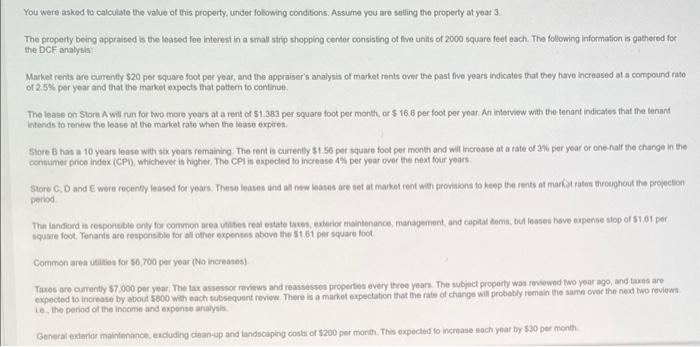

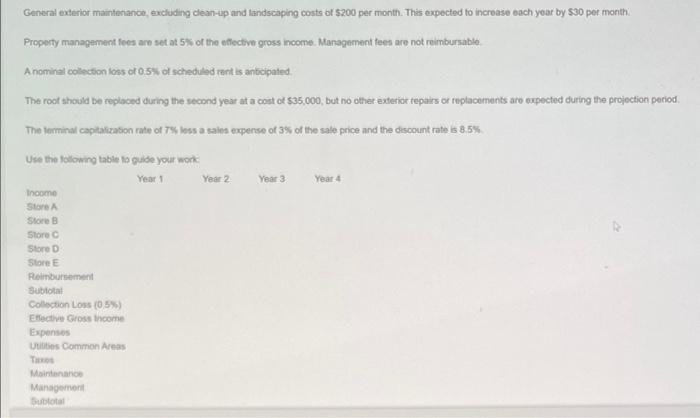

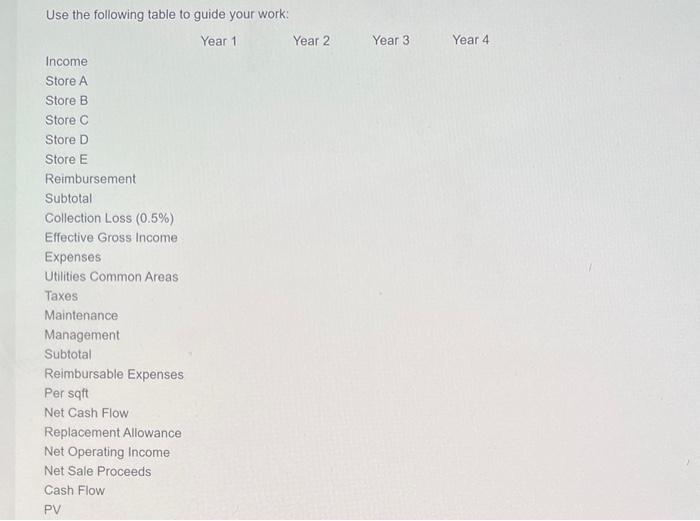

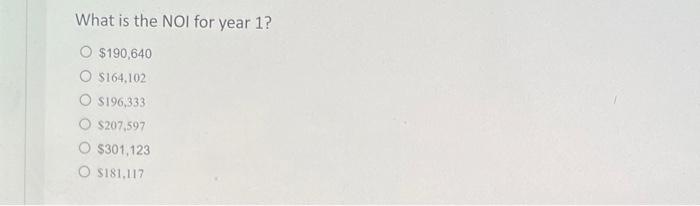

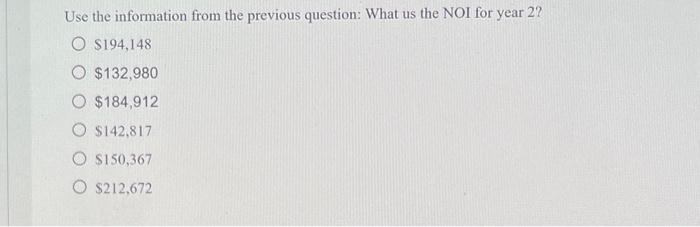

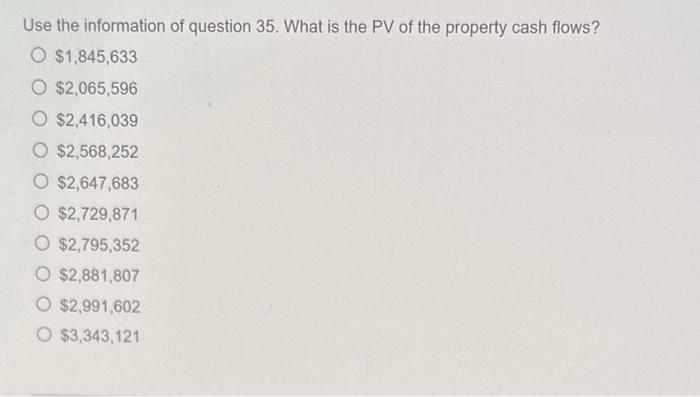

You were asked to calculate the vilue of this property. under following conditions. Assume you are setling the property at year 3. The properfy being appraised is the leased fee interest in a small strip shopping center consisting of five units of 2000 square feet each. The following information is gathered for the DCF analysis? Market rents are currently $20 per square foot per year, and the appraiser's analysis of market rents over the past five years indicales that they hive increased at a compound rate of 2.5\% per year and that the market expects that paltern to continue. The lease on Store A wili fun for two more years at a rent of 51.383 per square foot per month, or 516.6 per foot per year: An interview with the tenant indicates that the tenant. intends to renew the lease at the market rate when the lease expires. Slore B hars a 10 years leese with soc years remaining. The rent is currently 51.56 per square foot per month and wit increase at a rate of 3 yer yoar or ene-half the change in the cornumer prico index (CP1), whicherer is higher, The CPI is expected to increase 4% per yoar ower the next four years. Store C, D and E were recenty leased tod years. These leases and all new leases are set at market rent with provisions to keep the rents at markit ratas throughout the projecbon preriod. The landiord is resporsuble only for common area utithes real estate taxes, exterior thaintenance, managernent, and copital tema, but leases hove expense stop of s1.01 per square foot. Tenants are responsble for all ofter expenses abovi the 51.61 per square foot Common area utafies for 56,700 per year (No increases) Taxos aro carrently $7,000 per year, The tax assessor reviews and reassesses propertes every three years. The subject proporty was roviewnd two year ago, and taxns are expected to increase by about se00 with each subsequent roview. There is a market expectation that the rate of change will probebly remain the same over the nexd two roviews Le. the period of the insome and expense analydis. General extenor maintenance. escluding chaan-up and landscaping costs of 5200 per month. This oxpected to increase each ynar by 530 per month. General exterior maintenance, excluding clean-up and landscaping costs of $200 per month. This expected to increase each yoar by 530 per month. Property manapement fees are set at 5% of the effective gross income. Management fees are not reimbursable. A nominal collection loss of 0.5% of scheduled rent is anticipated. The root should be replaced during the second year at a coist of $35,000, but no other exterior tepairs or teplacements are expected during the projection period. The leminal capitaluzation rafe of T\% less a sales expense of 3% of the sale price and the discount rate is 8.5% I Inntho follinusinatahin in giuts waviriuncle: What is the NOI for year 1 ? $190,640$164,102$196,333$207,597$301,123$181,117 Use the information from the previous question: What us the NOI for year 2? $194,148$132,980$184,912$142,817$150,367$212,672 Use the information of question 35 . What is the PV of