You will be provided with the year special journals for their company. You will be process for posting special journals to the ledgers. This is a critical first step and will serve as the starting point for the project. You will be required to prepared a pre-adjusted trial balance, record and post the end of the year adjusting journal entries, prepare an adjusted trial balance, the first year income statement and balance sheet, and the closing entries.

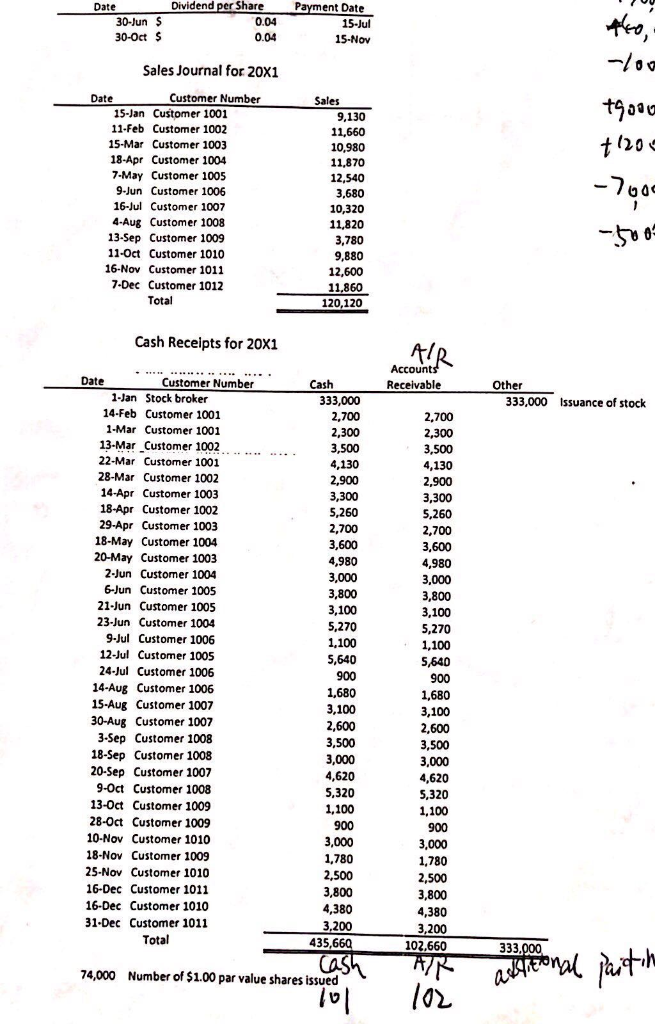

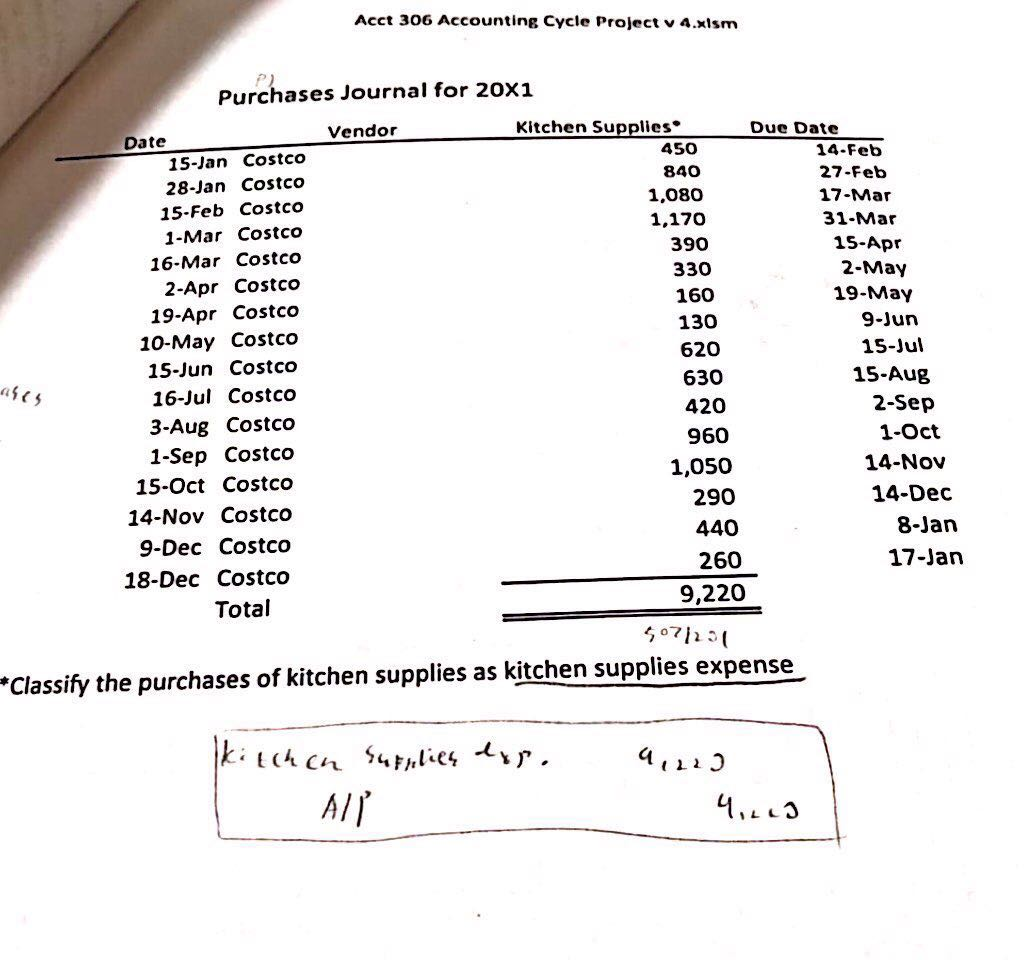

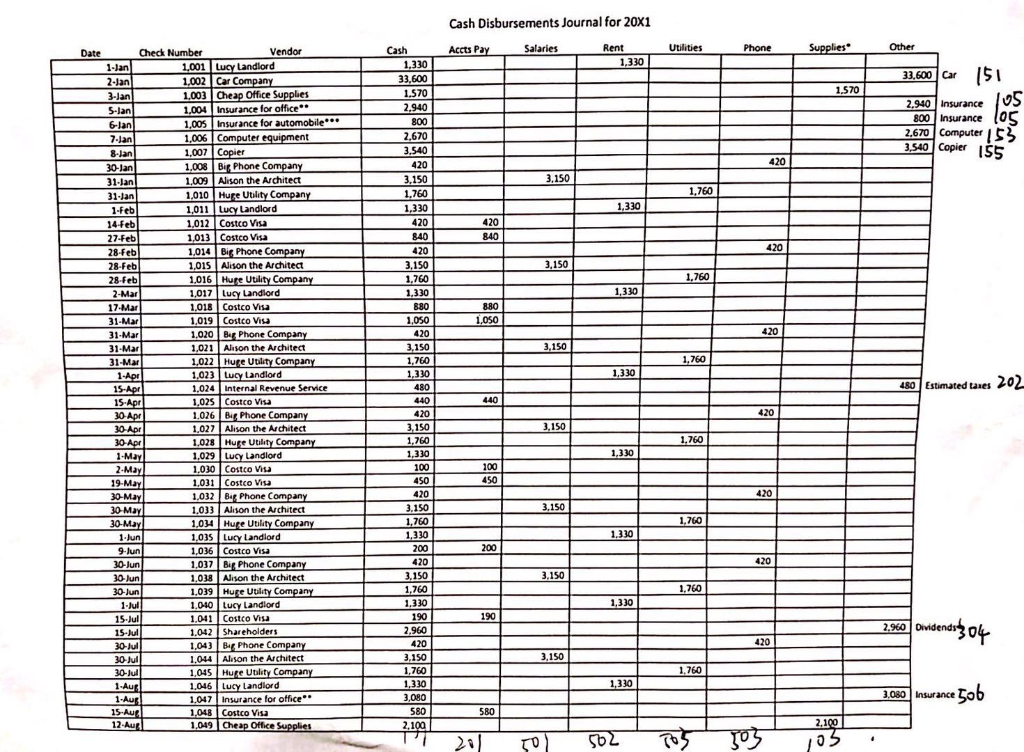

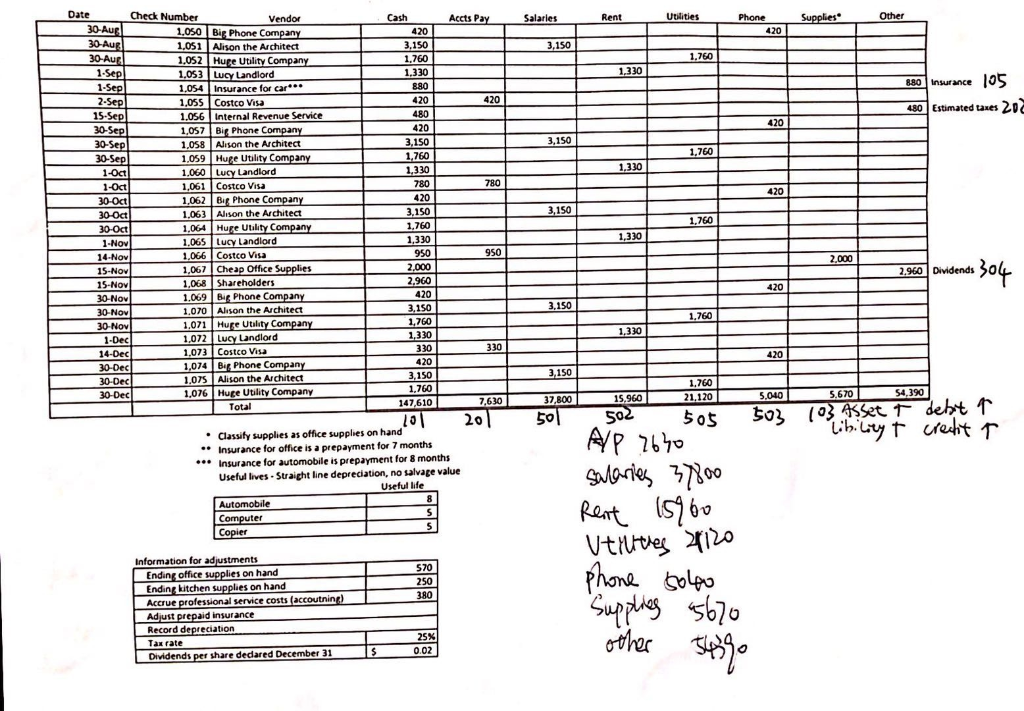

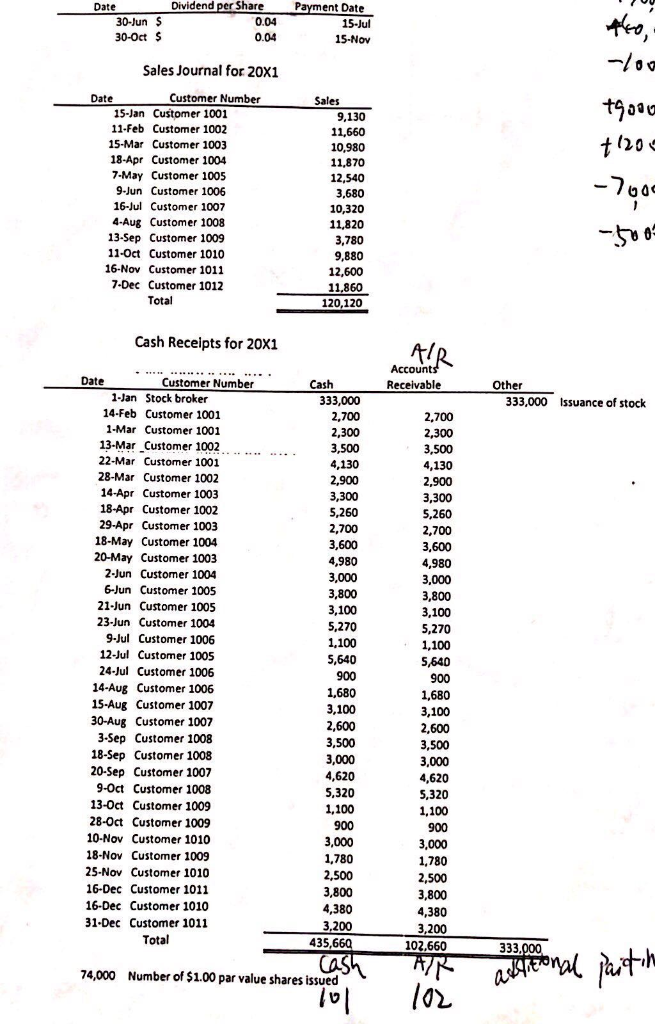

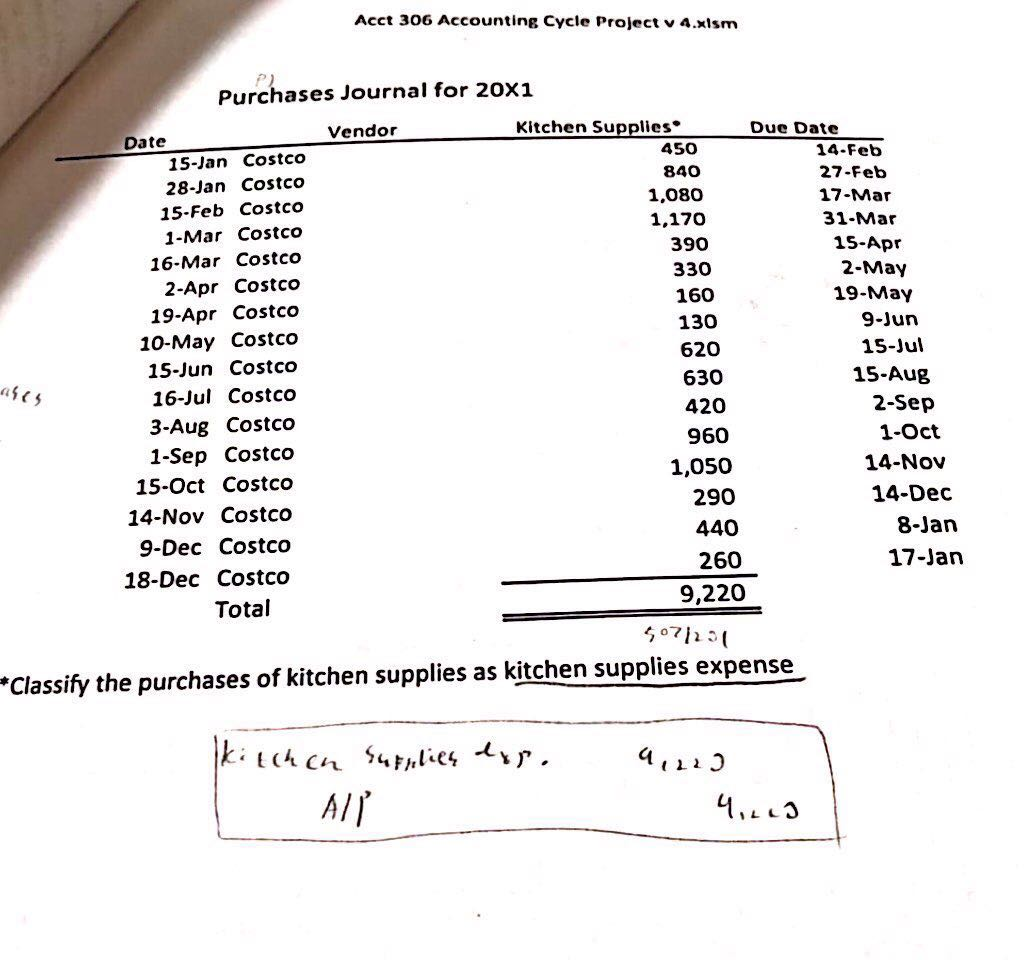

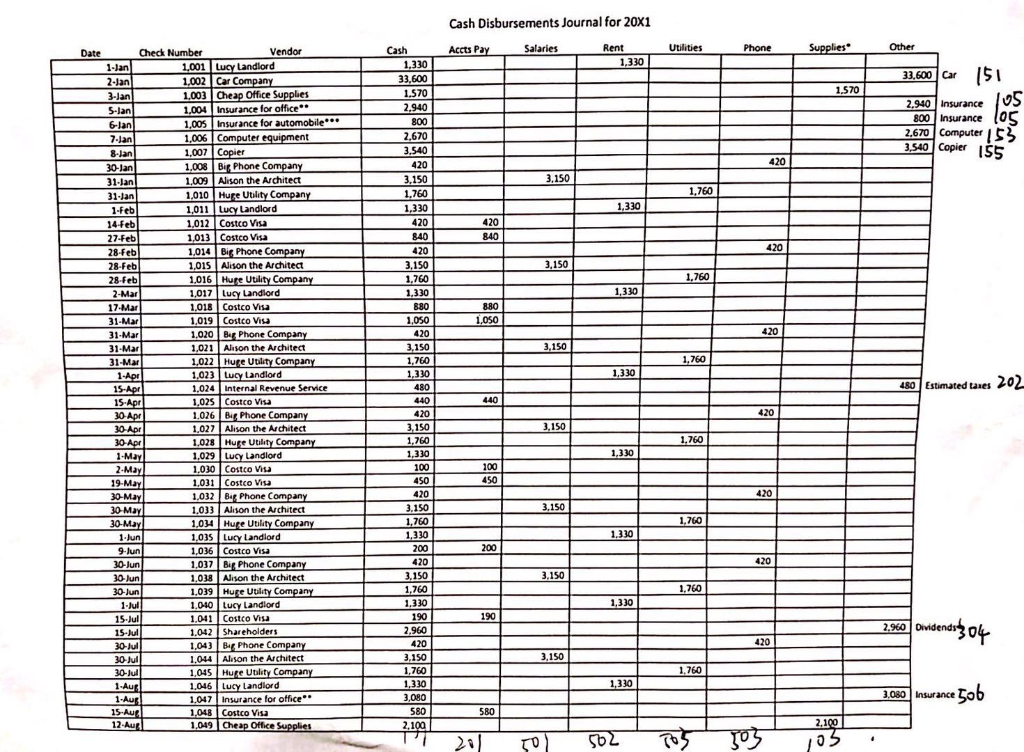

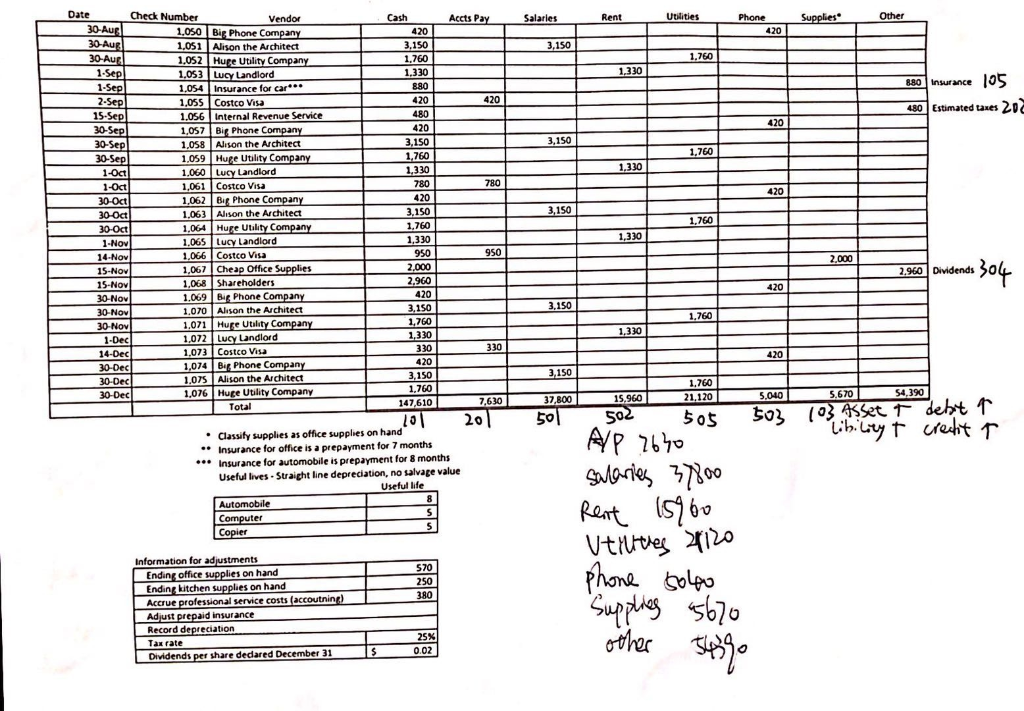

