Question

You work on the new product development team for your company's new tablet computer offering, a smaller version of your wildly popular eTablet line. You

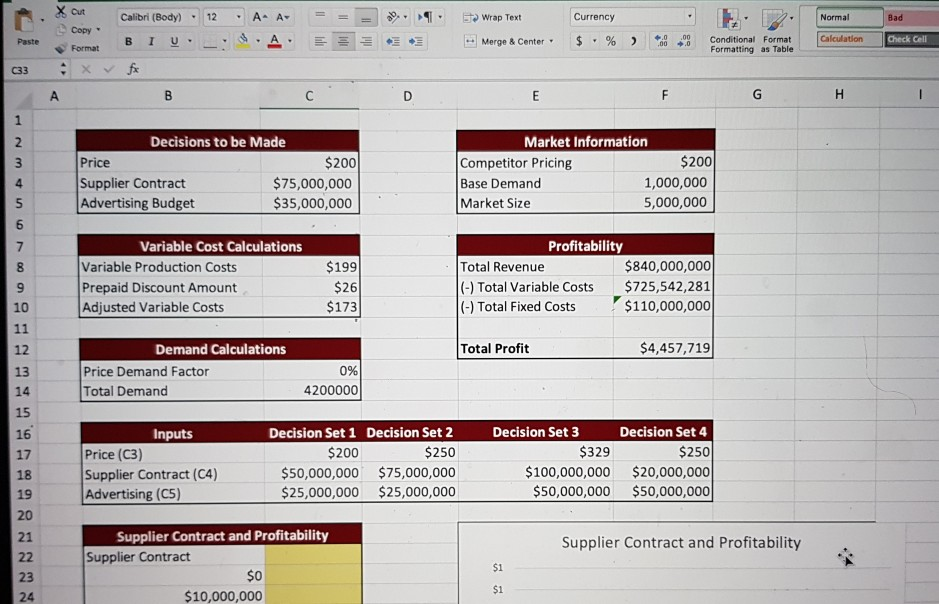

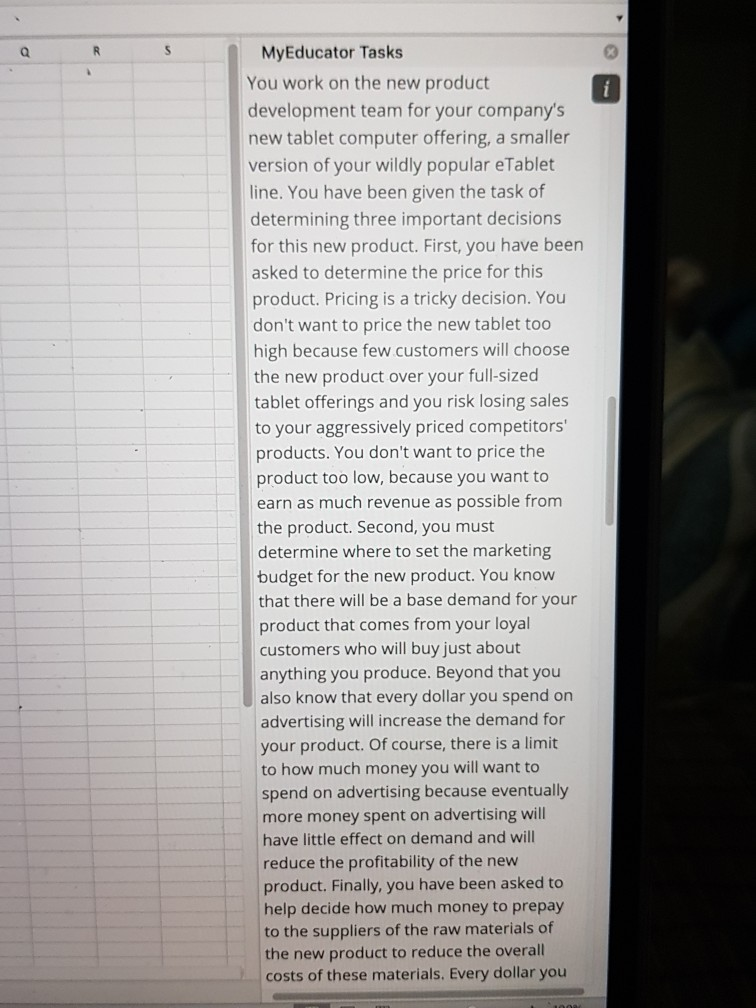

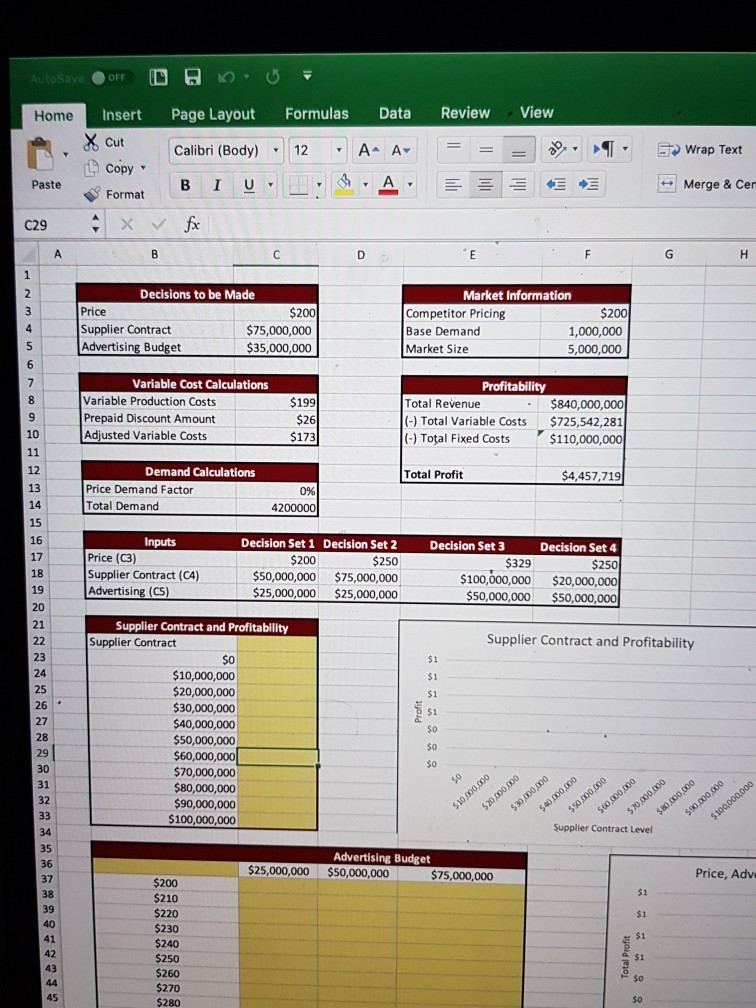

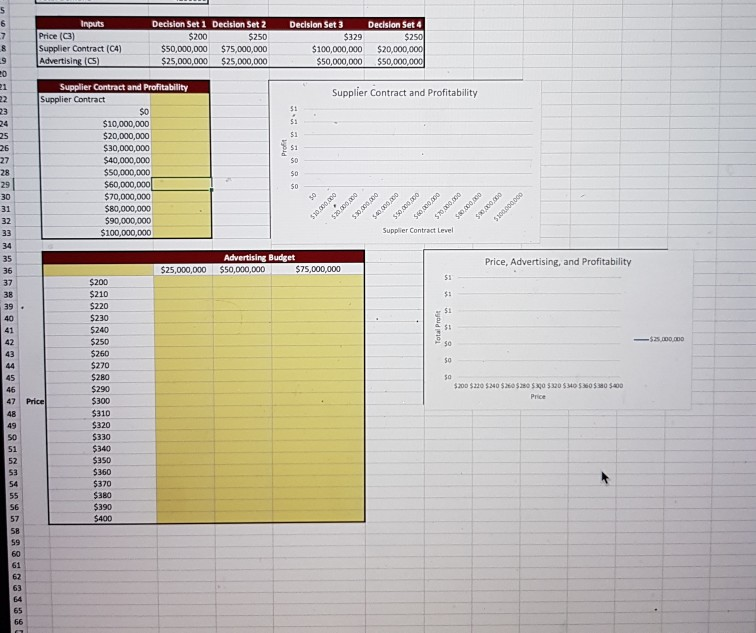

You work on the new product development team for your company's new tablet computer offering, a smaller version of your wildly popular eTablet line. You have been given the task of determining three important decisions for this new product. First, you have been asked to determine the price for this product. Pricing is a tricky decision. You don't want to price the new tablet too high because few customers will choose the new product over your full-sized tablet offerings and you risk losing sales to your aggressively priced competitors' products. You don't want to price the product too low, because you want to earn as much revenue as possible from the product. Second, you must determine where to set the marketing budget for the new product. You know that there will be a base demand for your product that comes from your loyal customers who will buy just about anything you produce. Beyond that you also know that every dollar you spend on advertising will increase the demand for your product. Of course, there is a limit to how much money you will want to spend on advertising because eventually more money spent on advertising will have little effect on demand and will reduce the profitability of the new product. Finally, you have been asked to help decide how much money to prepay to the suppliers of the raw materials of the new product to reduce the overall costs of these materials. Every dollar you spend on prepaying your suppliers will reduce the costs of these materials and will ensure that your competitors don't have access to these materials. You have completed a spreadsheet model to aid in your analysis. Use the 'What If Analysis' options in Excel to help you determine the right price, advertising spending, and prepaid supplier contract for your new product.

