Answered step by step

Verified Expert Solution

Question

1 Approved Answer

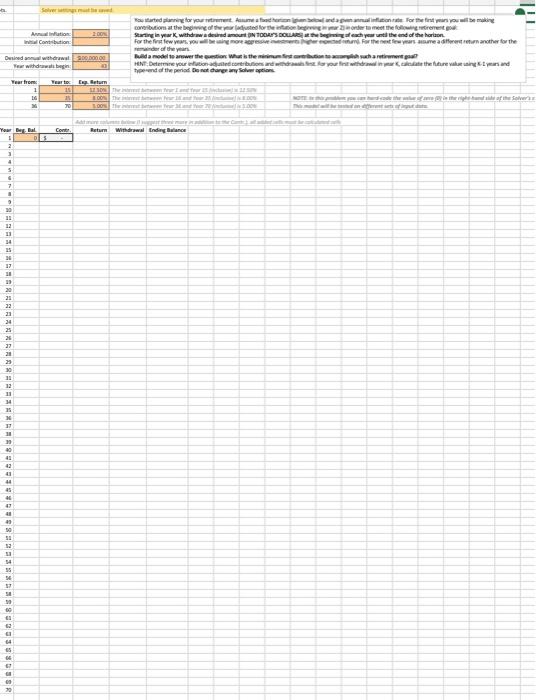

You started planning for your retirement. Assume a fixed horizon (given below) and a given annual inflation rate. For the first years you will be

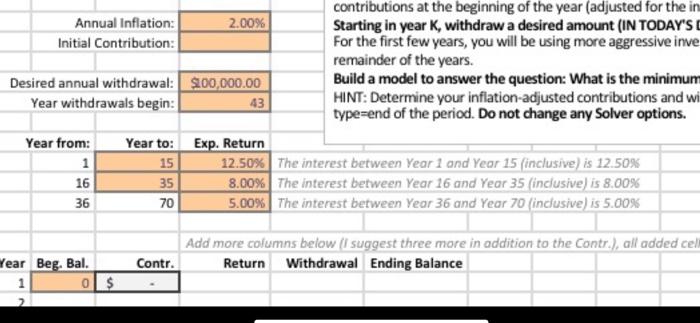

You started planning for your retirement. Assume a fixed horizon (given below) and a given annual inflation rate. For the first years you will be making contributions at the beginning of the year (adjusted for the inflation beginning in year 2) in order to meet the following retirement goal:

Starting in year K, withdraw a desired amount (IN TODAY'S DOLLARS) at the beginning of each year until the end of the horizon.

For the first few years, you will be using more aggressive investments (higher expected return). For the next few years assume a different return another for the remainder of the years.

Build a model to answer the question: What is the minimum first contribution to accomplish such a retirement goal?

HINT: Determine your inflation-adjusted contributions and withdrawals first. For your first withdrawal in year K, calculate the future value using K-1 years and type=end of the period. Do not change any Solver options.

*the three extra rows mentioned to add i added already: return, withdrawal, and ending balance*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started