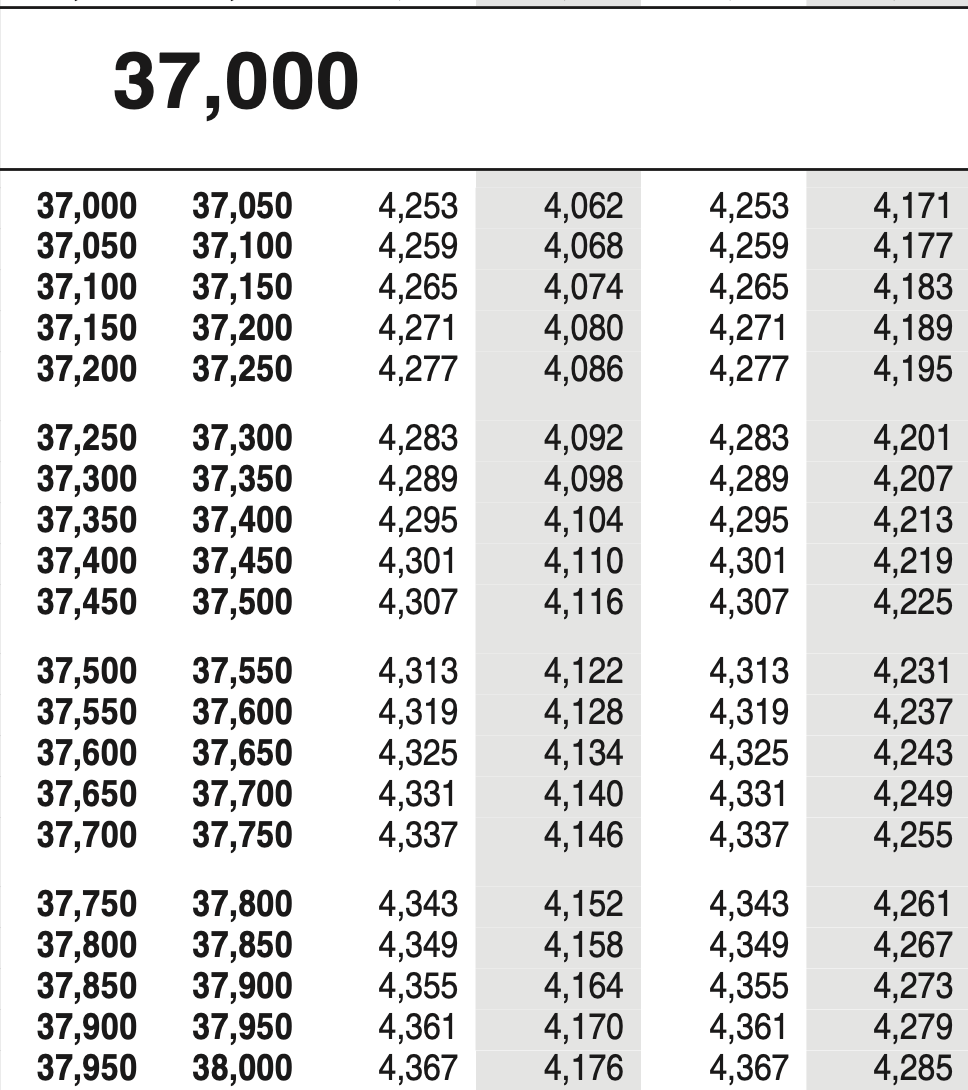

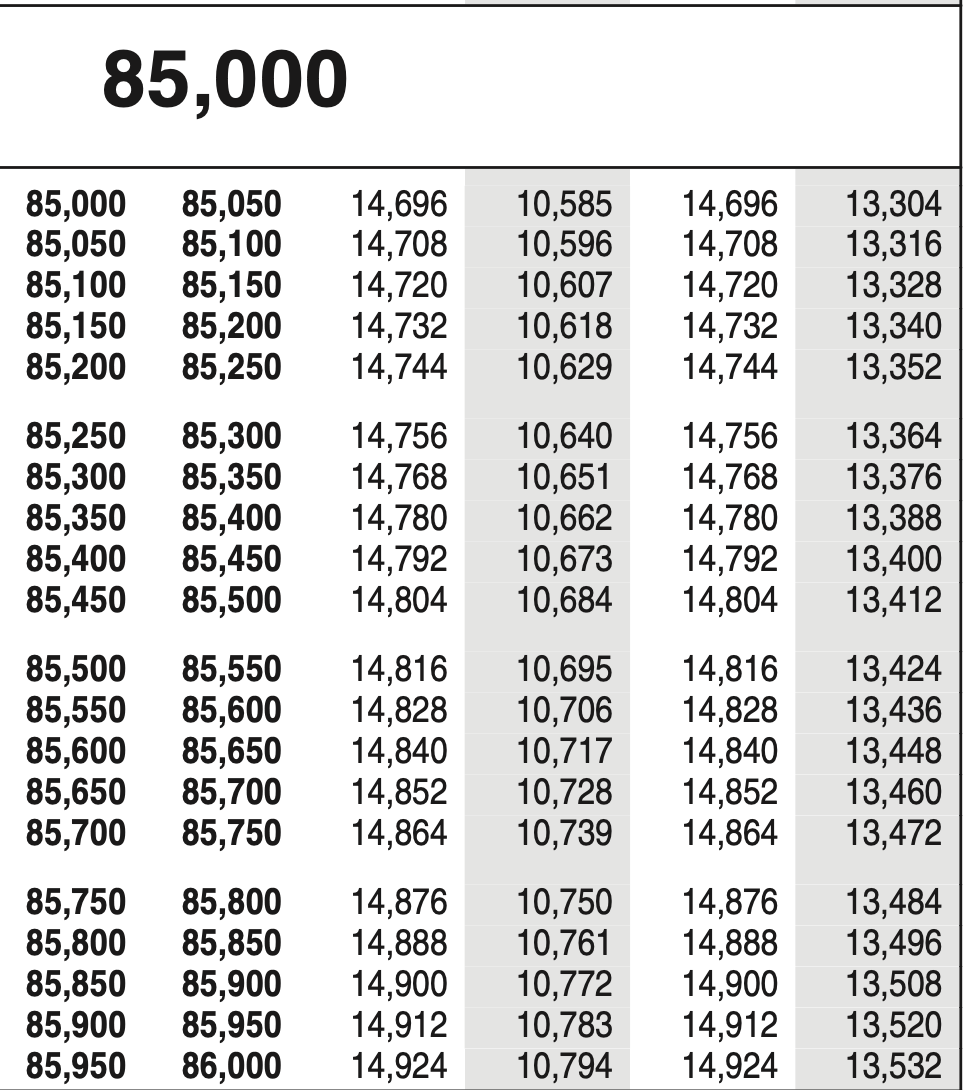

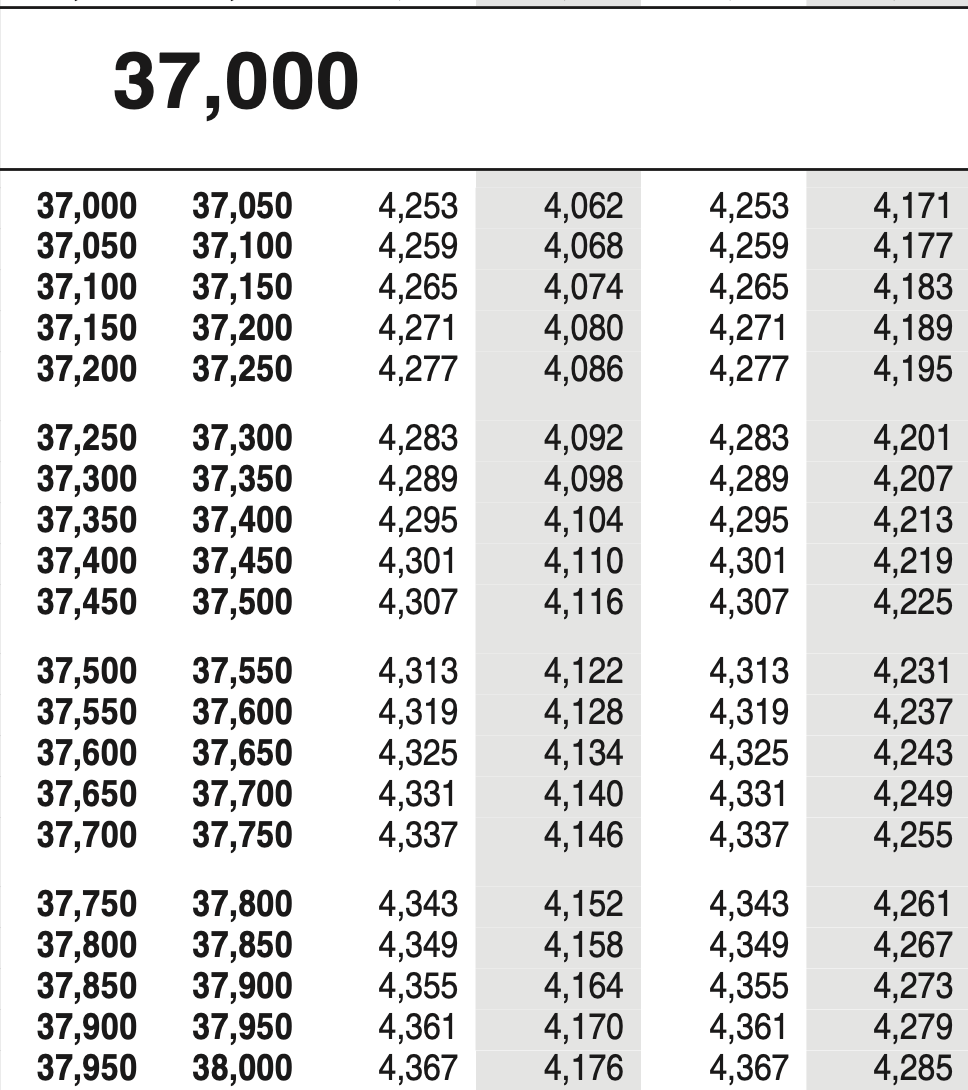

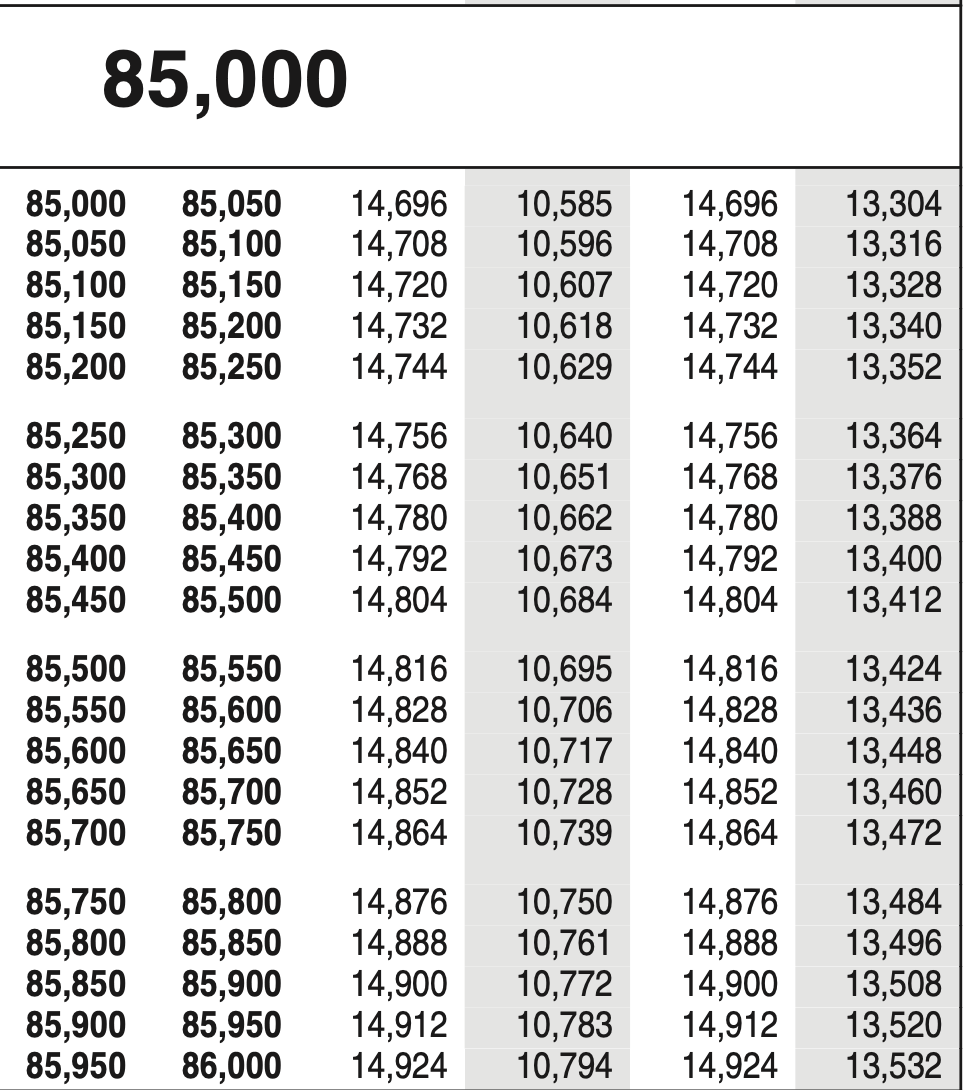

You will need to use the 2018 Tax Table from the class website. Assume you were born after 1950, you are not blind and no one else can claim you as a dependent. Adjusted Gross Income (AGI) = Wages + interest Taxable income = AGI standard individual deduction ($12,000) #2. Your W-2 form reports that your total wages were $37,450 for 2018. Your W-2 form also reports that $4,178 was withheld from your wages for federal income tax. You receive a 1099- INT from your bank that indicated interest earned of $316. You are single and not claimed by any other person as a dependent. 