Question

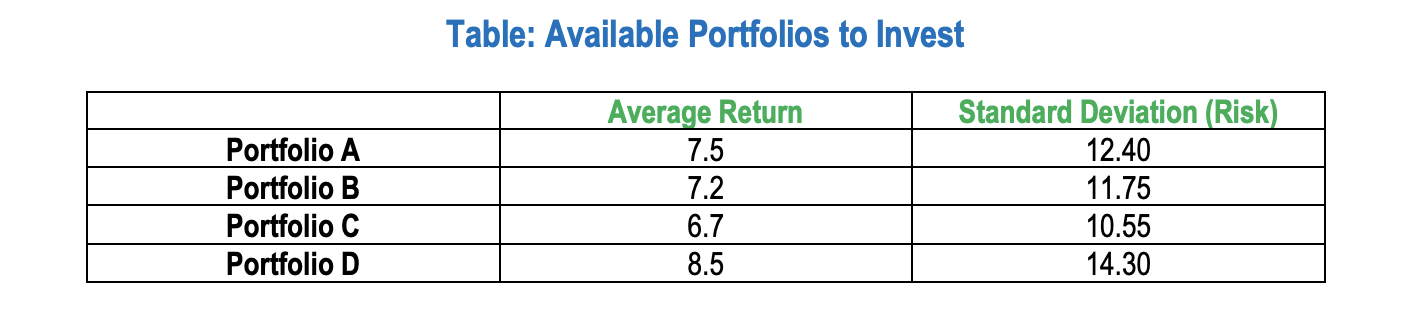

You went to your financial advisor and you wanted to get an overview of the other available investment options. The advisor shows you the following

You went to your financial advisor and you wanted to get an overview of the other available investment options. The advisor shows you the following available portfolios for investment that fits your investment criteria and their risk-return combinations. You want to use the average Risk-free rate = 2.18% for your analysis and calculation.

a. Select the best one among these using appropriate tool (formula) and provide your rationale for your selection. Show necessary calculations.

b. Should you stick to your original portfolio or switch to one of the following? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started