Question

Blossom Inc. wishes to accumulate $1,508,000 by December 31, 2030, to retire bonds outstanding. The company deposits $232,000 on December 31, 2020, which will

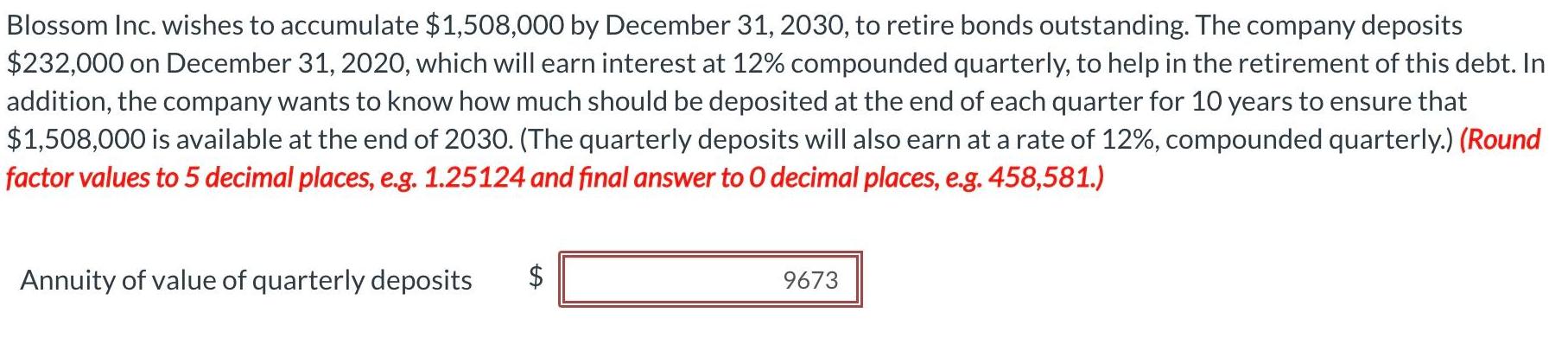

Blossom Inc. wishes to accumulate $1,508,000 by December 31, 2030, to retire bonds outstanding. The company deposits $232,000 on December 31, 2020, which will earn interest at 12% compounded quarterly, to help in the retirement of this debt. In addition, the company wants to know how much should be deposited at the end of each quarter for 10 years to ensure that $1,508,000 is available at the end of 2030. (The quarterly deposits will also earn at a rate of 12%, compounded quarterly.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Annuity of value of quarterly deposits 9673

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

751207776633 967261242 Book1 Microsoft Excel File Home Insert Page Layout Formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Charles Horngren, William Thomas, Walter Harrison, Greg Berberich, Catherine Seguin

5th Canadian edition

133472264, 978-0133446265, 133446263, 978-0133472264

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App