the property cash flows? $1,845,633$2,065,596$2,416,039$2,568,252$2,647,683$2,729,871$2,795,352$2,881,807$2,991,602$3,343,121 You were asked to calculate the vilue of this property. under following conditions. Assume you are setling the property at year 3. The properfy being appraised is the leased fee interest in a small strip shopping center consisting of five units of 2000 square feet each. The following information is gathered for the DCF analysis? Market rents are currently $20 per square foot per year, and the appraiser's analysis of market rents over the past five years indicales that they hive increased at a compound rate of 2.5\% per year and that the market expects that paltern to continue. The lease on Store A wili fun for two more years at a rent of 51.383 per square foot per month, or 516.6 per foot per year: An interview with the tenant indicates that the tenant. intends to renew the lease at the market rate when the lease expires. Slore B hars a 10 years leese with soc years remaining. The rent is currently 51.56 per square foot per month and wit increase at a rate of 3 yer yoar or ene-half the change in the cornumer prico index (CP1), whicherer is higher, The CPI is expected to increase 4% per yoar ower the next four years. Store C, D and E were recenty leased tod years. These leases and all new leases are set at market rent with provisions to keep the rents at markit ratas throughout the projecbon preriod. The landiord is resporsuble only for common area utithes real estate taxes, exterior thaintenance, managernent, and copital tema, but leases hove expense stop of s1.01 per square foot. Tenants are responsble for all ofter expenses abovi the 51.61 per square foot Common area utafies for 56,700 per year (No increases) Taxos aro carrently $7,000 per year, The tax assessor reviews and reassesses propertes every three years. The subject proporty was roviewnd two year ago, and taxns are expected to increase by about se00 with each subsequent roview. There is a market expectation that the rate of change will probebly remain the same over the nexd two roviews Le. the period of the insome and expense analydis. General extenor maintenance. escluding chaan-up and landscaping costs of 5200 per month. This oxpected to increase each ynar by 530 per month. General exterior maintenance, excluding clean-up and landscaping costs of $200 per month. This expected to increase each yoar by 530 per month. Property manapement fees are set at 5% of the effective gross income. Management fees are not reimbursable. A nominal collection loss of 0.5% of scheduled rent is anticipated. The root should be replaced during the second year at a coist of $35,000, but no other exterior tepairs or teplacements are expected during the projection period. The leminal capitaluzation rafe of T\% less a sales expense of 3% of the sale price and the discount rate is 8.5% I Inntho follinusinatahin in giuts waviriuncle: What is the NOI for year 1 ? $190,640$164,102$196,333$207,597$301,123$181,117 Use the information from the previous question: What us the NOI for year 2? $194,148$132,980$184,912$142,817$150,367$212,672 Use the information of question 35 . What is the PV of the property cash flows? $1,845,633$2,065,596$2,416,039$2,568,252$2,647,683$2,729,871$2,795,352$2,881,807$2,991,602$3,343,121