please solve and show the formulas and the steps

That's everything what else do you need

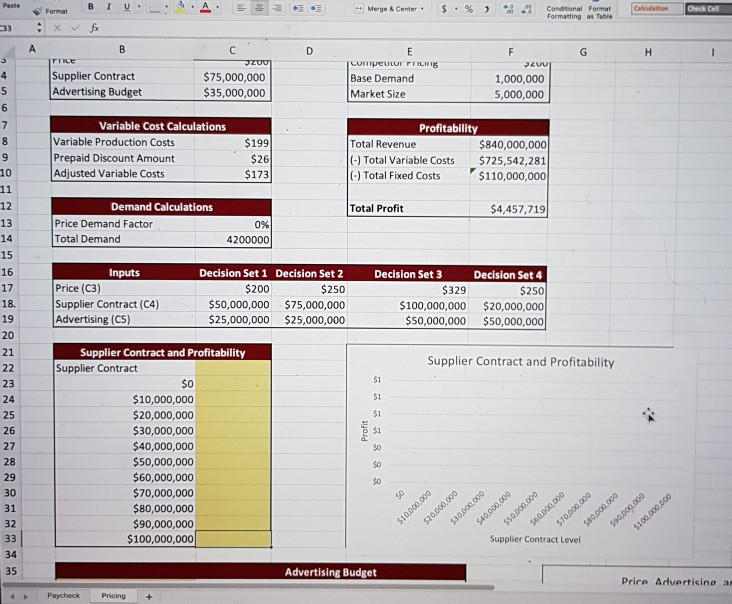

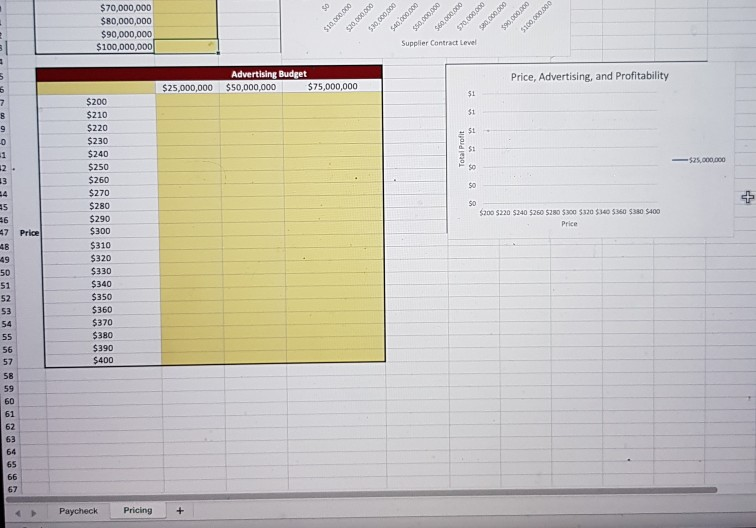

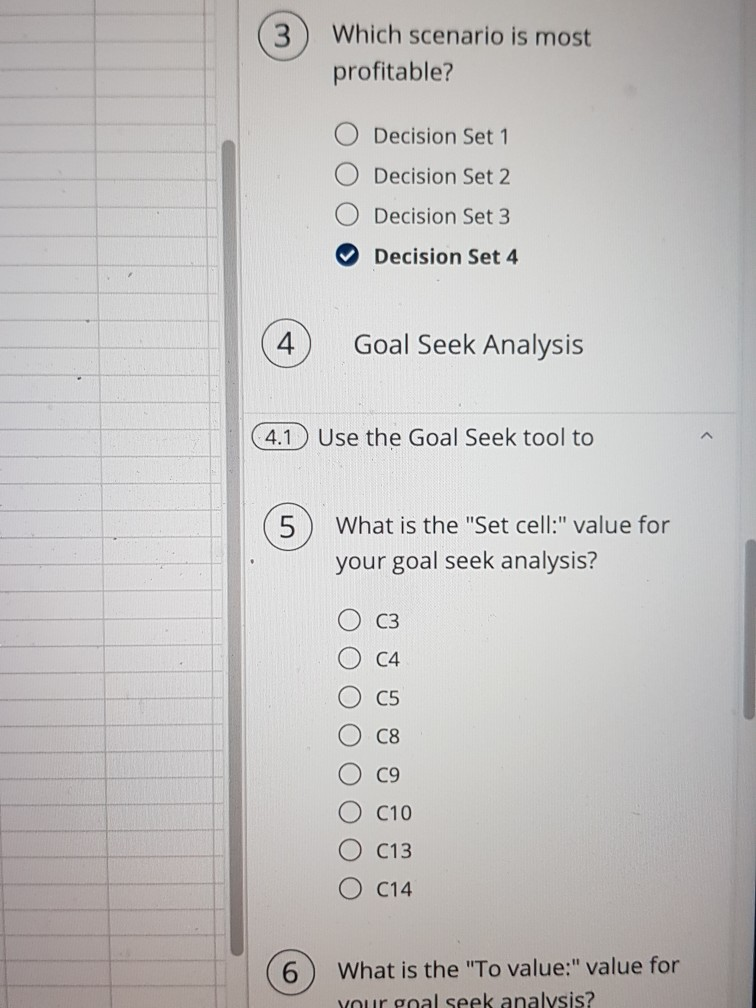

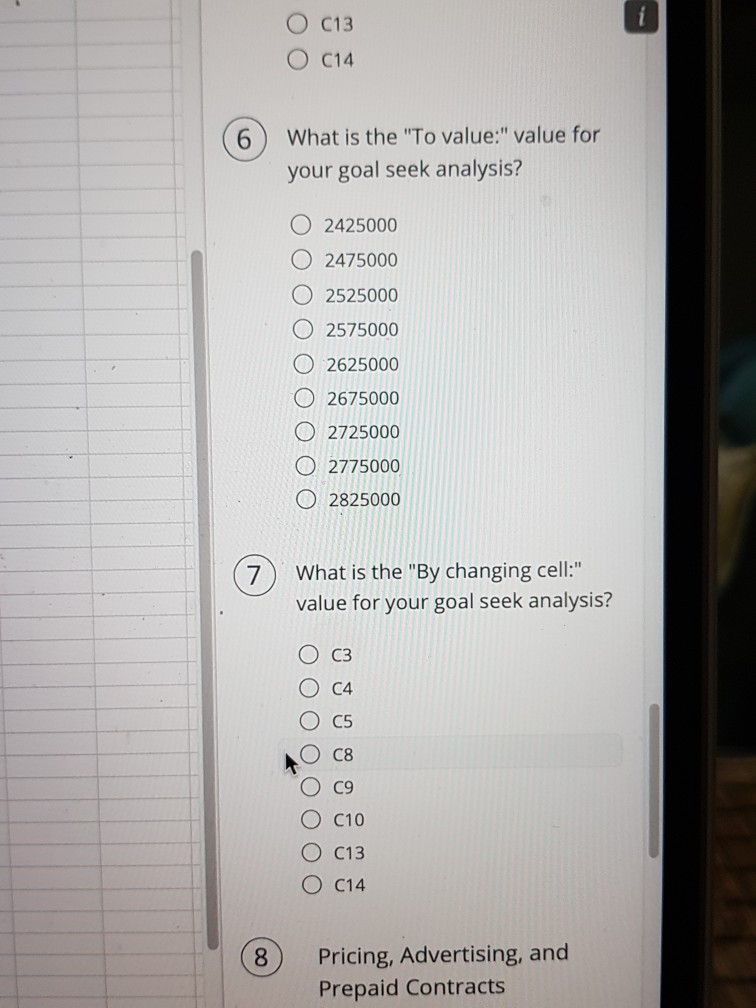

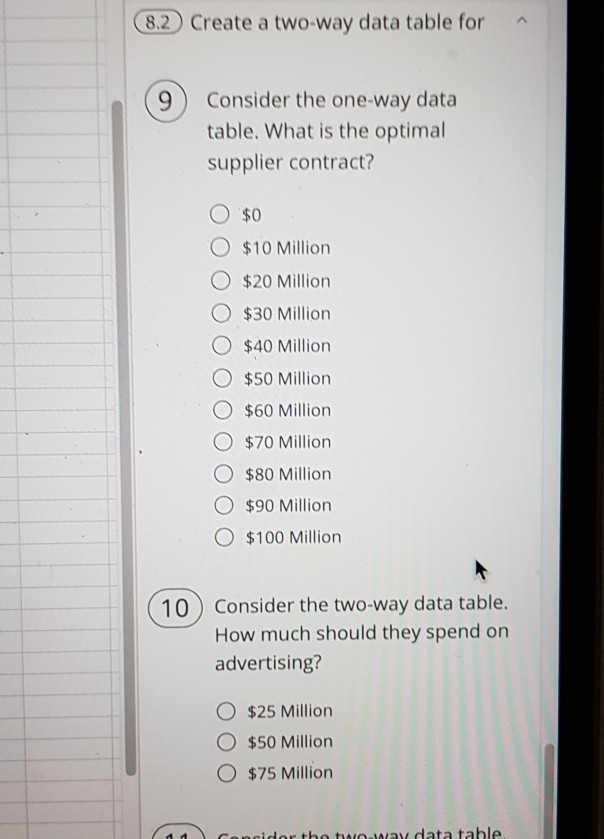

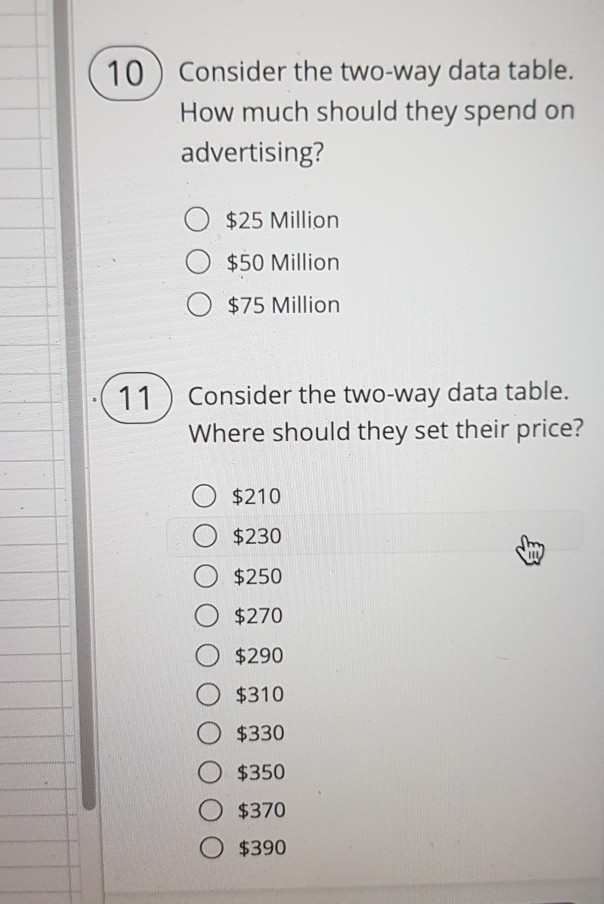

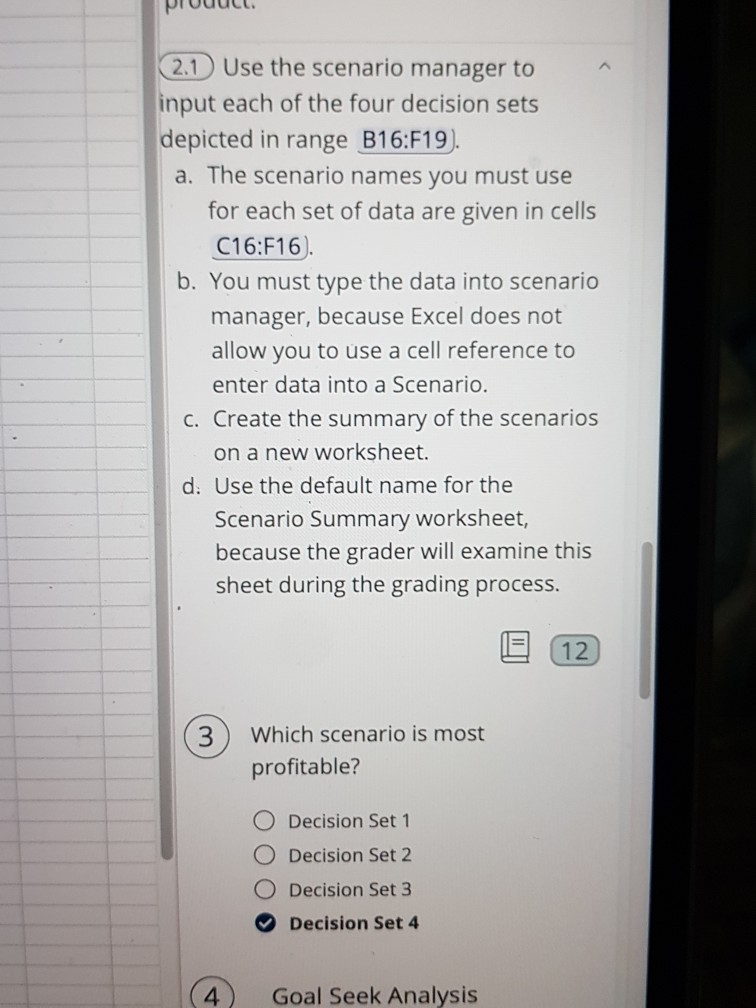

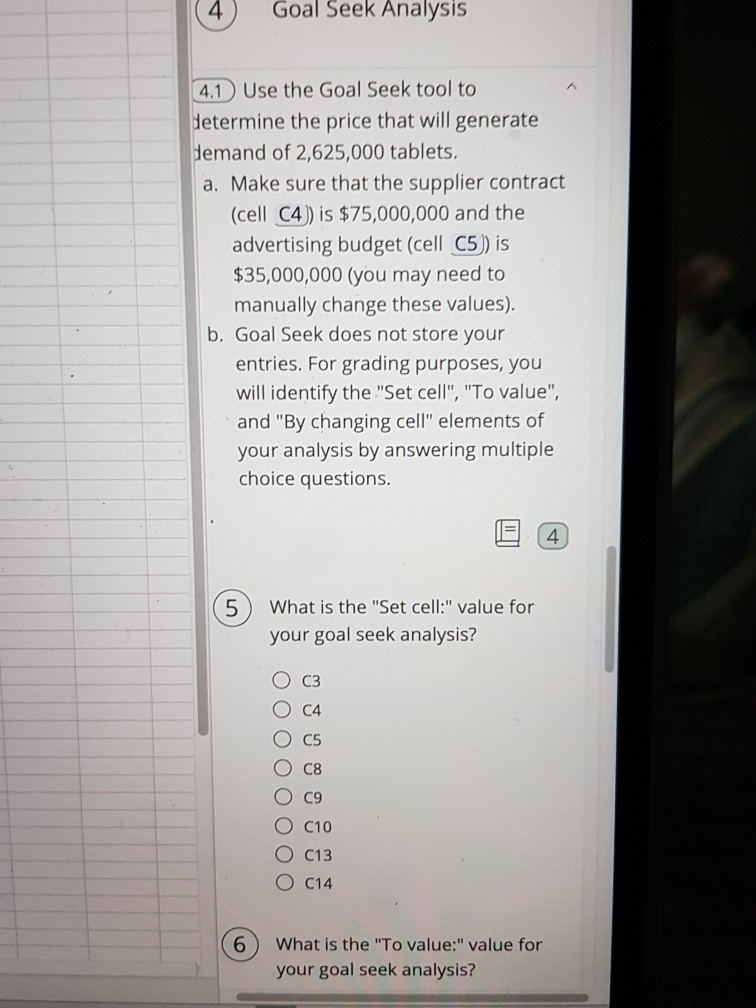

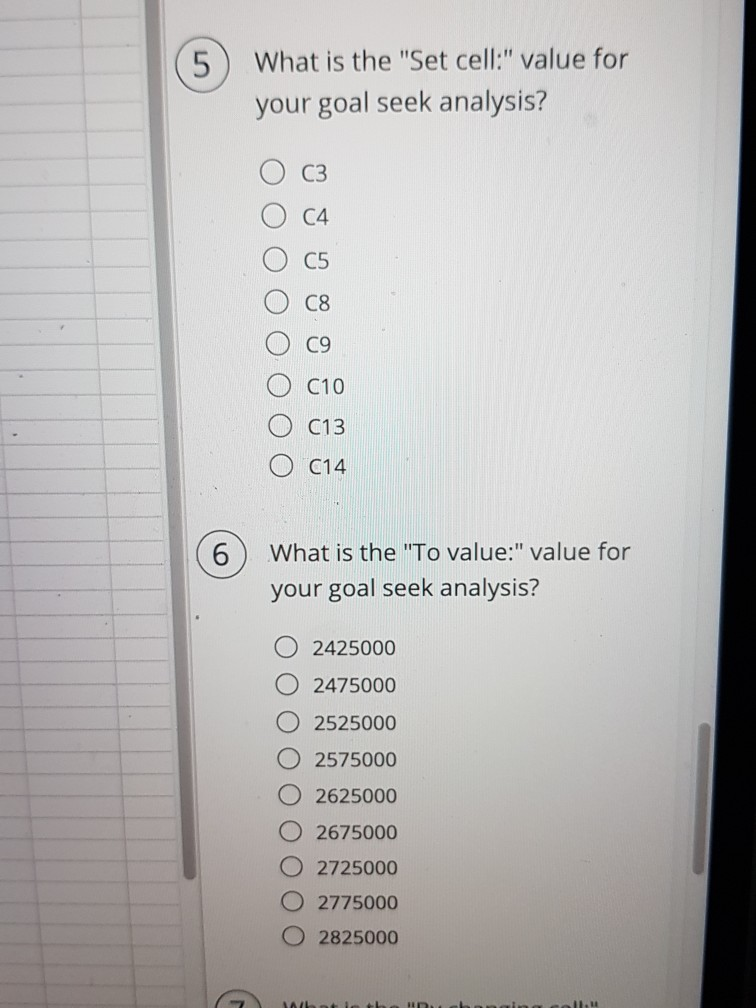

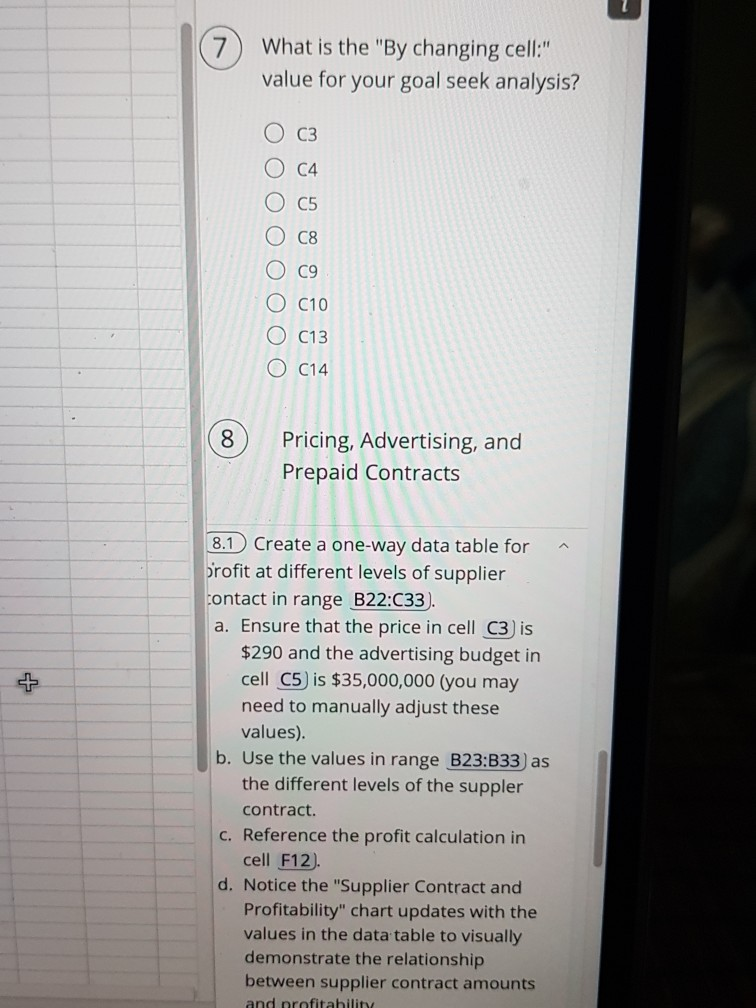

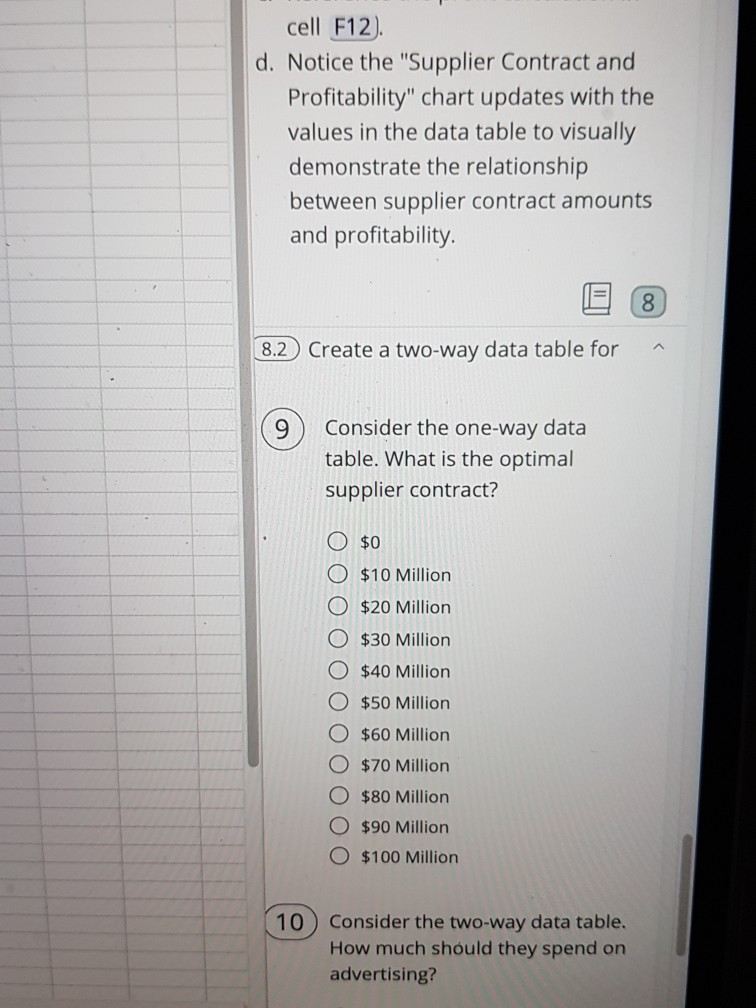

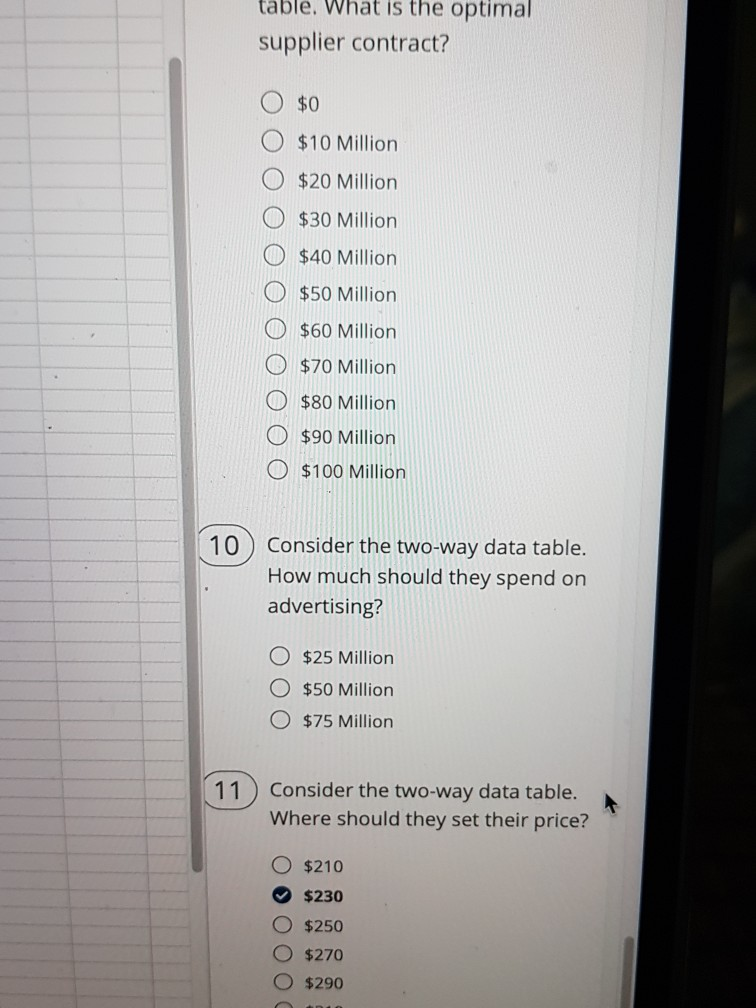

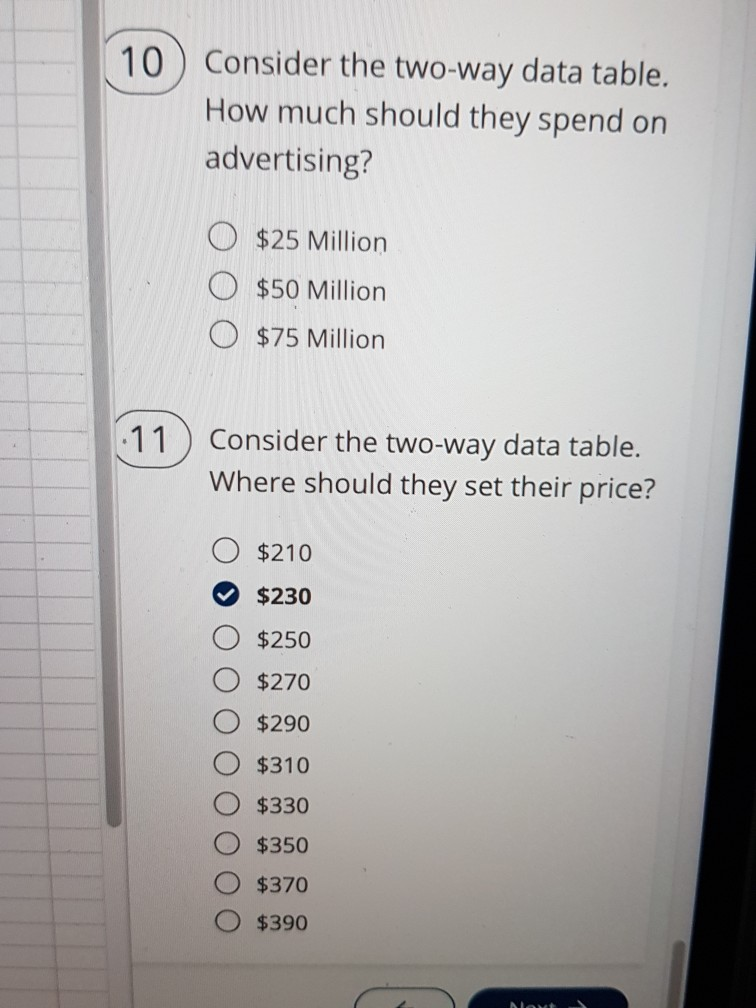

Calibri (Body) 12 AA- Wrap Text Currency Normal Bad Xan Copy Format Paste B I U- A Merge & Center - $ % ) 4.0 .00 .00 .0 Calculation Check Cell Conditional Format Formatting as Table 033 B F G H N- 2 3 Decisions to be Made Price $200 Supplier Contract $75,000,000 Advertising Budget $35,000,000 Market Information Competitor Pricing $200 Base Demand 1,000,000 Market Size 5,000,000 4 5 7 8 9 Variable Cost Calculations Variable Production Costs Prepaid Discount Amount Adjusted Variable Costs $199 $26 $173 Profitability Total Revenue $840,000,000 (-) Total Variable Costs $725,542,281 (-) Total Fixed Costs $110,000,000 10 11 12 Total Profit $4,457,719 13 Demand Calculations Price Demand Factor Total Demand 0% 4200000 14 15 16 17 Inputs Price (C3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 $329 $100,000,000 $50,000,000 Decision Set 4 $250 $20,000,000 $50,000,000 18 19 2 Supplier Contract and Profitability 20 21 22 23 24 Supplier Contract and Profitability Supplier Contract $0 $10,000,000 $1 $1 Paste BI U- Format Merge & Center $ . % ) Conditional Format Formatting as Table Calculation Checker B D - FILE PZU 4 Supplier Contract Advertising Budget $75,000,000 $35,000,000 E Base Demand Market Size F DEUUT 1,000,000 5,000,000 5 6 7 8 9 10 Variable Cost Calculations Variable Production Costs Prepaid Discount Amount Adjusted Variable Costs $199 $26 $173 Profitability Total Revenue $840,000,000 (-) Total Variable Costs $725,542,281 - Total Fixed Costs $110,000,000 11 Total Profit $4,457,719 Demand Calculations Price Demand Factor Total Demand 0% 4200000 Inputs Price (C3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 Decision Set 4 $329 $250 $100,000,000 $20,000,000 $50,000,000 $50,000,000 Supplier Contract and Profitability $1 12 13 14 15 16 17 18. 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 $1 Profit $1 $1 Supplier Contract and Profitability Supplier Contract SO $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 $70,000,000 $80,000,000 $90,000,000 $100,000,000 $0 $0 $0 50 $20.000.000 $40.000.000 $70,000.000 $10,000,000 $30,000,000 $80.000.000 Supplier Contract Level $50.000.000 560,000,000 590.000.000 $100,000,000 Advertising Budget Price Advertising a Paycheck Pricing os $70,000,000 $80,000,000 $90,000,000 $100,000,000 000000 OES $40.000.000 550.000.000 00000005 0.000.000 DOCT000065 000000 Oors $10.000.000 Supplier Contract Level 5 Advertising Budget $25,000,000 $50,000,000 $75,000,000 Price, Advertising, and Profitability $1 Si $1 7 8 9 0 -1 12 13 Total Profit -$25,000,000 $0 $0 + SO $200 5220 5240 5260 5200 5300 5320 $340 5360 $380 $400 Price 45 26 47 Price 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 Paycheck Pricing + 3 Which scenario is most profitable? Decision Set 1 Decision Set 2 Decision Set 3 Decision Set 4 4 Goal Seek Analysis 4.1 Use the Goal Seek tool to 5 What is the "Set cell:" value for your goal seek analysis? C4 C5 C8 C9 O O O O O O C10 C13 C14 6 What is the "To value:" value for your goal seek analysis? C13 O c14 6 What is the "To value:" value for your goal seek analysis? 