Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to undertake a new project in South Africa, one of the fastest growing countries in Africa, albeit one with lots of problems.

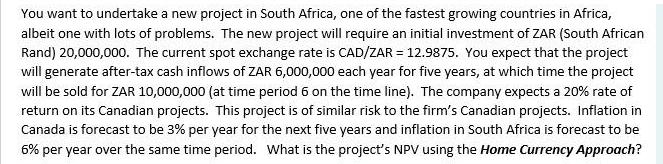

You want to undertake a new project in South Africa, one of the fastest growing countries in Africa, albeit one with lots of problems. The new project will require an initial investment of ZAR (South African Rand) 20,000,000. The current spot exchange rate is CAD/ZAR = 12.9875. You expect that the project will generate after-tax cash inflows of ZAR 6,000,000 each year for five years, at which time the project will be sold for ZAR 10,000,000 (at time period 6 on the time line). The company expects a 20% rate of return on its Canadian projects. This project is of similar risk to the firm's Canadian projects. Inflation in Canada is forecast to be 3% per year for the next five years and inflation in South Africa is forecast to be 6% per year over the same time period. What is the project's NPV using the Home Currency Approach?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the projects NPV using the Home Currency Approach we need to convert the projected cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started