Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you get for free one of following two securities: (a) an annuity that pays $10,000 at the end of each of the next

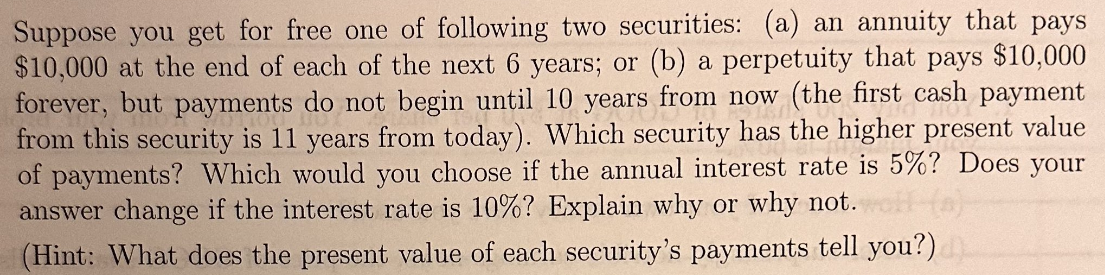

Suppose you get for free one of following two securities: (a) an annuity that pays $10,000 at the end of each of the next 6 years; or (b) a perpetuity that pays $10,000 forever, but payments do not begin until 10 years from now (the first cash payment from this security is 11 years from today). Which security has the higher present value of payments? Which would you choose if the annual interest rate is 5%? Does your answer change if the interest rate is 10%? Explain why or why not. (Hint: What does the present value of each security's payments tell you?)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine which security has the higher present value of payments we need to calculate the present value of each securitys cash flows a Annuity The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started