2425000 O 2475000 O 2525000 O 2575000 O 2625000 O 2675000 O 2725000 O 2775000 O 2825000 7 What is the "By changing cell." value for your goal seek analysis? O C3 O C4 8 C5 C8 C9 OOOOO C10 C13 O C14 8 Pricing, Advertising, and Prepaid Contracts A 8.2 Create a two-way data table for 9 Consider the one-way data table. What is the optimal supplier contract? O $0 $10 Million O $20 Million O $30 Million $40 Million $50 Million $60 Million $70 Million $80 Million $90 Million $100 Million 10 ) Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million $75 Million Consider the tax data table. 10) Consider the two-way data table. How much should they spend on advertising? $25 Million O $50 Million $75 Million 11 Consider the two-way data table. Where should they set their price? $210 $230 $250 $270 $290 $310 O $330 $350 $370 O $390 Q R 5 MyEducator Tasks You work on the new product development team for your company's new tablet computer offering, a smaller version of your wildly popular e Tablet line. You have been given the task of determining three important decisions for this new product. First, you have been asked to determine the price for this product. Pricing is a tricky decision. You don't want to price the new tablet too high because few.customers will choose the new product over your full-sized tablet offerings and you risk losing sales to your aggressively priced competitors' products. You don't want to price the product too low, because you want to earn as much revenue as possible from the product. Second, you must determine where to set the marketing budget for the new product. You know that there will be a base demand for your product that comes from your loyal customers who will buy just about anything you produce. Beyond that you also know that every dollar you spend on advertising will increase the demand for your product. Of course, there is a limit to how much money you will want to spend on advertising because eventually more money spent on advertising will have little effect on demand and will reduce the profitability of the new product. Finally, you have been asked to help decide how much money to prepay to the suppliers of the raw materials of the new product to reduce the overall costs of these materials. Every dollar you 2.1 Use the scenario manager to input each of the four decision sets depicted in range B16:F19). a. The scenario names you must use for each set of data are given in cells C16:F16. b. You must type the data into scenario manager, because Excel does not allow you to use a cell reference to enter data into a Scenario. C. Create the summary of the scenarios on a new worksheet. d. Use the default name for the Scenario Summary worksheet, because the grader will examine this sheet during the grading process. 