Answered step by step

Verified Expert Solution

Question

1 Approved Answer

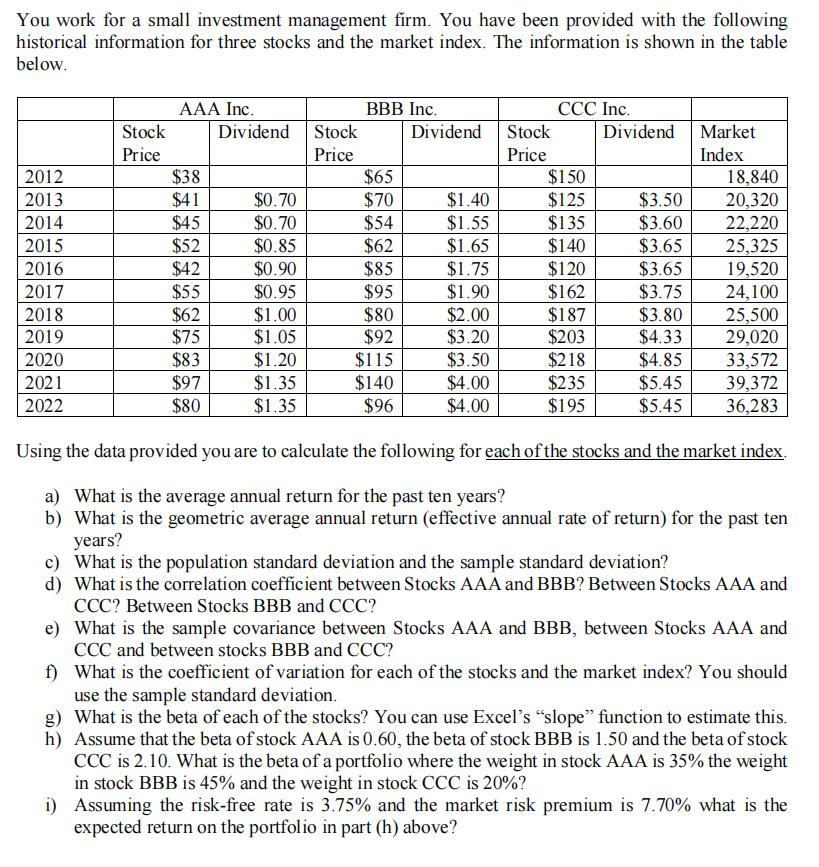

You work for a small investment management firm. You have been provided with the following historical information for three stocks and the market index.

You work for a small investment management firm. You have been provided with the following historical information for three stocks and the market index. The information is shown in the table below. 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Stock Price AAA Inc. $38 $41 $45 $52 $42 $55 $62 $75 $83 $97 $80 Dividend $0.70 $0.70 $0.85 $0.90 $0.95 $1.00 $1.05 Stock Price $1.20 $1.35 $1.35 BBB Inc. $65 $70 $54 $62 Dividend $85 $95 $80 $92 $115] $140 $96 Stock Price CCC Inc. $1.40 $1.55 $1.65 $1.75 $1.90 $2.00 $3.20 $3.50 $4.00 $4.00 Using the data provided you are to calculate the following for each of the stocks and the market index. a) What is the average annual return for the past ten years? b) What is the geometric average annual return (effective annual rate of return) for the past ten years? c) What is the population standard deviation and the sample standard deviation? d) What is the correlation coefficient between Stocks AAA and BBB? Between Stocks AAA and CCC? Between Stocks BBB and CCC? e) What is the sample covariance between Stocks AAA and BBB, between Stocks AAA and CCC and between stocks BBB and CCC? f) What is the coefficient of variation for each of the stocks and the market index? You should use the sample standard deviation. g) What is the beta of each of the stocks? You can use Excel's "slope" function to estimate this. h) Assume that the beta of stock AAA is 0.60, the beta of stock BBB is 1.50 and the beta of stock CCC is 2.10. What is the beta of a portfolio where the weight in stock AAA is 35% the weight in stock BBB is 45% and the weight in stock CCC is 20%? i) Assuming the risk-free rate is 3.75% and the market risk premium is 7.70% what is the expected return on the portfolio in part (h) above? $150 $125 $135 $140 $120 $162 Dividend $187 $203 $218 $235 $195 $3.50 $3.60 $3.65 $3.65 $3.75 Market Index $3.80 $4.33 $4.85 $5.45 $5.45 18,840 20,320 22,220 25,325 19,520 24,100 25,500 29,020 33,572 39,372 36,283

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help with that This will be a multistep process to address each of the individual questions Lets take them one by one a To calculate the average annual return for each of the stocks and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started