Question

You work as a middle manager for one of the top U.S. producers of luxury and mass-market automobiles and trucks. The company from the course

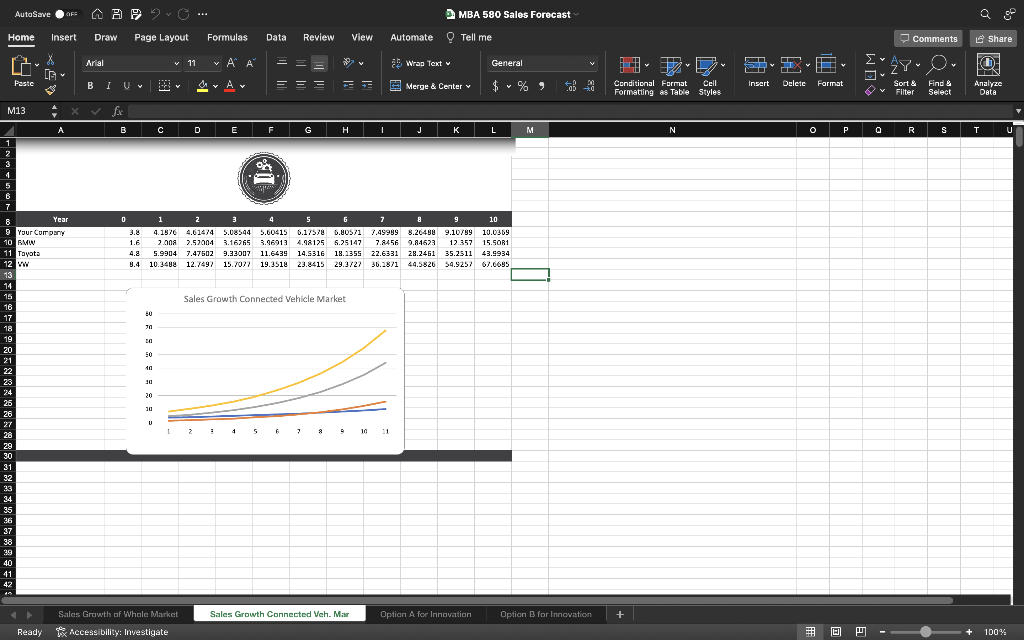

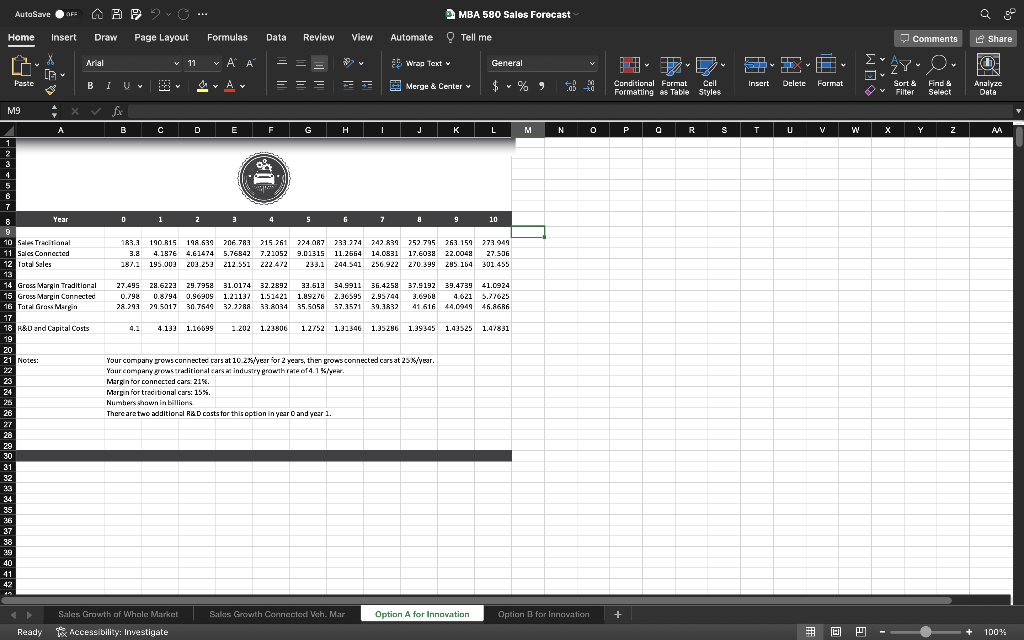

You work as a middle manager for one of the top U.S. producers of luxury and mass-market automobiles and trucks. The company from the course scenario has decided to incorporate internet of things (IoT) technology in its vehicles (also called connected cars). Often organizations have to choose from multiple innovate implementation options. The choice is usually determined by many factors including the financial viability each idea. In this assignment, we will compare the financial benefits for two innovation options and create data visualizations to help determine the option with greater financial benefit. This assignment will help you make recommendation for one or two options in milestone one.