Date Dividend per Share Payment Date 30-Jun 30-0ct Sales Journal for 20X1 Customer Number 15-Jan Customer 1001 11-Feb Customer 100:2 15-Mar Customer 1003 18-Apr Customer 1004 7-May Customer 1005 9-Jun Customer 1006 16-Jul Customer 1007 4-Aug Customer 1008 13-Sep Customer 1009 11-Oct Customer 1010 16-Nov Customer 1011 7-Dec Customer 1012 11,660 10,980 11,870 12,540 3,680 10,320 11,820 3,780 9,880 12,600 11,860 120,120 Total Cash Receipts for 20X1 Account Customer Number Receivable er 1-Jan Stock broker 14-Feb Customer 1001 1-Mar Customer 1001 13-Mar Customer 1002 333,000 ssuance of stock 333,000 2,700 2,300 3,500 4,130 2.700 2,300 3,500 4,130 2,900 3,300 5,260 22-Mar Customer 1001 28-Mar Customer 1002 14-Apr Customer 1003 18-Apr Customer 1002 29-Apr Customer 1003 18-May Customer 1004 20-May Customer 1003 2-Jun Customer 1004 6-Jun Customer 1005 21-Jun Customer 1005 23-Jun Customer 1004 9-Jul Customer 1006 Customer 1005 24-Jul Customer 1006 14-Aug Customer 1006 15-Aug Customer 1007 30-Aug Customer 1007 3-Sep Customer 1008 18-Sep Customer 1008 20-Sep Customer 1007 9-Oct Customer 1008 13-0ct Customer 1009 28-0ct Customer 1009 10-Nov Customer 1010 18-Nov Customer 1009 25-Nov Customer 1010 3,300 5,260 3,600 3,600 4,980 3,000 3,800 3,000 3,800 3,100 5,270 1,100 12-Jul 5,640 900 1,680 1,680 2,600 3,500 3,000 4,620 5,320 3,500 3,000 1,100 3,000 1,780 2,500 3,000 1,780 16-Dec Customer 1011 16-Dec Customer 1010 4,380 31.Dec Customer 1011 435,660 102,660 74,000 Number of $1.00 par value shares issued Acct 306 Accounting Cycle Project v 4.xlsm Purchases Journal for 20X1 Vendor Kitchen Supplies Due Date Date 450 840 