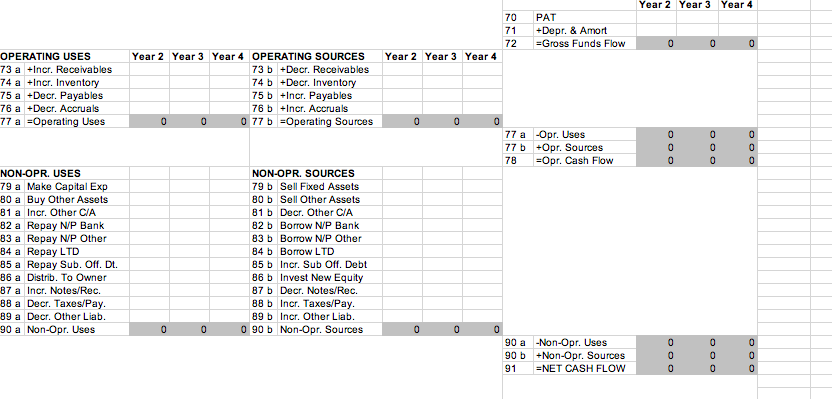

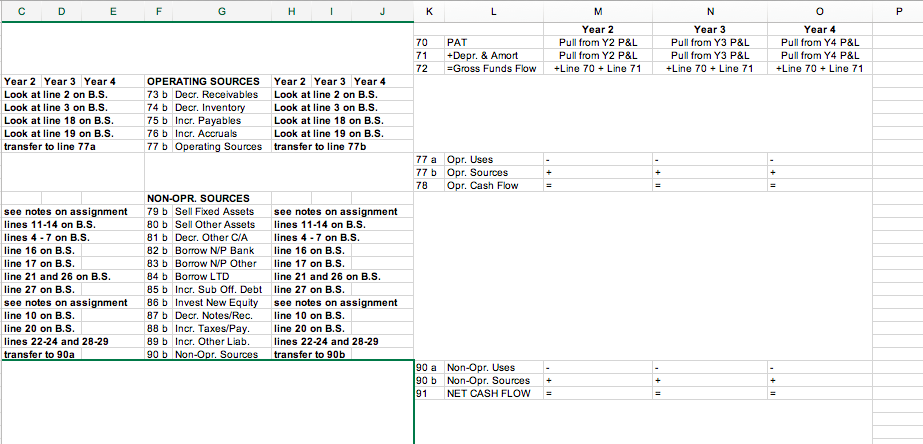

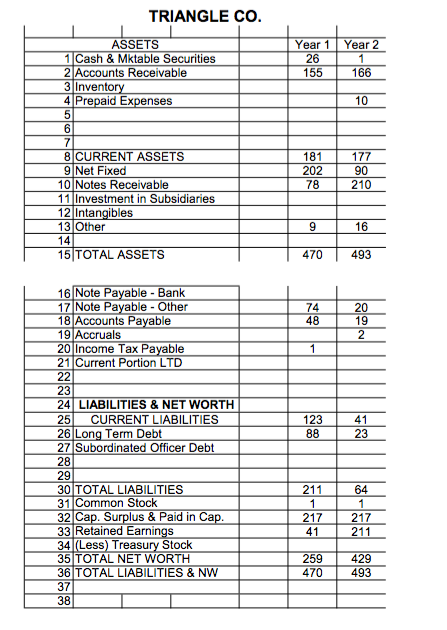

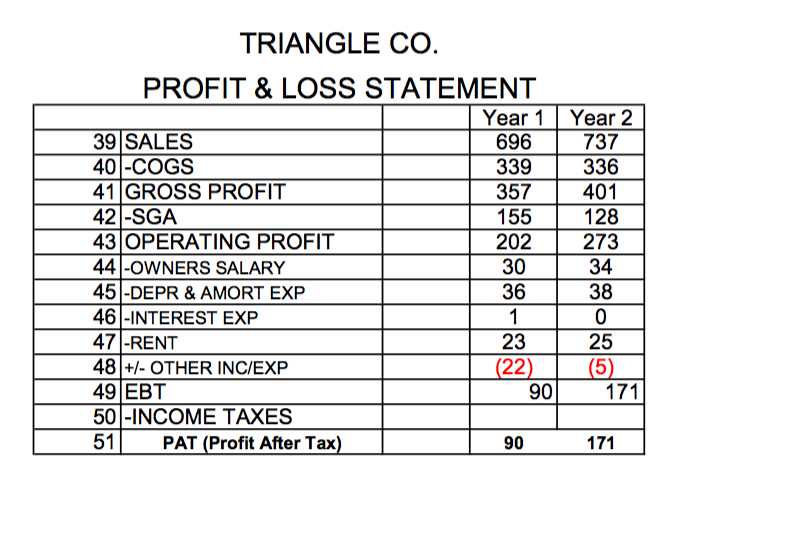

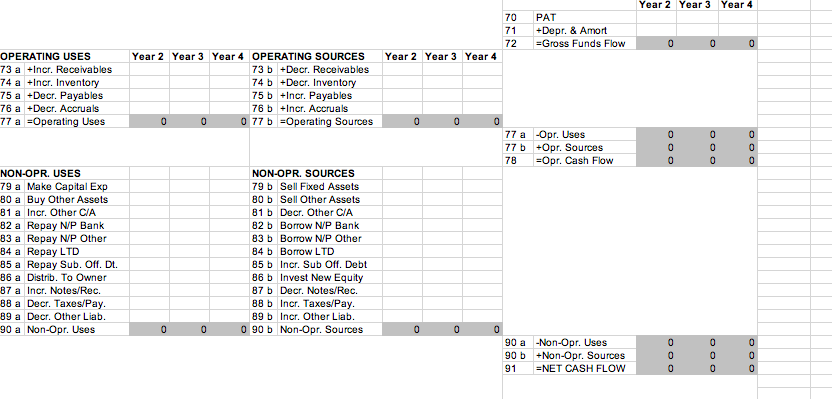

You will only complete the Year 2 column since you only have financials for Years 1 and 2. TO COMPUTE LINE 79 ON THE CASH FLOW STATEMENT: + Ending Net Fixed Assets (Year 2) + Depreciation/Amort Expense (Year 2) - Beginning Net Fixed Assets (Year 1) = Net Capital Expenditures (Sell Fixed Assets if negative) TO COMPUTE LINE 86 ON THE CASH FLOW STATEMENT: + Ending Net Worth (Year 2) - PAT (on Profit & Loss Year 2) - Beginning Net Worth (Year 1) = New Equity (Distributions if negative) TO COMPUTE LINE 81 ON THE CASH FLOW STATEMENT: Use the Prepaid line on the Balance Sheet for the Increase in Other Current Assets

