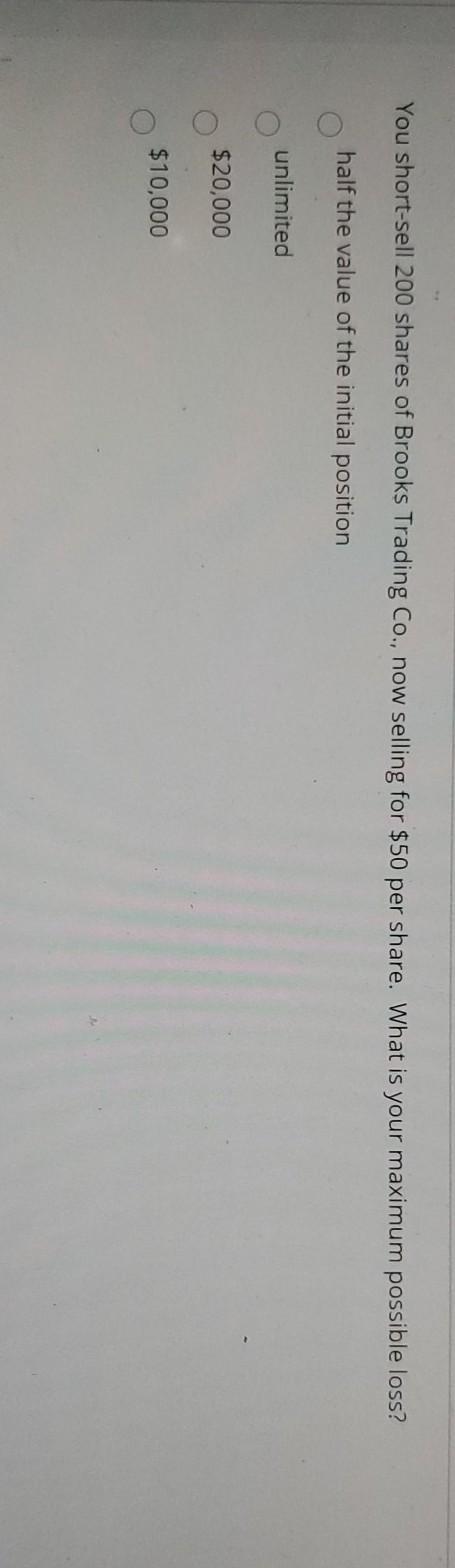

You short-sell 200 shares of Brooks Trading Co., now selling for $50 per share. What is your maximum possible loss? half the value of the