1,080 1,170 14-Feb 27 -Feb 17-Mar 31-Mar 15-Jan Costco 28-Jan Costco 15-Feb Costco 1-Mar Costco 16-Mar Costco 2-Apr Costco 19-Apr Costco 10-May Costco 15-Jun Costco 16-Jul Costco 3-Aug Costco 1-Sep Costco 15-Oct Costco 14-Nov Costco 9-Dec Costco 18-Dec Costco 390 330 160 130 620 15-Apr 2-May 19-May 9-Jun 15-Jul 15-Aug 630 420 960 2-Sep 1-oct 14-Nov 14-Dec 1,050 290 440 260 9,220 8-Jan 17-Jan Total Classify the purchases of kitchen supplies as kitchen supplies expense 3 A/ Cash Disbursements Journal for 20X1 Date Check Number Vendor Cash Accts Pay Salaries 1.001 Lucy Landlord 1,002 Car C 1003 Cheap Office Supplies 1004 Insurance for office 1,005 Insurance for automobile ,006 Computer 1,007 1008 Bi Phone Company 1,009 Alison the Architect 1.010 Hure Utility Compan 1-Jan 33.600 Car 33,600 1.570 2,940 1.570 3-Jan S-Jan 6-lan 2.940InsuranceS 8 Insurance 10S 2670 Computers3 540 CopierISS 8-Jan 3.540 420 30-Jan 31-Jan 31-Jan 1-Feb 14-Feb 27-Feb 28-Feb 3,150 1.760 Landlord 1.330 420 1,012 Costco Visa 1,013 Costco Visa 1,014 840 015 Alison the Architect ,016 1017 Lucy Landlord 1,018 Costco Visa 1019 Costco Visa 1 28-Feb ulity Company 17-Mar 31-Mar 31-Mar 31-Mar 31-Mar 880 1,050 1,050 420 020 B Phone Company 1,021 Alison the Architect 1,022 1,760 760 Landlord 1,330 480 Estimated taes 20 1.024 internal Revenue Service 1,025 Costco Visa 1026 Big Phone 420 027 Alison the Architect 1,028 Hu 1,029 1030 Costco Visa 30-Apr 30- 1,760 Landlord 450 031 Costco Visa 1,032 1033 Alison the Architect Phone C Utility Company 1,760 60 1-Jun 1.035 Lucy Landlord 1,036 Costco Visa 1,037 038 Alison the Architect 1,039 