12 3 Which scenario is most profitable? Decision Set 1 O Decision Set 2 Decision Set 3 Decision Set 4 4 Goal Seek Analysis 4 Goal Seek Analysis 4.1 Use the Goal Seek tool to determine the price that will generate demand of 2,625,000 tablets. a. Make sure that the supplier contract (cell C4)) is $75,000,000 and the advertising budget (cell C5) is $35,000,000 (you may need to manually change these values). b. Goal Seek does not store your entries. For grading purposes, you will identify the "Set cell", "To value", and "By changing cell" elements of your analysis by answering multiple choice questions. 4 5 What is the "Set cell:" value for your goal seek analysis? C3 C4 C5 C8 O O O O O OOO C9 O C10 O C13 O C14 6 What is the "To value:" value for your goal seek analysis? 5 What is the "Set cell:" value for your goal seek analysis? C3 C4 C5 C8 C9 C10 C13 - C14 6 What is the "To value:" value for your goal seek analysis? 2425000 2475000 2525000 2575000 2625000 2675000 2725000 O 2775000 2825000 TAL ll 7 What is the "By changing cell:" value for your goal seek analysis? C3 C4 C5 O C8 O O O O O O O O O C9 O C10 C13 O C14 8 Pricing, Advertising, and Prepaid Contracts 8.1 Create a one-way data table for profit at different levels of supplier contact in range B22:C33. a. Ensure that the price in cell C3 is $290 and the advertising budget in cell C5 is $35,000,000 (you may need to manually adjust these values). b. Use the values in range B23:B33 as the different levels of the suppler contract. c. Reference the profit calculation in cell F12) d. Notice the "Supplier Contract and Profitability" chart updates with the values in the data table to visually demonstrate the relationship between supplier contract amounts and profitability cell F12). d. Notice the "Supplier Contract and Profitability" chart updates with the values in the data table to visually demonstrate the relationship between supplier contract amounts and profitability 8 A 8.2 Create a two-way data table for 9 Consider the one-way data table. What is the optimal supplier contract? O $0 O $10 Million $20 Million $30 Million $40 Million $50 Million $60 Million $70 Million OO O $80 Million O $90 Million O $100 Million 10 Consider the two-way data table. How much should they spend on advertising? table. What is the optimal supplier contract? $0 $10 Million $20 Million $30 Million O $40 Million $50 Million $60 Million O $70 Million O O O O O $80 Million O $90 Million $100 Million 10 Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million O $75 Million 11 Consider the two-way data table. Where should they set their price? $210 $230 $250 OOO $270 O $290 10 ) Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million $75 Million .11 Consider the two-way data table. Where should they set their price? $210 $230 $250 $270 $290 $310 $330 $350 $370 $390 NO $40,000,000 AutoSave OFF Home Insert Page Layout Formulas Data Review View Cut Calibri (Body) 12 A- A+ Wrap Text Copy Paste B U 3 A , Merge & Cer Format 029 Ax & fx A B D "E F G H 1 2 Decisions to be Made Market Information 3 Price $200 Competitor Pricing $200 4 Supplier Contract $75,000,000 Base Demand 1,000,000 5 Advertising Budget $35,000,000 Market Size 5,000,000 6 7 Variable Cost Calculations Profitability 8 Variable Production Costs $199 Total Revenue $840,000,000 9 Prepaid Discount Amount $26 (-) Total Variable costs $725,542,281 10 Adjusted Variable Costs $173 (-) Total Fixed Costs $110,000,000 11 12 Demand Calculations Total Profit $4,457,719 13 Price Demand Factor 0% 14 Total Demand 4200000 15 16 Inputs Decision Set 1 Decision Set 2 Decision Set 3 Decision Set 4 17 Price (C3) $200 $250 $329 $250 18 Supplier Contract (C4) $50,000,000 $75,000,000 $100,000,000 $20,000,000 19 Advertising (C5) $25,000,000 $25,000,000 $50,000,000 $50,000,000 20 21 Supplier Contract and Profitability 22 Supplier Contract Supplier Contract and Profitability 23 $0 $1 24 $10,000,000 $1 25 $20,000,000 $1 26 $30,000,000 $1 27 $0 28 $50,000,000 $0 29 $60,000,000 $o 30 $70,000,000 31 $80,000,000 32 $90,000,000 33 $100,000,000 34 Supplier Contract Level 35 Advertising Budget $25,000,000 $50,000,000 37 $75,000,000 Price, Adve $200 38 $1 $210 39 $220 $1 40 $230 $1 41 $240 42 $250 $1 43 $260 44 $270 45 $280 $0 . $40,000,000 $50,000,000 50 $10,000,000 $20,000,000 $30,000,000 $100,000,000 560,000,000 $70,000,000 $80,000,000 $90,000,000 36 Total Profit $0 un 6 7 8 Inputs Price (3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 $329 $100,000,000 $50,000,000 Decision Set 4 $250 $20,000,000 $50,000,000 Supplier Contract and Profitability $1 si $1 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Profit Supplier Contract and Profitability Supplier Contract $0 $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 $70,000,000 $80,000,000 $90,000,000 $100,000,000 51 $0 $0 SO 50 So 550.000 DO OSOS 095 00000OOOTS $10.000.000 5.30.000.000 Supplier Contract Level 34 Advertising Budget $50,000,000 $75,000,000 Price, Advertising, and Profitability $25,000,000 51 35 36 37 38 39 - 40 $1 SI Total Profit 51 42 525.000.000 $0 50 45 46 50 $200 $220 5240 $250 $200 $300 5320 5340 5360 $340 $400 Price 47 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 Price 48 49 so 51 52 53 54 55 S6 57 2 58 59 60 61 62 63 64 65 66 Calibri (Body) 12 AA- Wrap Text Currency Normal Bad Xan Copy Format Paste B I U- A Merge & Center - $ % ) 4.0 .00 .00 .0 Calculation Check Cell Conditional Format Formatting as Table 033 B F G H N- 2 3 Decisions to be Made Price $200 Supplier Contract $75,000,000 Advertising Budget $35,000,000 Market Information Competitor Pricing $200 Base Demand 1,000,000 Market Size 5,000,000 4 5 7 8 9 Variable Cost Calculations Variable Production Costs Prepaid Discount Amount Adjusted Variable Costs $199 $26 $173 Profitability Total Revenue $840,000,000 (-) Total Variable Costs $725,542,281 (-) Total Fixed Costs $110,000,000 10 11 12 Total Profit $4,457,719 13 Demand Calculations Price Demand Factor Total Demand 0% 4200000 14 15 16 17 Inputs Price (C3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 $329 $100,000,000 $50,000,000 Decision Set 4 $250 $20,000,000 $50,000,000 18 19 2 Supplier Contract and Profitability 20 21 22 23 24 Supplier Contract and Profitability Supplier Contract $0 $10,000,000 $1 $1 Paste BI U- Format Merge & Center $ . % ) Conditional Format Formatting as Table Calculation Checker B D - FILE PZU 4 Supplier Contract Advertising Budget $75,000,000 $35,000,000 E Base Demand Market Size F DEUUT 1,000,000 5,000,000 5 6 7 8 9 10 Variable Cost Calculations Variable Production Costs Prepaid Discount Amount Adjusted Variable Costs $199 $26 $173 Profitability Total Revenue $840,000,000 (-) Total Variable Costs $725,542,281 - Total Fixed Costs $110,000,000 11 Total Profit $4,457,719 Demand Calculations Price Demand Factor Total Demand 0% 4200000 Inputs Price (C3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 Decision Set 4 $329 $250 $100,000,000 $20,000,000 $50,000,000 $50,000,000 Supplier Contract and Profitability $1 12 13 14 15 16 17 18. 