Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You should assume that today's date is 21 April 2023. Wei registered for value added tax (VAT) many years ago, but does not use any

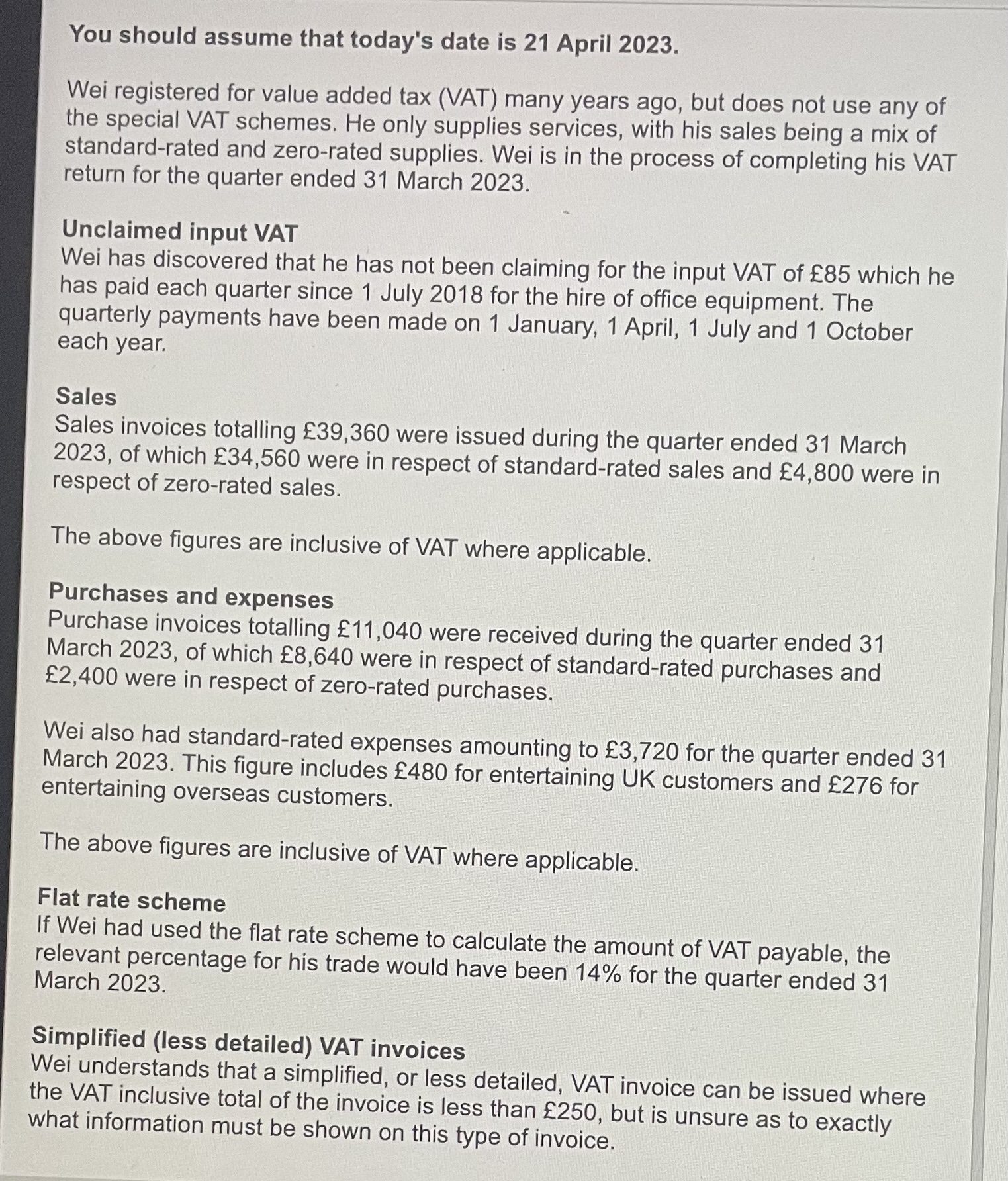

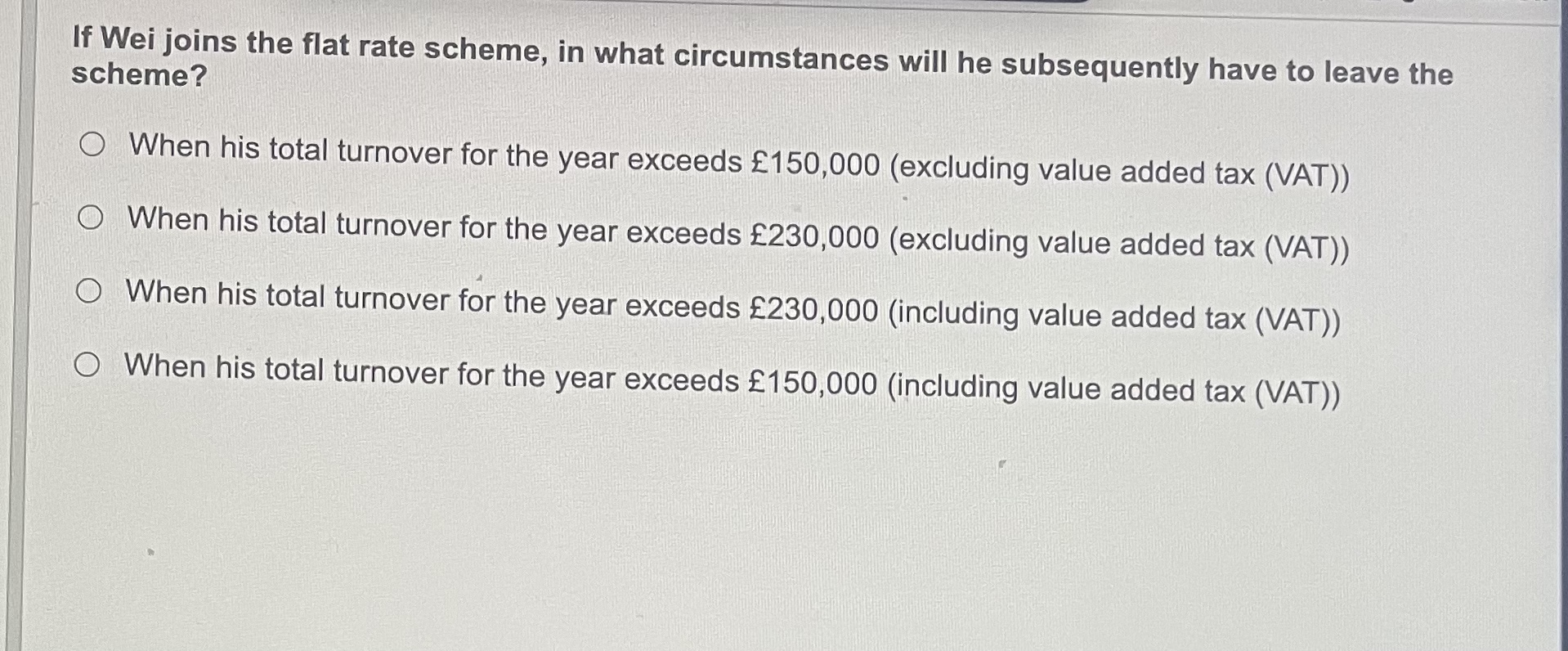

You should assume that today's date is 21 April 2023. Wei registered for value added tax (VAT) many years ago, but does not use any of the special VAT schemes. He only supplies services, with his sales being a mix of standard-rated and zero-rated supplies. Wei is in the process of completing his VAT return for the quarter ended 31 March 2023. Unclaimed input VAT Wei has discovered that he has not been claiming for the input VAT of 85 which he has paid each quarter since 1 July 2018 for the hire of office equipment. The quarterly payments have been made on 1 January, 1 April, 1 July and 1 October each year. Sales Sales invoices totalling 39,360 were issued during the quarter ended 31 March 2023 , of which 34,560 were in respect of standard-rated sales and 4,800 were in respect of zero-rated sales. The above figures are inclusive of VAT where applicable. Purchases and expenses Purchase invoices totalling 11,040 were received during the quarter ended 31 March 2023 , of which 8,640 were in respect of standard-rated purchases and 2,400 were in respect of zero-rated purchases. Wei also had standard-rated expenses amounting to 3,720 for the quarter ended 31 March 2023. This figure includes 480 for entertaining UK customers and 276 for entertaining overseas customers. The above figures are inclusive of VAT where applicable. Flat rate scheme If Wei had used the flat rate scheme to calculate the amount of VAT payable, the relevant percentage for his trade would have been 14% for the quarter ended 31 March 2023. Simplified (less detailed) VAT invoices Wei understands that a simplified, or less detailed, VAT invoice can be issued where the VAT inclusive total of the invoice is less than 250, but is unsure as to exactly what information must be shown on this type of invoice. If Wei joins the flat rate scheme, in what circumstances will he subsequently have to leave the scheme? When his total turnover for the year exceeds 150,000 (excluding value added tax (VAT)) When his total turnover for the year exceeds 230,000 (excluding value added tax (VAT)) When his total turnover for the year exceeds 230,000 (including value added tax (VAT)) When his total turnover for the year exceeds 150,000 (including value added tax (VAT))