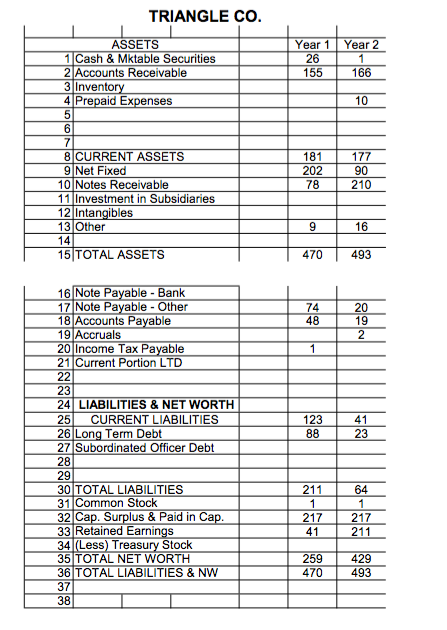

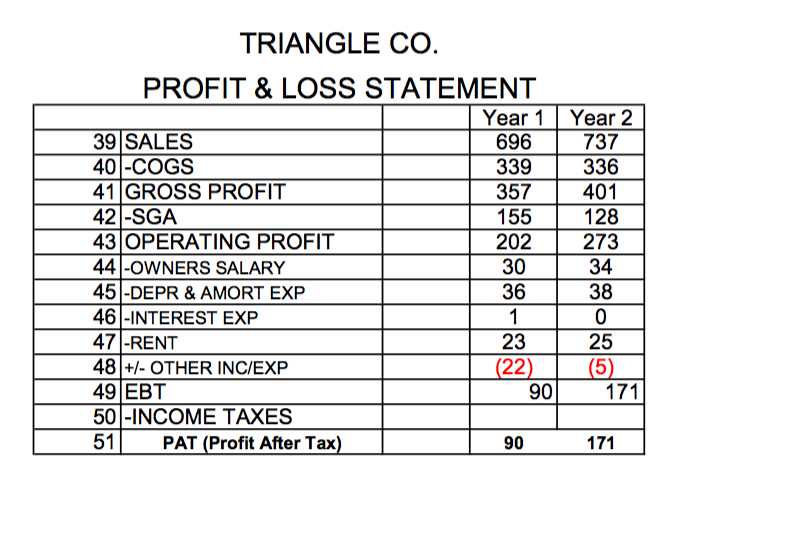

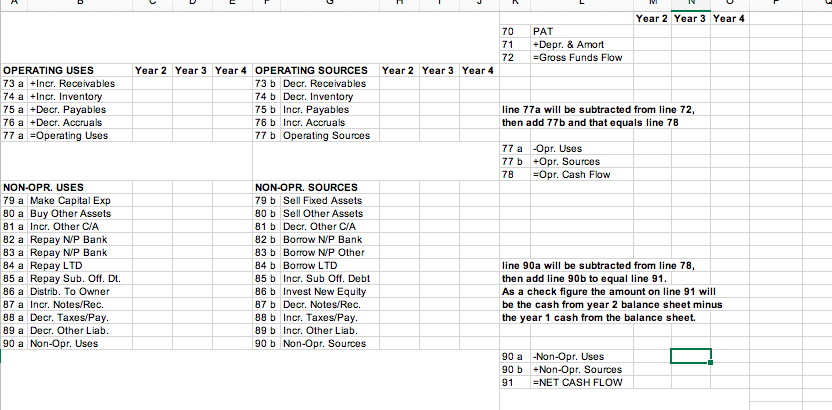

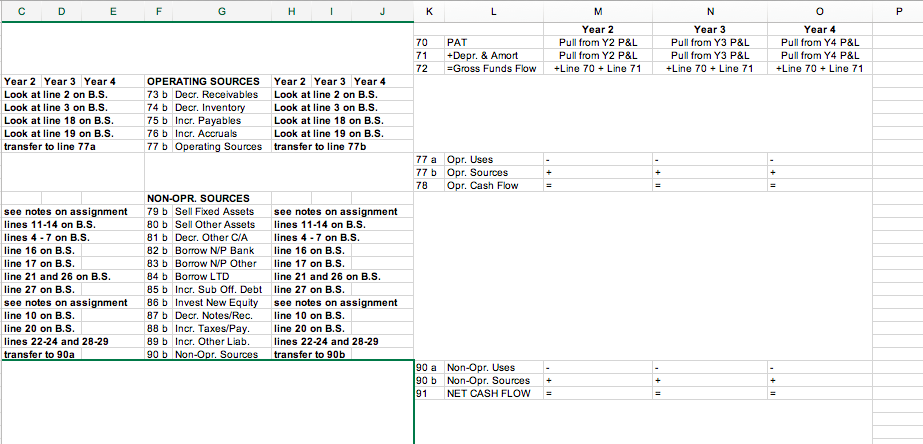

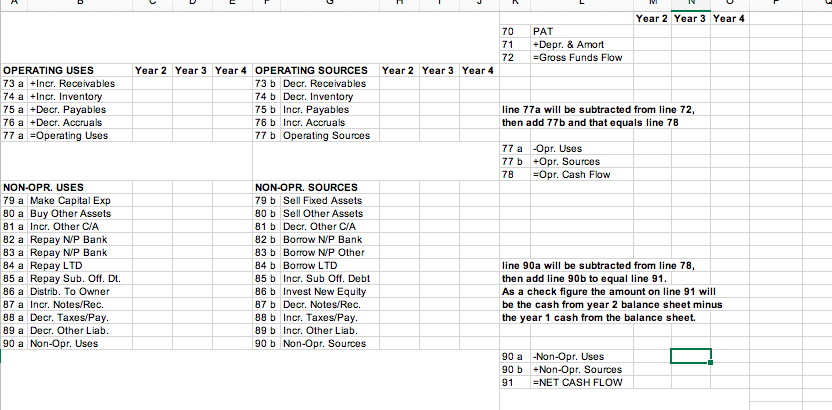

TRIANGLE CO. Year 1 26 155 Year 2 1 166 10 ASSETS 1 1 Cash & Mktable Securities 2 Accounts Receivable 3 Inventory 4 Prepaid Expenses 5 6 7 8 CURRENT ASSETS 9 Net Fixed 10 Notes Receivable 11 Investment in Subsidiaries 12 Intangibles 13 Other 14 15 TOTAL ASSETS 181 202 177 90 210 78 9 16 470 493 74 48 20 19 2 1 123 88 41 23 16 Note Payable - Bank 17 Note Payable - Other 18 Accounts Payable 19 Accruals 20 Income Tax Payable 21 Current Portion LTD 22 23 24 LIABILITIES & NET WORTH 25 CURRENT LIABILITIES 26 Long Term Debt 27 Subordinated Officer Debt 28 29 30 TOTAL LIABILITIES 31 Common Stock 32 Cap. Surplus & Paid in Cap. 33 Retained Earnings 34 (Less) Treasury Stock 35 TOTAL NET WORTH 36 TOTAL LIABILITIES & NW 37 38 211 1 217 41 64 1 217 211 259 470 429 493 TRIANGLE CO. PROFIT & LOSS STATEMENT Year 1 Year 2 39 SALES 696 737 40 -COGS 339 336 41 GROSS PROFIT 357 401 42 -SGA 155 128 43 OPERATING PROFIT 202 273 44 -OWNERS SALARY 30 34 45 -DEPR & AMORT EXP 36 38 46 -INTEREST EXP 1 0 47 -RENT 23 25 48 +- OTHER INC/EXP (22) (5) 49 EBT 90 171 50 -INCOME TAXES 51 PAT (Profit After Tax) 90 171 Year 2 Year 3 Year 4 70 71 72 PAT +Depr. & Amort =Gross Funds Flow 0 0 0 Year 2 Year 3 Year 4 OPERATING USES 73 a +Incr. Receivables 74 a +Incr. Inventory 75 a +Decr. Payables 76 a +Decr. Accruals 77 a =Operating Uses Year 2 Year 3 Year 4 OPERATING SOURCES 73 b +Decr. Receivables 74b +Deer. Inventory 75 b +Iner. Payables 76 b +Incr. Accruals 0 0 0 77 b =Operating Sources 0 0 0 77 a Opr. Uses 77 b +Opr. Sources 78 = Opr. Cash Flow 0 0 0 0 0 0 0 0 0 NON-OPR. USES 79 a Make Capital Exp 30 a Buy Other Assets 81 a Incr. Other CIA 82 a Repay NP Bank 83 a Repay NP Other 84 a Repay LTD 85 a Repay Sub. Off. Dt. 86 a Distrib. To Owner 87 a Incr. Notes/Rec. 88 a Decr. Taxos/Pay. 89 a Decr. Other Liab. 90 a Non-Opr. Uses NON-OPR. SOURCES 79 b Sell Fixed Assets 80 b Sell Other Assets 81 b Decr. Other CIA 82 b Borrow NP Bank 83 b Borrow NP Other 84 b Borrow LTD 85 b Incr. Sub Off. Debt 86 b Invest New Equity 87 b Decr. Notes/Rec. 88 b Iner. Taxes/Pay. 89 b Incr. Other Liab. O 90 b Non-Opr. Sources 0 0 0 0 0 90 a -Non-Opr. Uses 90 b +Non-Opr. Sources 91 =NET CASH FLOW 0 0 0 0 0 0 0 0 0 E F H L M N 0 70 71 72 PAT Depr. & Amort =Gross Funds Flow Year 2 Pull from Y2 P&L Pull from Y2 P&L +Line 70 + Line 71 Year 3 Pull from Y3 P&L Pull from Y3 P&L +Line 70 + Line 71 Year 4 Pull from Y4 P&L Pull from Y4 P&L +Line 70 + Line 71 Year 2 Year 3 Year 4 Look at line 2 on B.S. Look at line 3 on B.S. Look at line 18 on B.S. Look at line 19 on B.S. transfer to line 77a OPERATING SOURCES Year 2 Year 3 Year 4 73 b Decr. Receivables Look at line 2 on B.S. 74b Decr. Inventory Look at line 3 on B.S. 75 b Incr. Payables Look at line 18 on B.S. 76 b Incr. Accruals Look at line 19 on B.S. 77 b Operating Sources transfer to line 77b 77 a Opr. Uses 77 b Opr. Sources 78 Opr. Cash Flow see notes on assignment lines 11-14 on B.S. lines 4 - 7 on B.S. line 16 on B.S. line 17 on B.S. line 21 and 26 on B.S. line 27 on B.S. see notes on assignment line 10 on B.S. line 20 on B.S. lines 22-24 and 28-29 transfer to 90a NON-OPR. SOURCES 79 b Sell Fixed Assets see notes on assignment 80 b Sell Other Assets lines 11-14 on B.S. 81 b Decr. Other CIA lines 4 - 7 