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 $1 Profit $1 $1 Supplier Contract and Profitability Supplier Contract SO $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 $70,000,000 $80,000,000 $90,000,000 $100,000,000 $0 $0 $0 50 $20.000.000 $40.000.000 $70,000.000 $10,000,000 $30,000,000 $80.000.000 Supplier Contract Level $50.000.000 560,000,000 590.000.000 $100,000,000 Advertising Budget Price Advertising a Paycheck Pricing os $70,000,000 $80,000,000 $90,000,000 $100,000,000 000000 OES $40.000.000 550.000.000 00000005 0.000.000 DOCT000065 000000 Oors $10.000.000 Supplier Contract Level 5 Advertising Budget $25,000,000 $50,000,000 $75,000,000 Price, Advertising, and Profitability $1 Si $1 7 8 9 0 -1 12 13 Total Profit -$25,000,000 $0 $0 + SO $200 5220 5240 5260 5200 5300 5320 $340 5360 $380 $400 Price 45 26 47 Price 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 Paycheck Pricing + 3 Which scenario is most profitable? Decision Set 1 Decision Set 2 Decision Set 3 Decision Set 4 4 Goal Seek Analysis 4.1 Use the Goal Seek tool to 5 What is the "Set cell:" value for your goal seek analysis? C4 C5 C8 C9 O O O O O O C10 C13 C14 6 What is the "To value:" value for your goal seek analysis? C13 O c14 6 What is the "To value:" value for your goal seek analysis? 2425000 O 2475000 O 2525000 O 2575000 O 2625000 O 2675000 O 2725000 O 2775000 O 2825000 7 What is the "By changing cell." value for your goal seek analysis? O C3 O C4 8 C5 C8 C9 OOOOO C10 C13 O C14 8 Pricing, Advertising, and Prepaid Contracts A 8.2 Create a two-way data table for 9 Consider the one-way data table. What is the optimal supplier contract? O $0 $10 Million O $20 Million O $30 Million $40 Million $50 Million $60 Million $70 Million $80 Million $90 Million $100 Million 10 ) Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million $75 Million Consider the tax data table. 10) Consider the two-way data table. How much should they spend on advertising? $25 Million O $50 Million $75 Million 11 Consider the two-way data table. Where should they set their price? $210 $230 $250 $270 $290 $310 O $330 $350 $370 O $390 Q R 5 MyEducator Tasks You work on the new product development team for your company's new tablet computer offering, a smaller version of your wildly popular e Tablet line. You have been given the task of determining three important decisions for this new product. First, you have been asked to determine the price for this product. Pricing is a tricky decision. You don't want to price the new tablet too high because few.customers will choose the new product over your full-sized tablet offerings and you risk losing sales to your aggressively priced competitors' products. You don't want to price the product too low, because you want to earn as much revenue as possible from the product. Second, you must determine where to set the marketing budget for the new product. You know that there will be a base demand for your product that comes from your