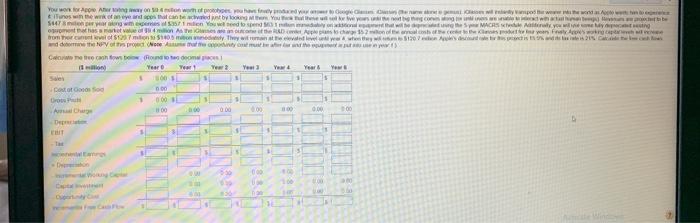

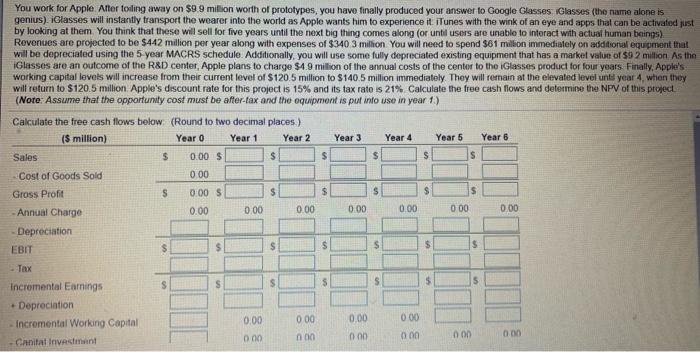

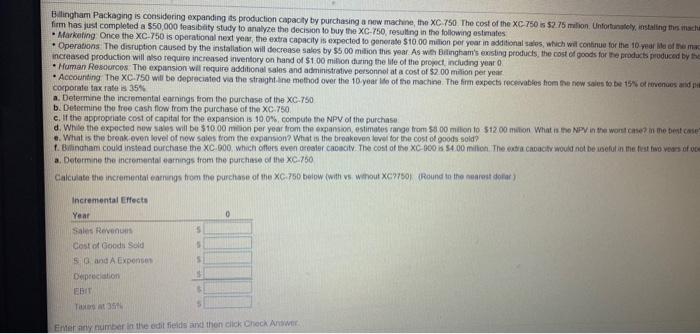

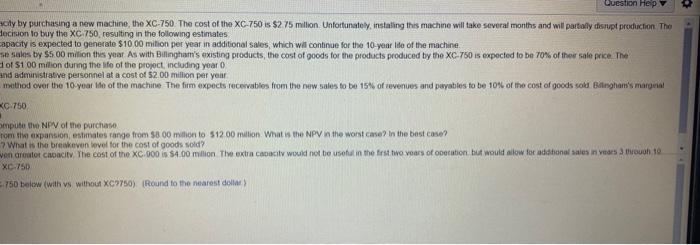

You won who will you wwwww es the width and by YouTube 5447 Sen Yowed to spend more SNACRS Sarly you will womentos contemporary art bromer 123750 Ty wieviel www520 Year Yew Yeart S Year You 5 Cheras om Year Y 00 postoso 0.00 000 Charge 100 3 100 De 1 5 5 Bilingham Packaging is considering expanding its production capacity by purchasing a new machine the XC 750 The cost of the XC 750 is 52.75 milion. Unfortunately, installing the mache firm has just completed a $50,000 feasibty study to analyze the decision to buy the XC-750 resulting in the following estimates - Marketing Once the XC-750 is operational next year, the extra capacity is expected to general $1000 milion per year in additional sales, which will continue for the 10 year of the mac Operations The disruption caused by the installation will decrease sales by $5.00 milion this year As with Betingham's existing products, the cost of goods for the products produced by the increased production will also require increased inventory on hand of $100 milion during the life of the project including year o Human Resources. The expansion will require additional sales and administrative personnel at a cost of $200 milion per year Accounting The XC-750 will be depreciated via the straight line method over the 10 year life of the machine. The firm expects receivables from the new sales to be 15% of revenues and Corporate tax rate is 35% a. Determine the incremental earnings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 100%, compute the NPV of the purchase d. While the expected now we will be $1000 milion per year from the expansion, estimates range from $800 milion to $1200 milion What is the NPV in the worse the best case e. What is the break oven level of now sales from the expansion? What is the breakove love for the cost of goods sold 1. Bilingham could instead Durchase the XC 900 which offers even greater City. The cost of the XC 900 54.00 million. The extra capacity would not be cutin me testovers of a. Determine the incrementalarnings from the purchase of the XC-750 Calculate the incremental coming hom the purchase of the Xc.750 below (with vs Who XC7701 Round to the corredor Incremental Effects Year 0 Sales Revenu 5 Cost of Goods Sold 5 and A Expenses Depreciation Elir Taxes 3 Emery number in the odit fields and then click Cock And Question HOP city by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.75 million. Unfortunately, instaling this machine will take several months and will partly fisrupt production. The decision to buy the XC 750 resulting in the following estimates apacity is expected to generate $1000 milion per year in additional sales, which will continue for the 10 year life of the machine se sales by SS 00 milion this year As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The of 5100 milion during the life of the project, including year 0 and administrative personnel at a cost of 5200 million per year method over the 10 year to of the machine. The firm expects receivables from the new sales to be 15% of revenues and peryables to be 10% of the cost of goods soll Bilingham's marga KC-750 ompute the NPV of the purchase rom the expansion estimates range from $800 million to 51200 million What is the NPV in the wont come in the best case? 7 What is the breakeven bevel for the cost of goods sold ven creator Choac The cost of the XC.000 in $4.00 million the extra coact would not be useful in the first two years of operation but would allow for additional sales invas 3 moun 10 XC 750 750 below (with