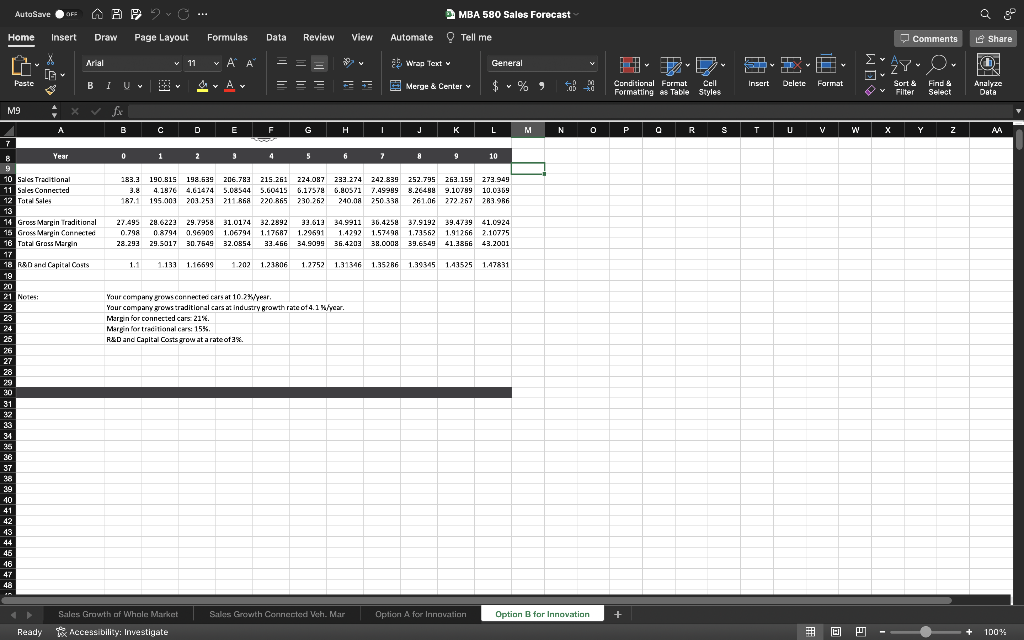

Create a series of charts in an Excel spreadsheet And a memo that compares the financial benefits of options A and B the charts in your spreadsheet should include a comparison of financial forecast for both innovation options (discontinuous and incremental). You should create the charts using the data. Make sure to add titles to all your charts so you can clearly reference them in your memo. Consider the following points:

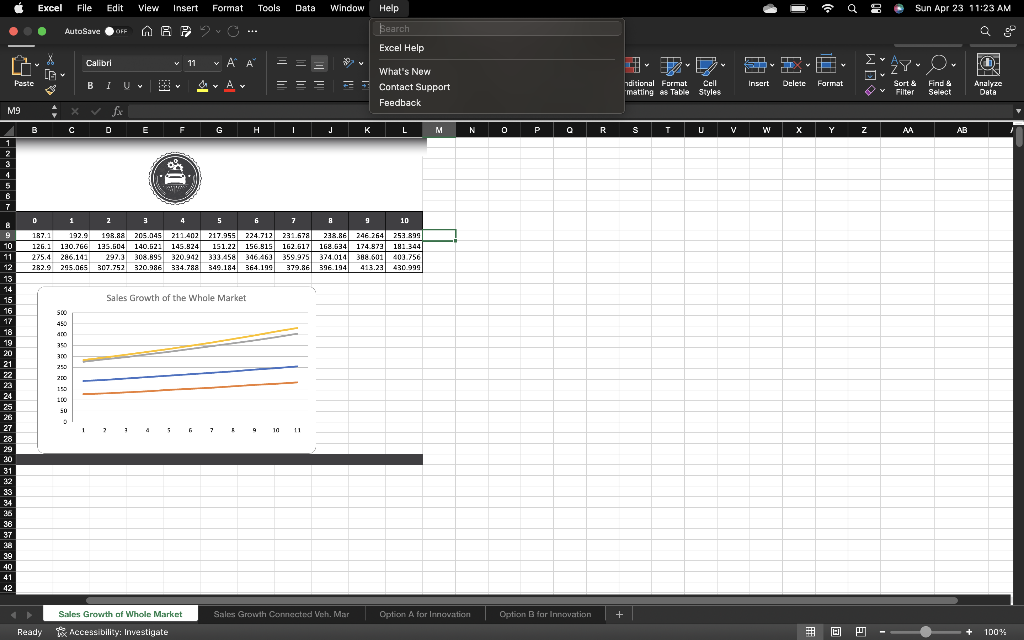

1. Create a chat for sales forecasts data. A. Graph sales forecast data for total sales for options a and B on a three dimensional stacked column chart. . Each column should show traditional seals on the bottom and connected seals on the top. . Both options may appear on the same three Dash dimensional chart, or you can make a separate chart for each option.

2. Create a chart for gross margin forecast data. A. Graph gross margin forecast data for total sales for options a and B on a three- dimensional stack column chart. . Each column should show traditional sales on the bottom and connect and sales on the top . both options may appear on the same three Dash dimensional chart, or you can make a separate chart for each option.

3. Create a chart for gross margin less R&D and capital cars calculations. A. Calculate gross margin less R&D and capital cost for options A&B. B. Graph total gross margin less R and D and caboodle cars forecast to compare options A and B on a line chart. . Both options should appear on the same chart.

4. Explain any conclusions you can draw with your data visualizations. A. Review the charts and discuss any conclusions you can make from those data visualizations. B. Explain whether option a or option B will provide your company the most financial benefit.

You should reference your data visualizations to justify your explanation and conclusions. Submit an Excel document with all your charts. Submit a one page word document. If you include references, they should be cited.

Submit an Excel document with all your charts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started