Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to have $61,000 in your savings account 4 years from now, and you're prepared to make equal annual deposits into the account at

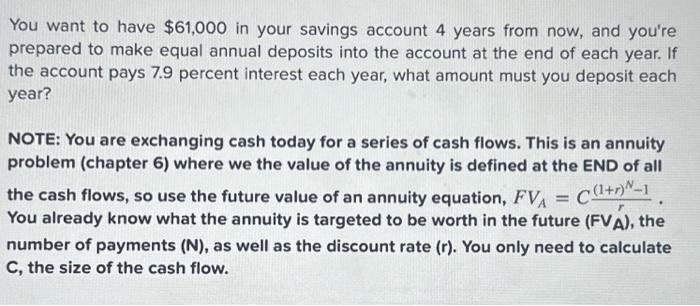

You want to have $61,000 in your savings account 4 years from now, and you're prepared to make equal annual deposits into the account at the end of each year. If the account pays 7.9 percent interest each year, what amount must you deposit each year? NOTE: You are exchanging cash today for a series of cash flows. This is an annuity problem (chapter 6) where we the value of the annuity is defined at the END of all the cash flows, so use the future value of an annuity equation, FVA C(1+r)-1 You already know what the annuity is targeted to be worth in the future (FVA), the number of payments (N), as well as the discount rate (r). You only need to calculate C, the size of the cash flow. =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started