Huge Utl 1.040 041 Costco Visa 1.042 Shareholders 1.043 BPhone Company 1.044 Alison the Architect 1,045 Huge Ublity C 1,046 1047 Insurance for office Phone C 30-Jun Jun 30-Jun 3,150 3.150 hot 2960 Dvidends0 2.960 15-Jul 30-Jul 30-Jul 30-Jul 3,150 1,760 3,150 Landlord 3.080 Insurance 3,080 580 ,100 Costco Visa 1049 Cheap Office Date Check Number Cash Accts P Salaries 1050 Big Phone 1,051 Alison the Architect 1,052 1,053 1,054 nsurance for car 1,055 Costco Visa 1.056 Internal Revenue Service 1.057 Bi Phone 1,058 Alison the Architect 420 3,150 1.760 1.330 3,150 1.760 Landlord 880insurance O 420 480 Estimated taxes 20 3,150 3,150 1.760 e UtilityC Landlord 1,330 1-Oct 1-Oct 1,060 1,061 Costco Visa 1,062 Big Phone C 1,063 Alison the Architect 1,064 Huge Utility C 1.065 ucy Landlord 1,066 Costco Visa 1,067 Cheap Office 1,068 Shareholders 1.069 Bif Phone C 1,070 Alison the Architect 1071 Huge Ut 1,072 Lucy Landlord 1073 Costco Vis 420 420 3,150 1.760 1,330 3,150 1.760 1,330 1-NOV 14-Nov 15-Nov 15-Nov 30-Nov 30-Nov 30-Nov 1-Dec 14-Dec 2,000 2,000 2,960 ,960 Dividends 50 420 150 3,150 1.760 420 420 150 1.760 147,610 150 1.07S Alison the Architect 1,076 Huge Utility Company 30-Dec 1.760 30-Dec ,040 54,390 7,630 7,800 15,960 otal Classify supplies as office supplies on hand *Insurance for office is a prepayment for 7 months Insurance for automobile is prepayment for 8 months Useful lives. Straight line depreciation, no salvage value Useful life Automobile s on hand ies on hand 250 Su 5670 Accrue professional service costs (accoutnin aid insurance eciation 25% 0.02 Dividends per share dedared December 31