vs without XC9750). (Round to the nearest della You won who will you wwwww es the width and by YouTube 5447 Sen Yowed to spend more SNACRS Sarly you will womentos contemporary art bromer 123750 Ty wieviel www520 Year Yew Yeart S Year You 5 Cheras om Year Y 00 postoso 0.00 000 Charge 100 3 100 De 1 5 5 Bilingham Packaging is considering expanding its production capacity by purchasing a new machine the XC 750 The cost of the XC 750 is 52.75 milion. Unfortunately, installing the mache firm has just completed a $50,000 feasibty study to analyze the decision to buy the XC-750 resulting in the following estimates - Marketing Once the XC-750 is operational next year, the extra capacity is expected to general $1000 milion per year in additional sales, which will continue for the 10 year of the mac Operations The disruption caused by the installation will decrease sales by $5.00 milion this year As with Betingham's existing products, the cost of goods for the products produced by the increased production will also require increased inventory on hand of $100 milion during the life of the project including year o Human Resources. The expansion will require additional sales and administrative personnel at a cost of $200 milion per year Accounting The XC-750 will be depreciated via the straight line method over the 10 year life of the machine. The firm expects receivables from the new sales to be 15% of revenues and Corporate tax rate is 35% a. Determine the incremental earnings from the purchase of the XC-750 b. Determine the free cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 100%, compute the NPV of the purchase d. While the expected now we will be $1000 milion per year from the expansion, estimates range from $800 milion to $1200 milion What is the NPV in the worse the best case e. What is the break oven level of now sales from the expansion? What is the breakove love for the cost of goods sold 1. Bilingham could instead Durchase the XC 900 which offers even greater City. The cost of the XC 900 54.00 million. The extra capacity would not be cutin me testovers of a. Determine the incrementalarnings from the purchase of the XC-750 Calculate the incremental coming hom the purchase of the Xc.750 below (with vs Who XC7701 Round to the corredor Incremental Effects Year 0 Sales Revenu 5 Cost of Goods Sold 5 and A Expenses Depreciation Elir Taxes 3 Emery number in the odit fields and then click Cock And Question HOP city by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.75 million. Unfortunately, instaling this machine will take several months and will partly fisrupt production. The decision to buy the XC 750 resulting in the following estimates apacity is expected to generate $1000 milion per year in additional sales, which will continue for the 10 year life of the machine se sales by SS 00 milion this year As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of the sale price. The of 5100 milion during the life of the project, including year 0 and administrative personnel at a cost of 5200 million per year method over the 10 year to of the machine. The firm expects receivables from the new sales to be 15% of revenues and peryables to be 10% of the cost of goods soll Bilingham's marga KC-750 ompute the NPV of the purchase rom the expansion estimates range from $800 million to 51200 million What is the NPV in the wont come in the best case? 7 What is the breakeven bevel for the cost of goods sold ven creator Choac The cost of the XC.000 in $4.00 million the extra coact would not be useful in the first two years of operation but would allow for additional sales invas 3 moun 10 XC 750 750 below (with vs without XC9750). (Round to the nearest della