You should assume that today's date is 21 April 2023. Wei registered for value added tax (VAT) many years ago, but does not use any of the special VAT schemes. He only supplies services, with his sales being a mix of standard-rated and zero-rated supplies. Wei is in the process of completing his VAT return for the quarter ended 31 March 2023. Unclaimed input VAT Wei has discovered that he has not been claiming for the input VAT of 85 which he has paid each quarter since 1 July 2018 for the hire of office equipment. The quarterly payments have been made on 1 January, 1 April, 1 July and 1 October each year. Sales Sales invoices totalling 39,360 were issued during the quarter ended 31 March 2023 , of which 34,560 were in respect of standard-rated sales and 4,800 were in respect of zero-rated sales. The above figures are inclusive of VAT where applicable. Purchases and expenses Purchase invoices totalling 11,040 were received during the quarter ended 31 March 2023 , of which 8,640 were in respect of standard-rated purchases and 2,400 were in respect of zero-rated purchases. Wei also had standard-rated expenses amounting to 3,720 for the quarter ended 31 March 2023. This figure includes 480 for entertaining UK customers and 276 for entertaining overseas customers. The above figures are inclusive of VAT where applicable. Flat rate scheme If Wei had used the flat rate scheme to calculate the amount of VAT payable, the relevant percentage for his trade would have been 14% for the quarter ended 31 March 2023. Simplified (less detailed) VAT invoices Wei understands that a simplified, or less detailed, VAT invoice can be issued where the VAT inclusive total of the invoice is less than 250, but is unsure as to exactly what information must be shown on this type of invoice. If Wei joins the flat rate scheme, in what circumstances will he subsequently have to leave the scheme? When his total turnover for the year exceeds 150,000 (excluding value added tax (VAT)) When his total turnover for the year exceeds 230,000 (excluding value added tax (VAT)) When his total turnover for the year exceeds 230,000 (including value added tax (VAT)) When his total turnover for the year exceeds 150,000 (including value added tax (VAT)) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started