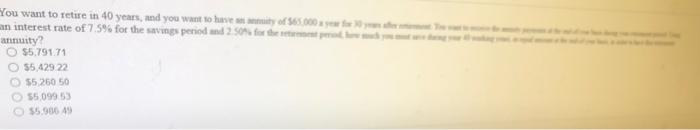

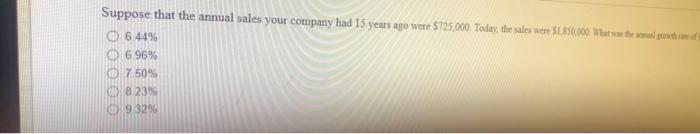

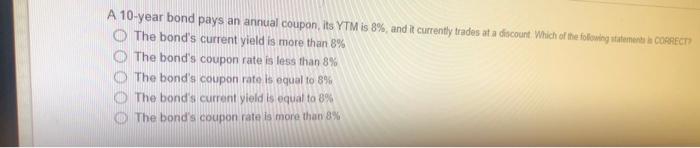

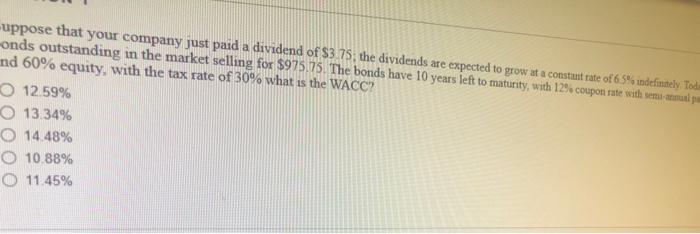

You want to retire in 40 years, and you want to have any of 365.000 an interest rate of 75% for the savings period and for the annuity? 55.791.71 55.429 22 55 250 50 55 099 53 $5.906 49 Suppose that the annual sales your company had 15 years ago were 5725.000. Today, the sales were $1,850,000 What was the amul modif 6.44% 6.96% 7 50% 82395 93298 A 10-year bond pays an annual coupon its YTM is 8%, and it currently trades at a discount Which of the following statement a CORRECTO The bond's current yield is more than 8% The bond's coupon rate is less than 8% The bond's coupon rate is equal to 8% The bond's current yield is equal to 8% The bond's coupon rate is more than 8% -uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45% You want to retire in 40 years, and you want to have any of 365.000 an interest rate of 75% for the savings period and for the annuity? 55.791.71 55.429 22 55 250 50 55 099 53 $5.906 49 Suppose that the annual sales your company had 15 years ago were 5725.000. Today, the sales were $1,850,000 What was the amul modif 6.44% 6.96% 7 50% 82395 93298 A 10-year bond pays an annual coupon its YTM is 8%, and it currently trades at a discount Which of the following statement a CORRECTO The bond's current yield is more than 8% The bond's coupon rate is less than 8% The bond's coupon rate is equal to 8% The bond's current yield is equal to 8% The bond's coupon rate is more than 8% -uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45%