Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your 18 year old friend is considering what to do with their working life until they retire at age 65 . They've sought your advice.

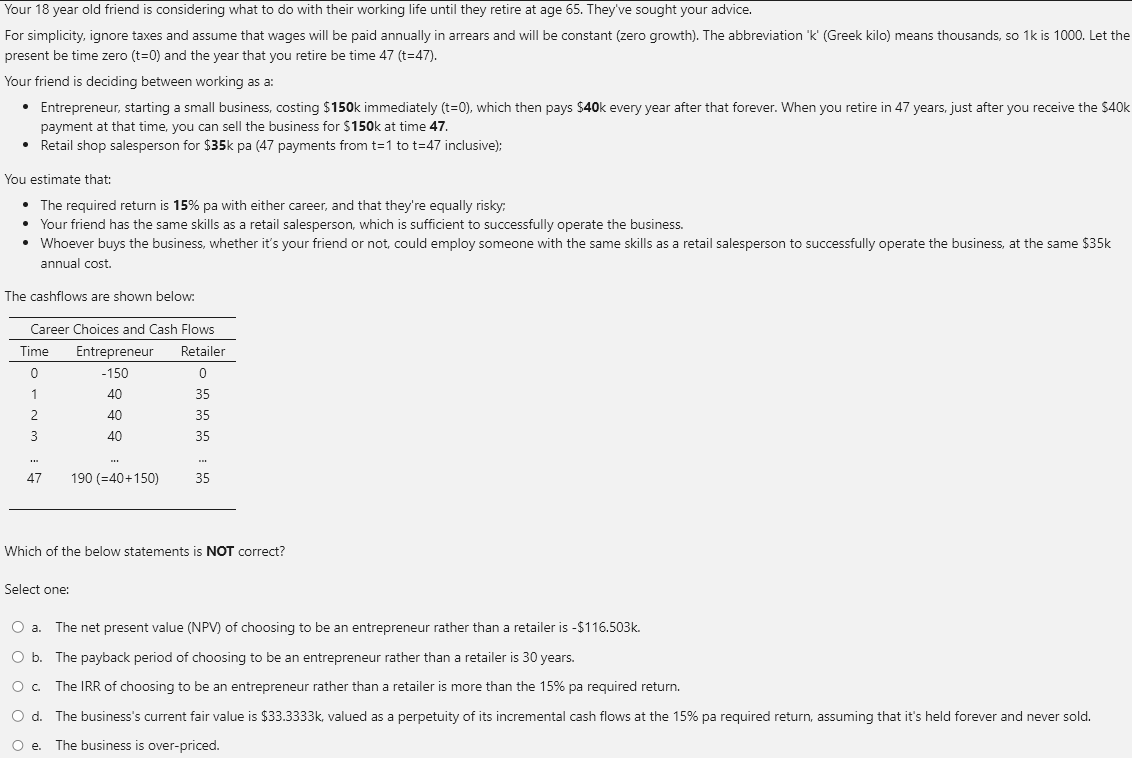

Your 18 year old friend is considering what to do with their working life until they retire at age 65 . They've sought your advice. For simplicity, ignore taxes and assume that wages will be paid annually in arrears and will be constant (zero growth). The abbreviation ' k ' (Greek kilo) means thousands, so 1k is 1000 . Let the present be time zero (t=0) and the year that you retire be time 47(t=47). Your friend is deciding between working as a: - Entrepreneur, starting a small business, costing $150k immediately (t=0), which then pays $40k every year after that forever. When you retire in 47 years, just after you receive the $40k payment at that time, you can sell the business for $150k at time 47. - Retail shop salesperson for $35k pa (47 payments from t=1 to t=47 inclusive); You estimate that: - The required return is 15% pa with either career, and that they're equally risky; - Your friend has the same skills as a retail salesperson, which is sufficient to successfully operate the business. - Whoever buys the business, whether it's your friend or not, could employ someone with the same skills as a retail salesperson to successfully operate the business, at the same $35k annual cost. The cashflows are shown below: Which of the below statements is NOT correct? Select one: a. The net present value (NPV) of choosing to be an entrepreneur rather than a retailer is $116.503k. b. The payback period of choosing to be an entrepreneur rather than a retailer is 30 years. c. The IRR of choosing to be an entrepreneur rather than a retailer is more than the 15% pa required return. d. The business's current fair value is $33.3333k, valued as a perpetuity of its incremental cash flows at the 15% pa required return, assuming that it's held forever and never sold. e. The business is over-priced

Your 18 year old friend is considering what to do with their working life until they retire at age 65 . They've sought your advice. For simplicity, ignore taxes and assume that wages will be paid annually in arrears and will be constant (zero growth). The abbreviation ' k ' (Greek kilo) means thousands, so 1k is 1000 . Let the present be time zero (t=0) and the year that you retire be time 47(t=47). Your friend is deciding between working as a: - Entrepreneur, starting a small business, costing $150k immediately (t=0), which then pays $40k every year after that forever. When you retire in 47 years, just after you receive the $40k payment at that time, you can sell the business for $150k at time 47. - Retail shop salesperson for $35k pa (47 payments from t=1 to t=47 inclusive); You estimate that: - The required return is 15% pa with either career, and that they're equally risky; - Your friend has the same skills as a retail salesperson, which is sufficient to successfully operate the business. - Whoever buys the business, whether it's your friend or not, could employ someone with the same skills as a retail salesperson to successfully operate the business, at the same $35k annual cost. The cashflows are shown below: Which of the below statements is NOT correct? Select one: a. The net present value (NPV) of choosing to be an entrepreneur rather than a retailer is $116.503k. b. The payback period of choosing to be an entrepreneur rather than a retailer is 30 years. c. The IRR of choosing to be an entrepreneur rather than a retailer is more than the 15% pa required return. d. The business's current fair value is $33.3333k, valued as a perpetuity of its incremental cash flows at the 15% pa required return, assuming that it's held forever and never sold. e. The business is over-priced Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started