1. How much is your adjusted gross income? 2. How much is your taxable income? 3. What is your total tax for the year? 4. What is the amount of your payment or refund? #3. Your W-2 form reports that your total wages were $85,000 for 2018. Your W-2 form also reports that $10,266 was withheld from your wages for federal income tax. You receive a 1099- INT from your bank that indicated interest earned of $1,203. You are married and will be filing as married filing jointly." 1. How much is your adjusted gross income? 2. How much is your taxable income? 3. What is your total tax for the year? 4. What is the amount of your payment or refund? 37,000 37,000 37,050 37,100 37,150 37,200 37,050 37,100 37,150 37,200 37,250 4,253 4,259 4,265 4,271 4,277 4,062 4,068 4,074 4,080 4,086 4,253 4,259 4,265 4,271 4,277 4,171 4,177 4,183 4,189 4, 195 37,250 37,300 37,350 37,400 37,450 37,300 37,350 37,400 37,450 37,500 4,283 4,289 4,295 4,301 4,307 4,092 4,098 4,104 4,110 4,116 4,283 4,289 4,295 4,301 4,307 4,201 4,207 4,213 4,219 4,225 37,500 37,550 37,600 37,650 37,700 37,550 37,600 37,650 37,700 37,750 4,313 4,319 4,325 4,331 4,337 4,122 4,128 4,134 4,140 4,146 4,313 4,319 4,325 4,331 4,337 4,231 4,237 4,243 4,249 4,255 37,750 37,800 37,850 37,900 37,950 37,800 37,850 37,900 37,950 38,000 4,343 4,349 4,355 4,361 4,367 4,152 4,158 4,164 4,170 4,176 4,343 4,349 4,355 4,361 4,367 4,261 4,267 4,273 4,279 4,285 85,000 85,000 85,050 85,100 85,150 85,200 85,050 85,100 85,150 85,200 85,250 14,696 14,708 14,720 14,732 14,744 10,585 10,596 10,607 10,618 10,629 14,696 14,708 14,720 14,732 14,744 13,304 13,316 13,328 13,340 13,352 85,250 85,300 85,350 85,400 85,450 85,300 85,350 85,400 85,450 85,500 14,756 14,768 14,780 14,792 14,804 10,640 10,651 10,662 10,673 10,684 14,756 14,768 14,780 14,792 14,804 13,364 13,376 13,388 13,400 13,412 85,500 85,550 85,600 85,650 85,700 85,550 85,600 85,650 85,700 85,750 14,816 14,828 14,840 14,852 14,864 10,695 10,706 10,717 10,728 10,739 14,816 14,828 14,840 14,852 14,864 13,424 13,436 13,448 13,460 13,472 85,750 85,800 85,850 85,900 85,950 85,800 85,850 85,900 85,950 86,000 14,876 14,888 14,900 14,912 14,924 10,750 10,761 10,772 10,783 10,794 14,876 14,888 14,900 14,912 14,924 13,484 13,496 13,508 13,520 13,532