Question

You will choose the best option for a person in their 20s putting money into a fund for retirement. Assume this individual is a moderate

You will choose the best option for a person in their 20s putting money into a fund for retirement.

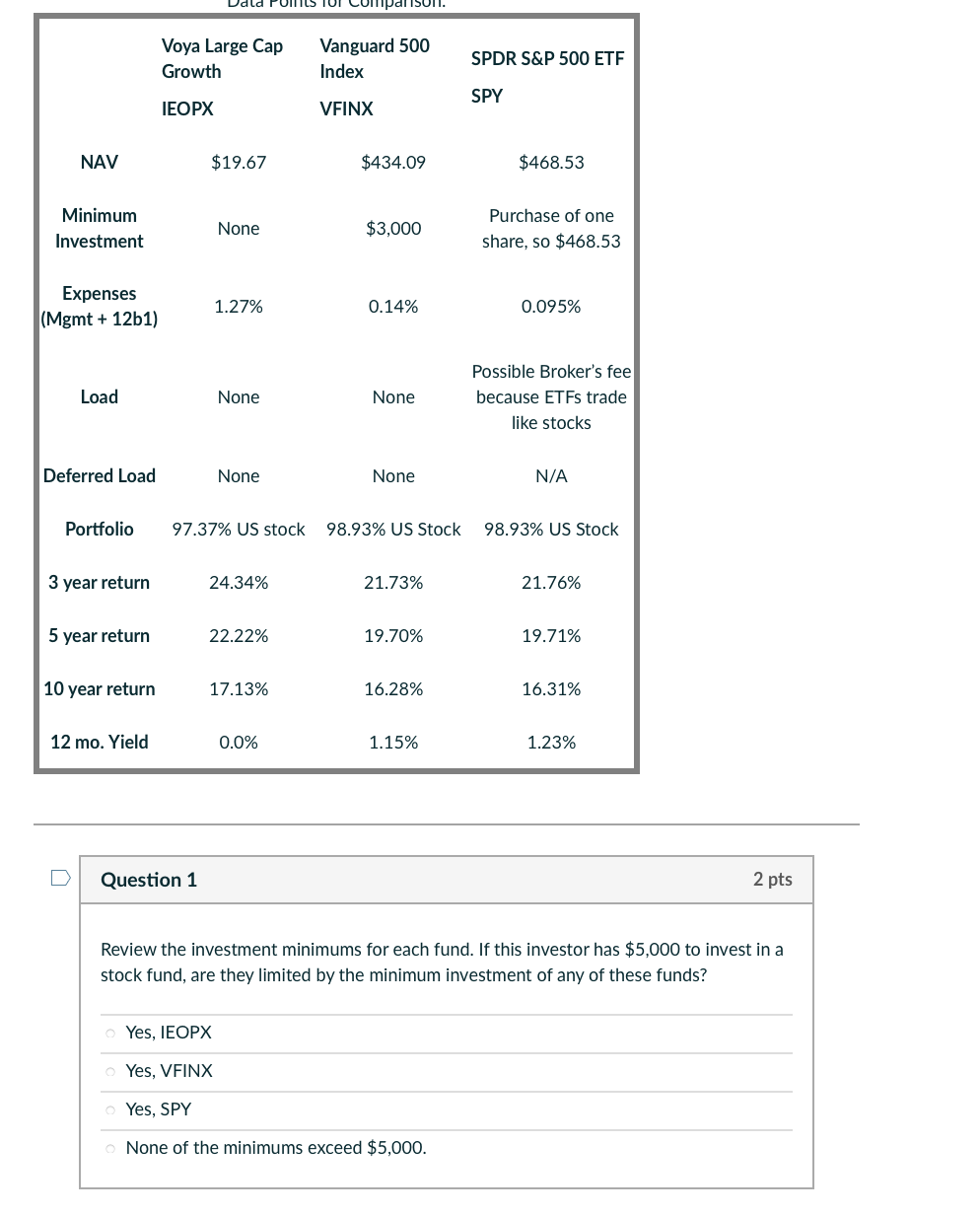

Assume this individual is a moderate investor and plans to put half of their long-term investments into the U.S. stock market. You will compare the data for three funds, all of which invest in large company U.S. stocks.

The first fund (IEOPX) is a traditional actively managed mutual fund. The second choice (VFINX) is an index fund. The third (SPY) is an exchange traded fund. As stated, all three invest in large company U.S. stocks.

Answer all of the questions using the quote comparison below.

QUESTION: Rank the funds from your first choice (#1) for this investor to your 2nd and 3rd choices. Explain your reasoning using data from this assignment.

Hint: a simple ranking of three funds does not answer the question. You must explain your thinking using data points from the analysis.

Do not use NAV as a reason to rank one fund over another. NAV is only useful for comparing a fund to itself over the years.

Example:

First Choice: _______; reason this is my first choice: ________________

and so on...

Dala POMLS TO COmparison. Voya Large Cap Growth Vanguard 500 Index SPDR S&P 500 ETF SPY IEOPX VEINX NAV $19.67 $434.09 $468.53 Minimum Investment None $3,000 Purchase of one share, so $468.53 Expenses (Mgmt + 12b1) 1.27% 0.14% 0.095% Load None None Possible Broker's fee because ETFs trade like stocks Deferred Load None None N/A Portfolio 97.37% US stock 98.93% US Stock 98.93% US Stock 3 year return 24.34% 21.73% 21.76% 5 year return 22.22% 19.70% 19.71% 10 year return 17.13% 16.28% 16.31% 12 mo. Yield 0.0% 1.15% 1.23% D Question 1 2 pts Review the investment minimums for each fund. If this investor has $5,000 to invest in a stock fund, are they limited by the minimum investment of any of these funds? Yes, IEOPX Yes, VFINX Yes, SPY None of the minimums exceed $5,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started