You win a lottery with a prize of $1.5 million. The prize is paid in ten equal annual installments. The first payment is one

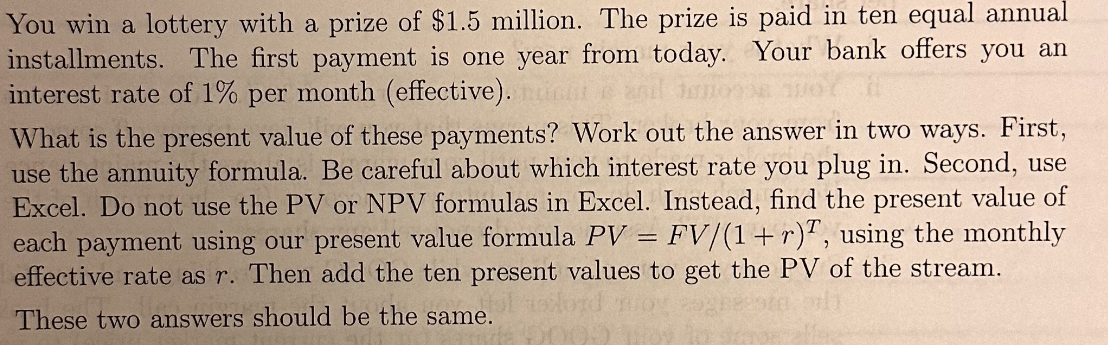

You win a lottery with a prize of $1.5 million. The prize is paid in ten equal annual installments. The first payment is one year from today. Your bank offers you an interest rate of 1% per month (effective). What is the present value of these payments? Work out the answer in two ways. First, use the annuity formula. Be careful about which interest rate you plug in. Second, use Excel. Do not use the PV or NPV formulas in Excel. Instead, find the present value of each payment using our present value formula PV = FV/(1+r), using the monthly effective rate as r. Then add the ten present values to get the PV of the stream. These two answers should be the same. You win a lottery with a prize of $1.5 million. The prize is paid in ten equal annual installments. The first payment is one year from today. Your bank offers you an interest rate of 1% per month (effective). What is the present value of these payments? Work out the answer in two ways. First, use the annuity formula. Be careful about which interest rate you plug in. Second, use Excel. Do not use the PV or NPV formulas in Excel. Instead, find the present value of each payment using our present value formula PV = FV/(1+r), using the monthly effective rate as r. Then add the ten present values to get the PV of the stream. These two answers should be the same. You win a lottery with a prize of $1.5 million. The prize is paid in ten equal annual installments. The first payment is one year from today. Your bank offers you an interest rate of 1% per month (effective). What is the present value of these payments? Work out the answer in two ways. First, use the annuity formula. Be careful about which interest rate you plug in. Second, use Excel. Do not use the PV or NPV formulas in Excel. Instead, find the present value of each payment using our present value formula PV = FV/(1+r), using the monthly effective rate as r. Then add the ten present values to get the PV of the stream. These two answers should be the same.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Using the annuity formula Payment amount 15 million 10 years 15000...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started