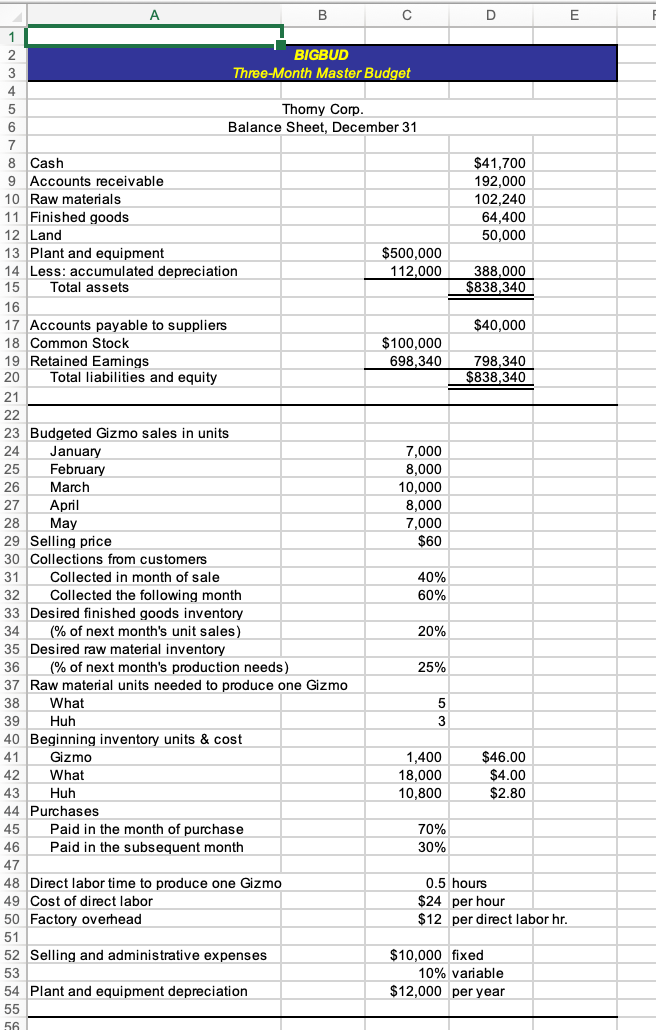

You will prepare a three month master budget (Jan, Feb & Mar) with the data contained in BIGBUD. This master budget WILL contain the following budgets.

Selling and Admin Expenses Ending Inventory Cash Budget Income Statement (one for every month) Balance Sheet (one for every month)

A B D E 1 2 BIGBUD 3 Three-Month Master Budget 4 5 Thomy Corp. 6 Balance Sheet, December 31 7 8 Cash $41,700 9 Accounts receivable 192,000 10 Raw materials 102,240 11 Finished goods 64,400 12 Land 50,000 13 Plant and equipment $500,000 14 Less: accumulated depreciation 112,000 388,000 15 Total assets $838,340 16 17 Accounts payable to suppliers $40,000 18 Common Stock $100,000 19 Retained Eamings 698,340 798,340 20 Total liabilities and equity $838,340 21 22 23 Budgeted Gizmo sales in units 24 January 7,000 25 February 8,000 26 March 10,000 27 April 8,000 28 May 7,000 29 Selling price 30 Collections from customers 31 Collected in month of sale 40% 32 Collected the following month 60% 33 Desired finished goods inventory 34 (% of next month's unit sales) 20% 35 Desired raw material inventory 36 (% of next month's production needs) 25% 37 Raw material units needed to produce one Gizmo 38 What 5 39 Huh 3 40 Beginning inventory units & cost 41 Gizmo 1,400 $46.00 What 18,000 $4.00 43 Huh 10,800 $2.80 44 Purchases 45 Paid in the month of purchase 70% 46 Paid in the subsequent month 30% 47 48 Direct labor time to produce one Gizmo 0.5 hours 49 Cost of direct labor $24 per hour 50 Factory overhead $12 per direct labor hr. 51 52 Selling and administrative expenses $10,000 fixed 53 10% variable 54 Plant and equipment depreciation $12,000 per year 55 56 $60 42 A B D E 1 2 BIGBUD 3 Three-Month Master Budget 4 5 Thomy Corp. 6 Balance Sheet, December 31 7 8 Cash $41,700 9 Accounts receivable 192,000 10 Raw materials 102,240 11 Finished goods 64,400 12 Land 50,000 13 Plant and equipment $500,000 14 Less: accumulated depreciation 112,000 388,000 15 Total assets $838,340 16 17 Accounts payable to suppliers $40,000 18 Common Stock $100,000 19 Retained Eamings 698,340 798,340 20 Total liabilities and equity $838,340 21 22 23 Budgeted Gizmo sales in units 24 January 7,000 25 February 8,000 26 March 10,000 27 April 8,000 28 May 7,000 29 Selling price 30 Collections from customers 31 Collected in month of sale 40% 32 Collected the following month 60% 33 Desired finished goods inventory 34 (% of next month's unit sales) 20% 35 Desired raw material inventory 36 (% of next month's production needs) 25% 37 Raw material units needed to produce one Gizmo 38 What 5 39 Huh 3 40 Beginning inventory units & cost 41 Gizmo 1,400 $46.00 What 18,000 $4.00 43 Huh 10,800 $2.80 44 Purchases 45 Paid in the month of purchase 70% 46 Paid in the subsequent month 30% 47 48 Direct labor time to produce one Gizmo 0.5 hours 49 Cost of direct labor $24 per hour 50 Factory overhead $12 per direct labor hr. 51 52 Selling and administrative expenses $10,000 fixed 53 10% variable 54 Plant and equipment depreciation $12,000 per year 55 56 $60 42