Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work for Frederick and Sons Company (FSC) as the VP Finance. FSC's CEO (your boss), I.M. Confewzed, is currently sitting in your office

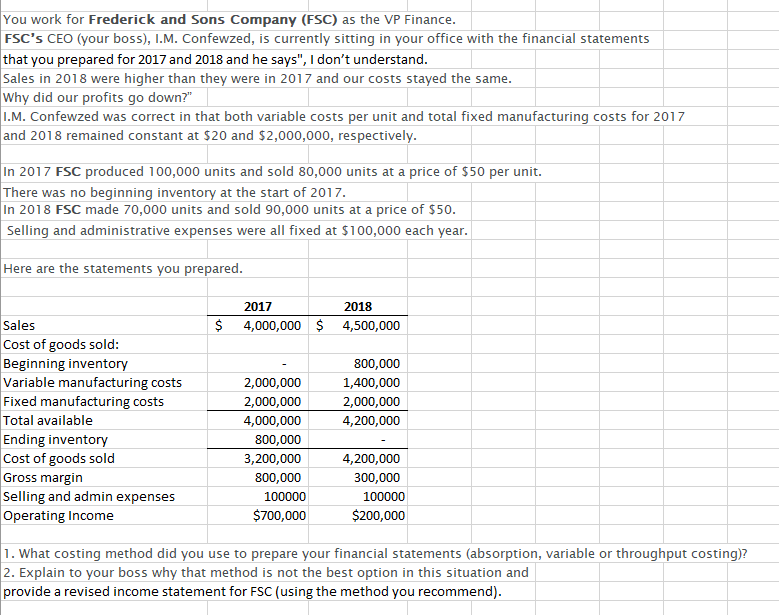

You work for Frederick and Sons Company (FSC) as the VP Finance. FSC's CEO (your boss), I.M. Confewzed, is currently sitting in your office with the financial statements that you prepared for 2017 and 2018 and he says", I don't understand. Sales in 2018 were higher than they were in 2017 and our costs stayed the same. Why did our profits go down?" I.M. Confewzed was correct in that both variable costs per unit and total fixed manufacturing costs for 2017 and 2018 remained constant at $20 and $2,000,000, respectively. In 2017 FSC produced 100,000 units and sold 80,000 units at a price of $50 per unit. There was no beginning inventory at the start of 2017. In 2018 FSC made 70,000 units and sold 90,000 units at a price of $50. Selling and administrative expenses were all fixed at $100,000 each year. Here are the statements you prepared. 2017 2018 Sales $ 4,000,000 $ 4,500,000 Cost of goods sold: Beginning inventory 800,000 Variable manufacturing costs 2,000,000 1,400,000 Fixed manufacturing costs 2,000,000 2,000,000 Total available 4,000,000 4,200,000 Ending inventory 800,000 Cost of goods sold 3,200,000 4,200,000 Gross margin Selling and admin expenses Operating Income 800,000 100000 $700,000 300,000 100000 $200,000 1. What costing method did you use to prepare your financial statements (absorption, variable or throughput costing)? 2. Explain to your boss why that method is not the best option in this situation and provide a revised income statement for FSC (using the method you recommend).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started