Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work for a small investment management firm. You have been provided with the following historical information for three stocks and the market index. The

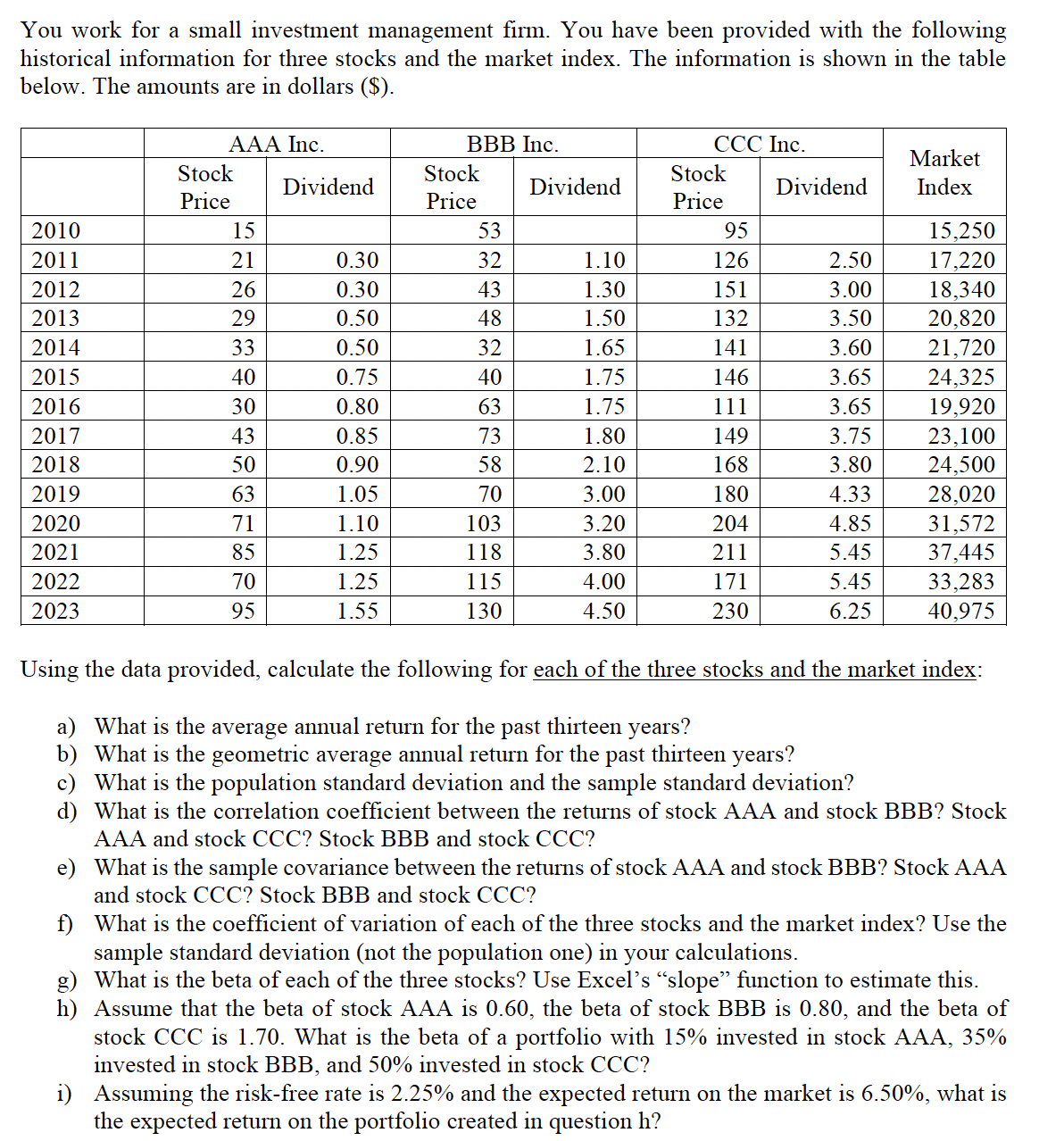

You work for a small investment management firm. You have been provided with the following

historical information for three stocks and the market index. The information is shown in the table

below. The amounts are in dollars $

Using the data provided, calculate the following for each of the three stocks and the market index:

a What is the average annual return for the past thirteen years?

b What is the geometric average annual return for the past thirteen years?

c What is the population standard deviation and the sample standard deviation?

d What is the correlation coefficient between the returns of stock AAA and stock BBB Stock

AAA and stock CCC Stock BBB and stock CCC

e What is the sample covariance between the returns of stock AAA and stock BBB Stock AAA

and stock CCC Stock BBB and stock CCC

f What is the coefficient of variation of each of the three stocks and the market index? Use the

sample standard deviation not the population one in your calculations.

g What is the beta of each of the three stocks? Use Excel's "slope" function to estimate this.

h Assume that the beta of stock AAA is the beta of stock BBB is and the beta of

stock CCC is What is the beta of a portfolio with invested in stock AAA,

invested in stock BBB and invested in stock CCC

i Assuming the riskfree rate is and the expected return on the market is what is

the expected return on the portfolio created in question

Please advise on how to solve this using Excel and please show the formulas. Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started