loyal customers who will buy just about anything you produce. Beyond that you also know that every dollar you spend on advertising will increase the demand for your product. Of course, there is a limit to how much money you will want to spend on advertising because eventually more money spent on advertising will have little effect on demand and will reduce the profitability of the new product. Finally, you have been asked to help decide how much money to prepay to the suppliers of the raw materials of the new product to reduce the overall costs of these materials. Every dollar you 2.1 Use the scenario manager to input each of the four decision sets depicted in range B16:F19). a. The scenario names you must use for each set of data are given in cells C16:F16. b. You must type the data into scenario manager, because Excel does not allow you to use a cell reference to enter data into a Scenario. C. Create the summary of the scenarios on a new worksheet. d. Use the default name for the Scenario Summary worksheet, because the grader will examine this sheet during the grading process. 12 3 Which scenario is most profitable? Decision Set 1 O Decision Set 2 Decision Set 3 Decision Set 4 4 Goal Seek Analysis 4 Goal Seek Analysis 4.1 Use the Goal Seek tool to determine the price that will generate demand of 2,625,000 tablets. a. Make sure that the supplier contract (cell C4)) is $75,000,000 and the advertising budget (cell C5) is $35,000,000 (you may need to manually change these values). b. Goal Seek does not store your entries. For grading purposes, you will identify the "Set cell", "To value", and "By changing cell" elements of your analysis by answering multiple choice questions. 4 5 What is the "Set cell:" value for your goal seek analysis? C3 C4 C5 C8 O O O O O OOO C9 O C10 O C13 O C14 6 What is the "To value:" value for your goal seek analysis? 5 What is the "Set cell:" value for your goal seek analysis? C3 C4 C5 C8 C9 C10 C13 - C14 6 What is the "To value:" value for your goal seek analysis? 2425000 2475000 2525000 2575000 2625000 2675000 2725000 O 2775000 2825000 TAL ll 7 What is the "By changing cell:" value for your goal seek analysis? C3 C4 C5 O C8 O O O O O O O O O C9 O C10 C13 O C14 8 Pricing, Advertising, and Prepaid Contracts 8.1 Create a one-way data table for profit at different levels of supplier contact in range B22:C33. a. Ensure that the price in cell C3 is $290 and the advertising budget in cell C5 is $35,000,000 (you may need to manually adjust these values). b. Use the values in range B23:B33 as the different levels of the suppler contract. c. Reference the profit calculation in cell F12) d. Notice the "Supplier Contract and Profitability" chart updates with the values in the data table to visually demonstrate the relationship between supplier contract amounts and profitability cell F12). d. Notice the "Supplier Contract and Profitability" chart updates with the values in the data table to visually demonstrate the relationship between supplier contract amounts and profitability 8 A 8.2 Create a two-way data table for 9 Consider the one-way data table. What is the optimal supplier contract? O $0 O $10 Million $20 Million $30 Million $40 Million $50 Million $60 Million $70 Million OO O $80 Million O $90 Million O $100 Million 10 