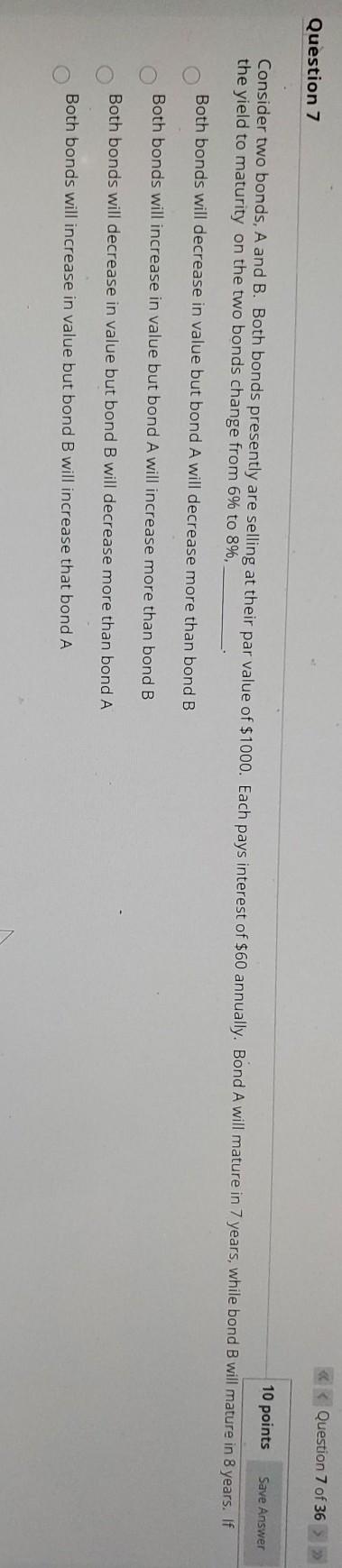

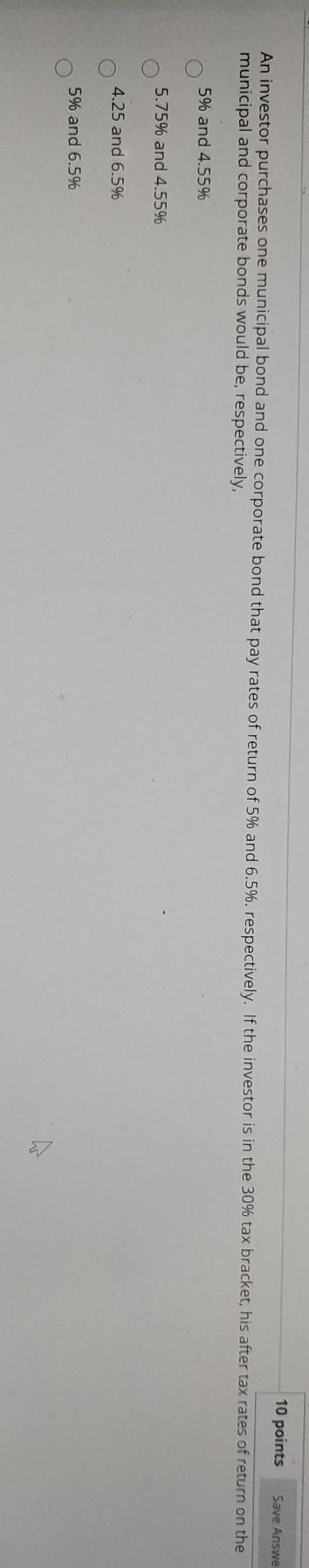

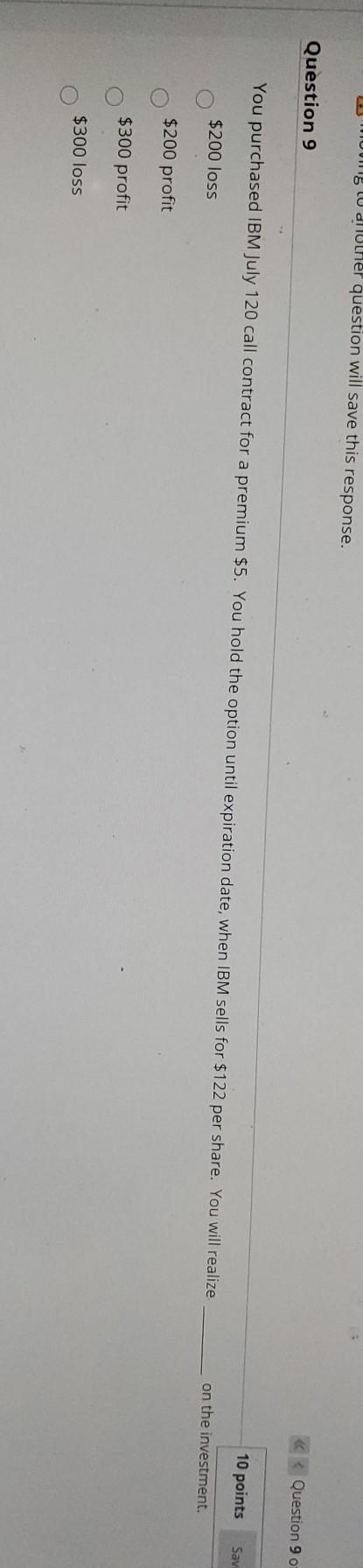

You short-sell 200 shares of Brooks Trading Co., now selling for $50 per share. What is your maximum possible loss? half the value of the initial position unlimited $20,000 $10,000 Question 7 of 36 Question 7 10 points Save Answer Consider two bonds, A and B. Both bonds presently are selling at their par value of $1000. Each pays interest of $60 annually. Bond A will mature in 7 years, while bond B will mature in 8 years. If the yield to maturity on the two bonds change from 6% to 8%, Both bonds will decrease in value but bond A will decrease more than bond B Both bonds will increase in value but bond A will increase more than bond B Both bonds will decrease in value but bond B will decrease more than bond A Both bonds will increase in value but bond B will increase that bond A 10 points Save Answe An investor purchases one municipal bond and one corporate bond that pay rates of return of 5% and 6.5%. respectively. If the investor is in the 30% tax bracket, his after tax rates of return on the municipal and corporate bonds would be, respectively, 5% and 4.55% 5.75% and 4.55% 4.25 and 6.5% 5% and 6.5% Mmg w d Ulher question will save this response. Question 9 Question 90 You purchased IBM July 120 call contract for a premium $5. You hold the option until expiration date, when IBM sells for $122 per share. You will realize 10 points Sav $200 loss on the investment. $200 profit $300 profit $300 loss Question 10 Using the Dividend Discount model DDM) if the Fed decides to decrease interest rates this will definitely decrease stock prices because inflation is low

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started