on B.S. 82 b Borrow NP Bank line 16 on B.S. 83 b Borrow NP Other line 17 on B.S. 84 b Borrow LTD line 21 and 26 on B.S. 85 b Incr. Sub Off. Debt line 27 on B.S. 86 b Invest New Equity see notes on assignment 87 b Decr. Notes/Rec. line 10 on B.S. 88 b Incr. Taxes/Pay. line 20 on B.S. 89 b Incr. Other Liab. lines 22-24 and 28-29 90 b Non-Opr. Sources transfer to 900 90 a Non-Opr. Uses 90 b Non-Opr. Sources 91 NET CASH FLOW Year 2 Year 3 Year 4 70 71 72 PAT +Depr. & Amort =Gross Funds Flow Year 2 Year 3 Year 4 OPERATING USES 73 a +Incr. Receivables 74 a +Iner. Inventory 75 a Decr. Payables 76 a +Decr. Accruals 77 a =Operating Uses Year 2 Year 3 Year 4 OPERATING SOURCES 73 b Decr. Receivables 74 b Decr. Inventory 75 b Incr. Payables 76 b Incr. Accruals 77 b Operating Sources line 77a will be subtracted from line 72, then add 77b and that equals line 78 77 a -Opr. Uses 77 b +Opr. Sources 78 =Opr. Cash Flow NON-OPR. USES 79 a Make Capital Exp 80 a Buy Other Assets 81 a Incr. Other CIA 82 a Repay NP Bank 83 a Repay NP Bank 84 a Repay LTD 85 a Repay Sub. Off. DL. 86 a Distrib. To Owner 87 a Incr. Notes/Rec. 88 a Decr. Taxes/Pay. 89 a Decr. Other Liab. 90 a Non-Opr. Uses NON-OPR. SOURCES 79 b Sell Fixed Assets 80 b Sell Other Assets 81 b Decr. Other CIA 82 b Borrow NP Bank 83 b Borrow N/P Other 84 b Borrow LTD 85 b Incr. Sub Off. Debt 86 b Invest New Equity 87 b Decr. Notes/Rec. 88 b Incr. Taxes/Pay. 89 b Incr. Other Liab. 90 b Non-Opr. Sources line 90a will be subtracted from line 78, then add line 90b to equal line 91. As a check figure the amount on line 91 will be the cash from year 2 balance sheet minus the year 1 cash from the balance sheet. 90 a Non-Opr. Uses 90 b +Non-Opr. Sources 91 =NET CASH FLOW