Consider the two-way data table. How much should they spend on advertising? table. What is the optimal supplier contract? $0 $10 Million $20 Million $30 Million O $40 Million $50 Million $60 Million O $70 Million O O O O O $80 Million O $90 Million $100 Million 10 Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million O $75 Million 11 Consider the two-way data table. Where should they set their price? $210 $230 $250 OOO $270 O $290 10 ) Consider the two-way data table. How much should they spend on advertising? $25 Million $50 Million $75 Million .11 Consider the two-way data table. Where should they set their price? $210 $230 $250 $270 $290 $310 $330 $350 $370 $390 NO $40,000,000 AutoSave OFF Home Insert Page Layout Formulas Data Review View Cut Calibri (Body) 12 A- A+ Wrap Text Copy Paste B U 3 A , Merge & Cer Format 029 Ax & fx A B D "E F G H 1 2 Decisions to be Made Market Information 3 Price $200 Competitor Pricing $200 4 Supplier Contract $75,000,000 Base Demand 1,000,000 5 Advertising Budget $35,000,000 Market Size 5,000,000 6 7 Variable Cost Calculations Profitability 8 Variable Production Costs $199 Total Revenue $840,000,000 9 Prepaid Discount Amount $26 (-) Total Variable costs $725,542,281 10 Adjusted Variable Costs $173 (-) Total Fixed Costs $110,000,000 11 12 Demand Calculations Total Profit $4,457,719 13 Price Demand Factor 0% 14 Total Demand 4200000 15 16 Inputs Decision Set 1 Decision Set 2 Decision Set 3 Decision Set 4 17 Price (C3) $200 $250 $329 $250 18 Supplier Contract (C4) $50,000,000 $75,000,000 $100,000,000 $20,000,000 19 Advertising (C5) $25,000,000 $25,000,000 $50,000,000 $50,000,000 20 21 Supplier Contract and Profitability 22 Supplier Contract Supplier Contract and Profitability 23 $0 $1 24 $10,000,000 $1 25 $20,000,000 $1 26 $30,000,000 $1 27 $0 28 $50,000,000 $0 29 $60,000,000 $o 30 $70,000,000 31 $80,000,000 32 $90,000,000 33 $100,000,000 34 Supplier Contract Level 35 Advertising Budget $25,000,000 $50,000,000 37 $75,000,000 Price, Adve $200 38 $1 $210 39 $220 $1 40 $230 $1 41 $240 42 $250 $1 43 $260 44 $270 45 $280 $0 . $40,000,000 $50,000,000 50 $10,000,000 $20,000,000 $30,000,000 $100,000,000 560,000,000 $70,000,000 $80,000,000 $90,000,000 36 Total Profit $0 un 6 7 8 Inputs Price (3) Supplier Contract (C4) Advertising (C5) Decision Set 1 Decision Set 2 $200 $250 $50,000,000 $75,000,000 $25,000,000 $25,000,000 Decision Set 3 $329 $100,000,000 $50,000,000 Decision Set 4 $250 $20,000,000 $50,000,000 Supplier Contract and Profitability $1 si $1 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Profit Supplier Contract and Profitability Supplier Contract $0 $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 $70,000,000 $80,000,000 $90,000,000 $100,000,000 51 $0 $0 SO 50 So 550.000 DO OSOS 095 00000OOOTS $10.000.000 5.30.000.000 Supplier Contract Level 34 Advertising Budget $50,000,000 $75,000,000 Price, Advertising, and Profitability $25,000,000 51 35 36 37 38 39 - 40 $1 SI Total Profit 51 42 525.000.000 $0 50 45 46 50 $200 $220 5240 $250 $200 $300 5320 5340 5360 $340 $400 Price 47 $200 $210 $220 $230 $240 $250 $260 $270 $280 $290 $300 $310 $320 $330 $340 $350 $360 $370 $380 $390 $400 Price 48 49 so 51 52 53 54 55 S6 57 2 58 59 60 61 62 63 64 65 66Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started